As a long-term Bitcoin investor with a deep interest in on-chain data, I find the recent revelation that early miners and long-term holder whales have been actively realizing profits between $62,000 and $70,000 to be both intriguing and validating. The trend of profit-taking isn’t unusual for a bull market like Bitcoin’s, but the sheer magnitude of these transactions is significant.

Early Bitcoin miners have taken out substantial profits within the current pricing bracket of the cryptocurrency, according to on-chain data.

Bitcoin Miners Have Harvested Large Profits Between $62,000 & $70,000

According to CryptoQuant CEO Ki Young Ju’s latest post on X, the initial Bitcoin miners, or those who joined the network during its early stages of adoption, have reaped substantial profits this year.

Most miners sell the cryptocurrency they mine to cover their operational expenses. However, some miners opt to hold onto their mined coins rather than selling them right away. A few early miners have kept their block rewards for extended periods of time.

It’s plausible that these miners could be holding onto their cryptocurrencies, but another possibility is that they’ve unintentionally lost access to their digital wallets. This could be due to forgetting about them or misplacing the necessary keys.

Despite being dormant for a long time, it seems that some of these old miners have become active again, as evidenced by their recent actions.

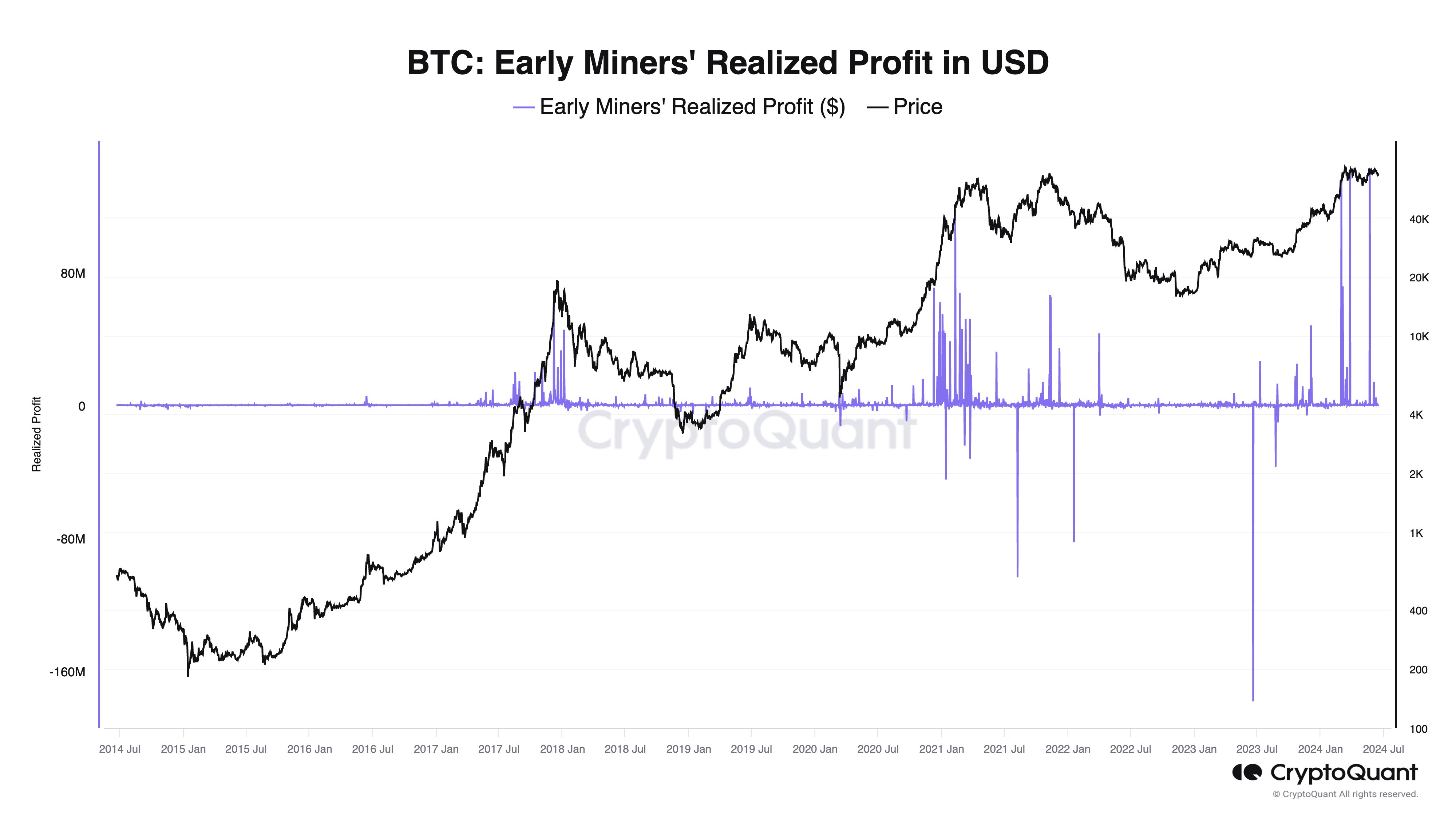

Here is a chart illustrating the development of “actual earnings” for these initial miners during the last ten years:

In simple terms, the realized profit refers to the total earnings (in USD) that early cryptocurrency miners have gained from their mining activities at a specific point in time.

As a crypto investor, I would describe it this way: I calculate the profit made by examining the difference between the current market price of the coins and the price at which these old entities last transacted with them.

In the chart, you can see that the indicator’s value has experienced several significant peaks this year, implying that some early miners have chosen to cash in on their profits.

