As a researcher with a background in blockchain analysis, I find the recent trend in Bitcoin’s circulation velocity to be an intriguing development. The data suggests that the rate at which Bitcoin tokens are being circulated has dropped to historically low levels, and this could potentially indicate a shift in how the asset is being used by its userbase.

The usage of Bitcoin as digital currency among its user base appears to have decreased significantly based on on-chain data, indicating a decline in its circulation.

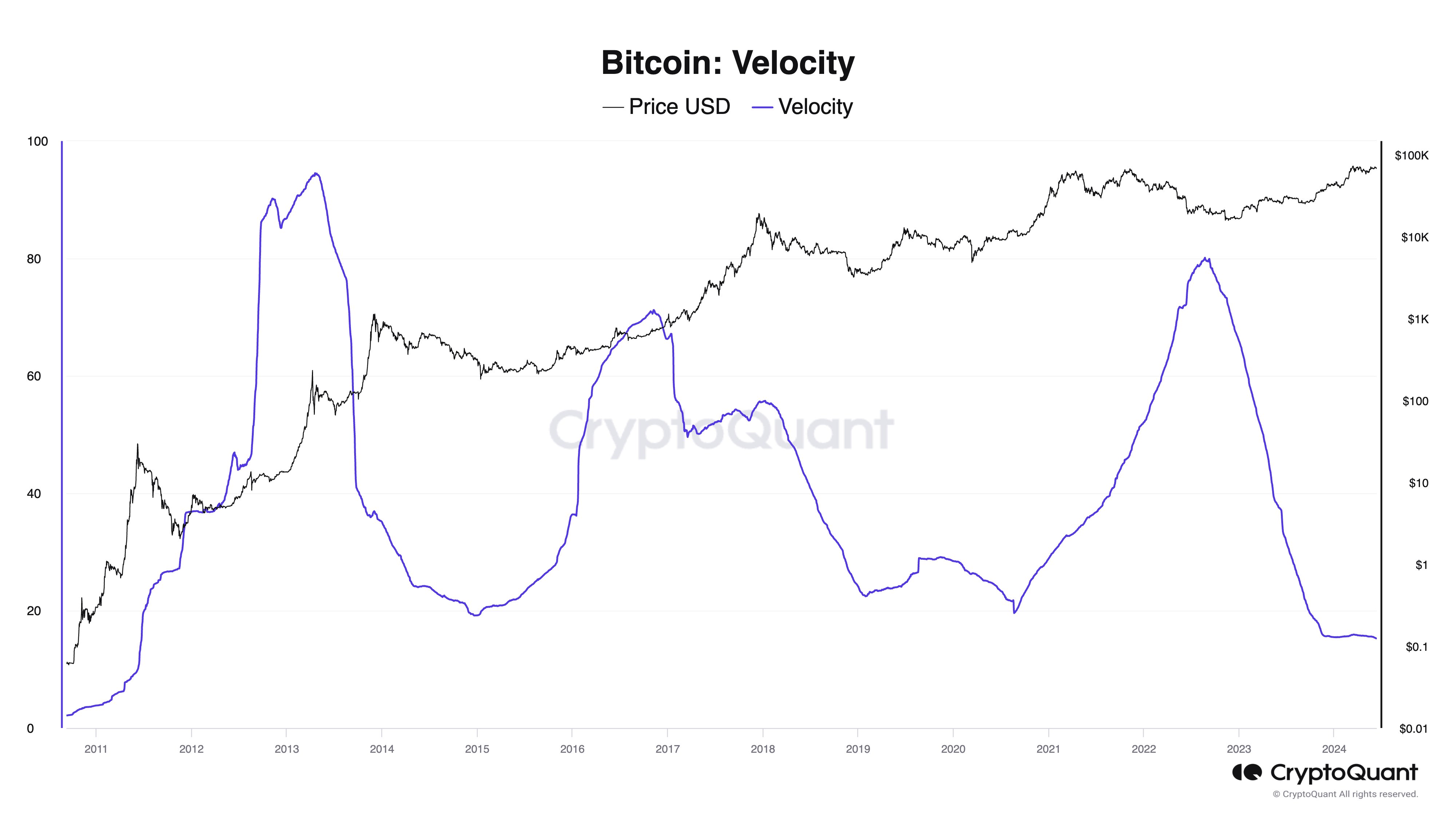

Bitcoin ‘Velocity’ Has Plunged To Historical Lows Recently

According to Ki Young Ju, the CEO of CryptoQuant, Bitcoin’s circulation has more recently decreased. A key metric to observe in this context is “Velocity,” which monitors the pace at which Bitcoin’s coins are being exchanged within the marketplace.

When the metric’s value is elevated, the coins exhibit rapid movement across the network. Conversely, a lower value suggests that tokens remain stationary in an address for an extended period before being transferred.

Below is a chart that shows how the Velocity of Bitcoin has changed throughout its history.

I’ve noticed an intriguing pattern with Bitcoin Velocity over the past year. During the 2021 bull run, this metric experienced a significant upward trend as depicted in the graph above. Reaching its peak right smack in the heart of the 2022 bear market. However, following this pinnacle, something unexpected happened – the Bitcoin Velocity took a sharp turn and began plummeting instead.

From the end of 2023, this downturn persisted with the metric displaying a horizontal trend. The graph indicates that these current low readings for the metric represent the lowest points seen in approximately 13 years.

The circulation rate of this cryptocurrency is currently similar to what it was back in 2011. As for the recent trend, it could be an indication of the current sentiment among the cryptocurrency’s userbase towards the asset.

Bitcoin was designed as a digital equivalent of cash, functioning independently of intermediaries in peer-to-peer (P2P) transactions. However, with the cessation of circulation for BTC tokens, there seems to be a decrease in their usage for monetary exchanges. As expressed by the founder of CryptoQuant,

As a crypto investor, I’ve noticed that while Satoshi Nakamoto envisioned Bitcoin as “Peer-to-Peer Electronic Cash,” the digital currency has predominantly been adopted as “Digital Gold” by institutional investors. They tend to hold large amounts of Bitcoin without engaging in frequent transactions.

The current low Bitcoin velocity raises questions about its permanence, considering this indicator previously showed significant spikes to higher values within the past few years.

Based on the chart’s representation, it is clear that the indicator has experienced fluctuations throughout the history of cryptocurrencies, moving between notable peaks and troughs. I, as an analyst, believe that Bitcoin will reach its maximum velocity at some point in the future when it becomes extensively utilized for transactions.

BTC Price

Bitcoin’s price has dropped further, currently sitting at $66,400. This represents a decline of 8% from its peak of $72,000 reached only a few days ago.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD COP PREDICTION

- MNT PREDICTION. MNT cryptocurrency

- Ethereum (ETH) Crashes Dramatically, What’s Next? Solana (SOL) Can Still Reach $200, XRP Struggling Before $0.63 Test

- SOL PREDICTION. SOL cryptocurrency

- Lucky Animal Crossing: New Horizons Player Discovers Infinite Clam Glitch

- I Physically Need WWE 2K25’s Showcase to Feature The Bloodline

- Destiny 2 Player Transforms Their Warlock Into Team Fortress 2’s Medic

- ETHW PREDICTION. ETHW cryptocurrency

2024-06-12 08:11