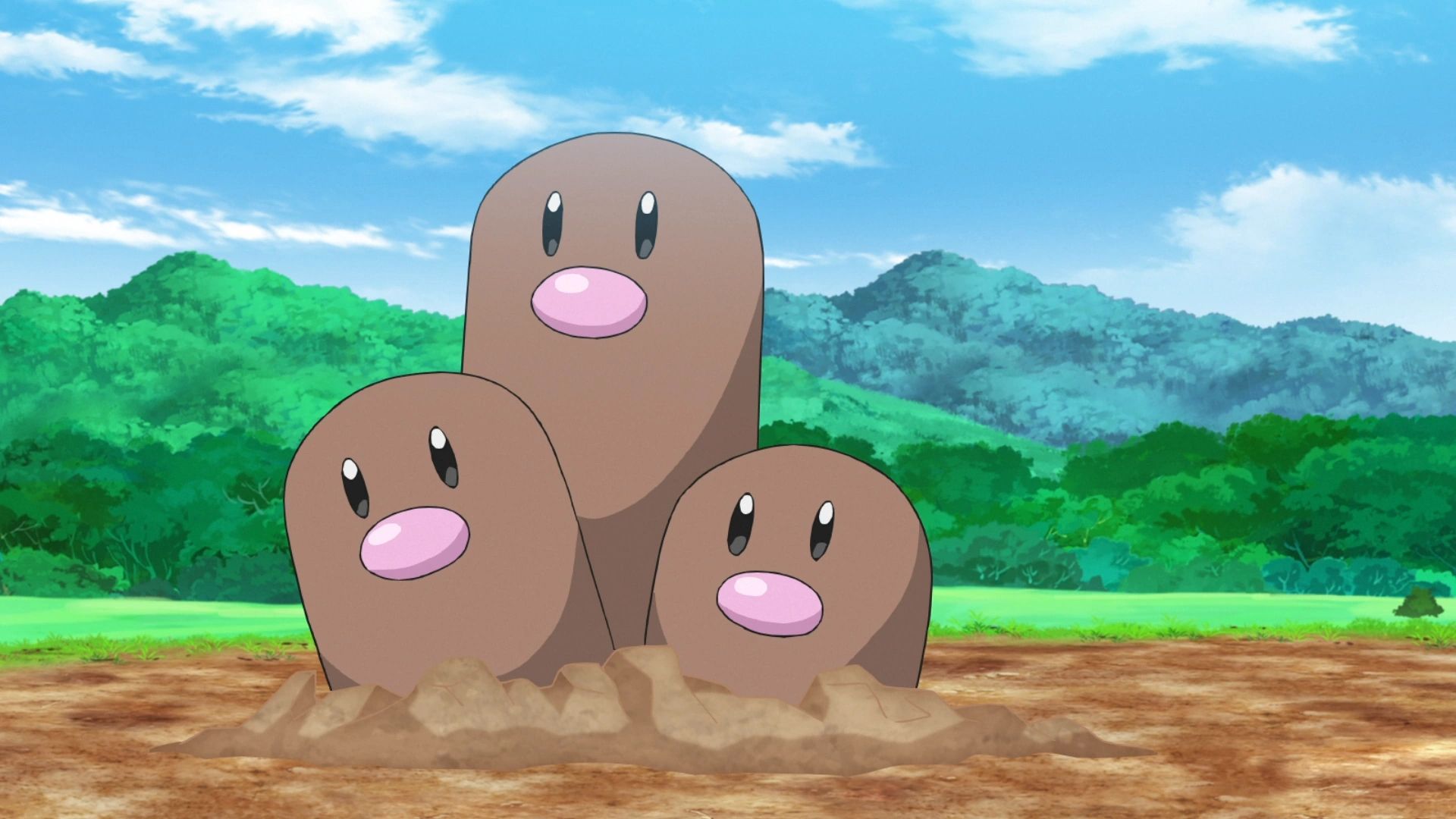

Pokemon Fan and Artist Uses Polymer Clay to Make Realistic Versions of Diglett and Dugtrio

What’s amazing about the Pokémon fanbase is how creatively fans express their love for the series. Over the past thirty years, artists of all kinds have shared their work inspired by Pokémon. A recent example is a fan who designed red envelopes with horse themes to celebrate the Lunar New Year and Year of the Horse. This shows how the franchise continues to inspire creativity and excitement, with fans constantly finding new ways to showcase their passion through Pokémon designs.