Large indicator readings emerged as the price fluctuated between the $62,000 and $70,000 mark, resulting in an impressive $550 million worth of profits being reaped.

As a researcher studying cryptocurrency markets, I’ve observed that the current trend depicted in the graph is not uncommon during a bull market. In the past, similar phases have seen early miners become more active, eventually cashing in on substantial profits after prolonged periods of mining.

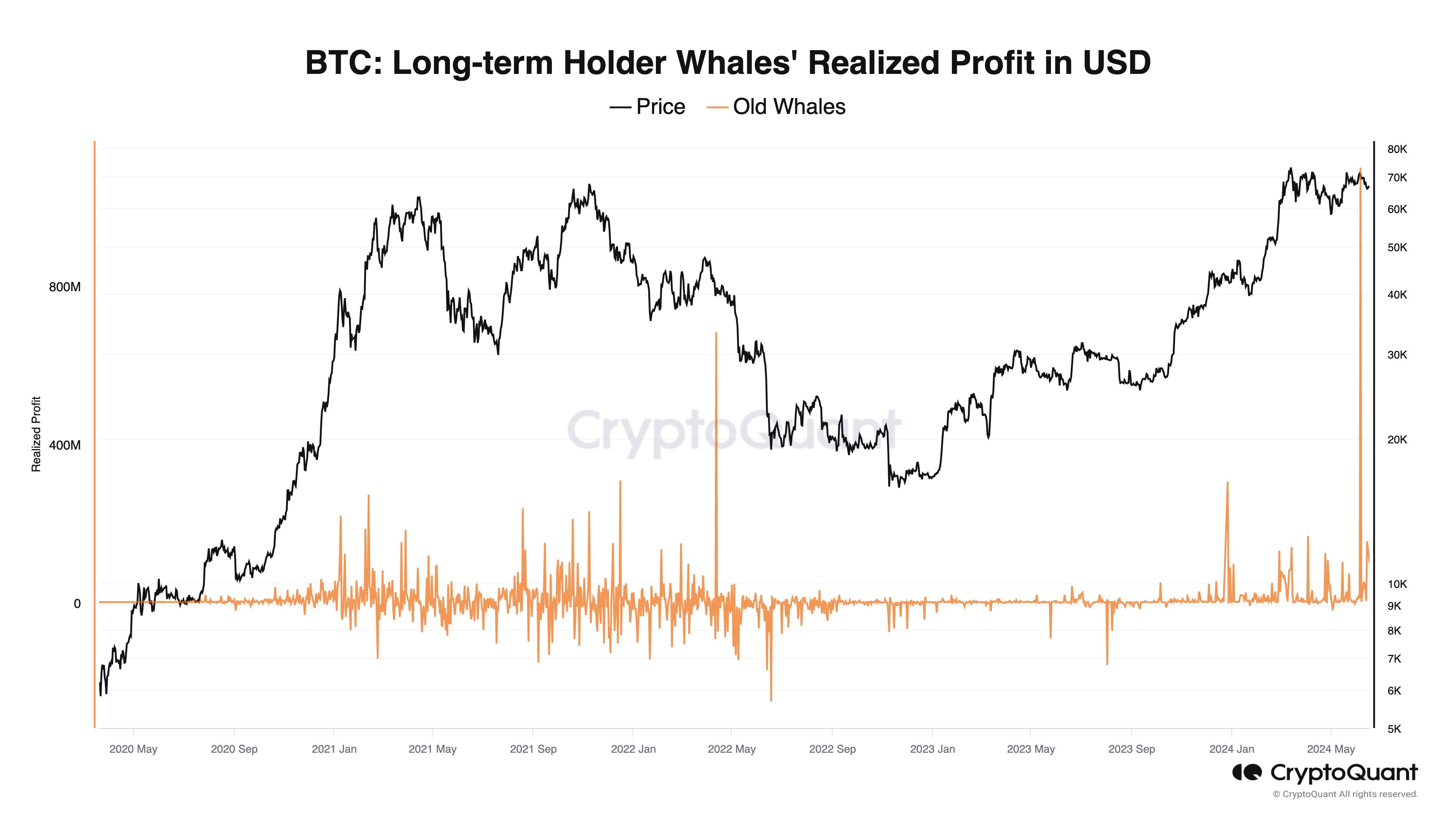

A significant group of long-term investors, commonly referred to as “whale” investors or “long-term holder whales,” have recently taken part in substantial profit-making activities. These investors fall under two categories: those who have owned their coins for over 155 days, classified as long-term holders (LTHs), and the larger investors with a minimum of 1,000 Bitcoins in their possession, known as “whales.”

As a market analyst, I’ve identified that Large Holder Whales (LTH) in the cryptocurrency market hold the largest stashes of coins. Based on the chart shared by the CryptoQuant founder in another post, it is evident that these investors have experienced substantial realized profits recently.

BTC Price

At the time of writing, Bitcoin is trading at around $65,000, down around 4% over the past week.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- AVAX PREDICTION. AVAX cryptocurrency

- MNT PREDICTION. MNT cryptocurrency

- ANKR PREDICTION. ANKR cryptocurrency

- OP PREDICTION. OP cryptocurrency

- VIC PREDICTION. VIC cryptocurrency

- Dogecoin And Shiba Inu Fear & Greed Index Drops To Neutral, Time To Buy?

- INV PREDICTION. INV cryptocurrency

- SUPER PREDICTION. SUPER cryptocurrency

2024-06-20 00:11