Bitcoin’s Wild Ride: $3B Gamble Sparks Chaos

Bitcoin stirs like a slumbering beast, its digital pulse quickening as it inches toward a $3 billion threshold, a point where the market’s nerves fray and fortunes rise or fall with the flick of a candle.

Bitcoin stirs like a slumbering beast, its digital pulse quickening as it inches toward a $3 billion threshold, a point where the market’s nerves fray and fortunes rise or fall with the flick of a candle.

During a recent chat on the PBD Podcast, Scaramucci-man with a mouth like a cannon-declared Bitcoin the “largest by far” chunk of his portfolio. And when the price took a nosedive, he was out there like a hound on a scent, buying more coins. Seems he’s got a long game in mind, though I reckon his patience could rival a frog waiting for a fly in a drought.

A new reasoning framework empowers AI agents to systematically improve code quality by continuously questioning and verifying design choices.

The lawsuit claims that opening cases in Counter-Strike 2 is similar to gambling on a slot machine. Players buy cases hoping to win cosmetic items, and the game uses a spinning wheel to randomly determine what they receive. While these items don’t affect gameplay, they can be resold for real money on online marketplaces.

A stronger dollar can tighten global financial conditions and often weighs on risk assets such as equities and cryptocurrencies. Higher oil prices-both Brent crude and West Texas Intermediate are hovering around $100 per barrel-reinforce inflation concerns and heighten expectations of interest-rate increases. Higher rates also detract from the attraction of such investments. One wonders if the market is merely playing a cruel game of musical chairs.

According to the ever-watchful Glassnode, who posted their findings on the mystical platform X, Bitcoin and its crypto cousins have parted ways like a badly choreographed dance routine. The “spot trading volume,” a metric as straightforward as a Discworld troll, shows who’s still got the moves.

On a Thursday that shall henceforth be remembered as the day the financial overlords condescended to mingle with the crypto rabble, BlackRock unveiled its ETHB. The fund, with a hauteur befitting its lineage, promises to “provide investors with exposure to spot ether while potentially generating income by staking a portion of its ether holdings.” How generous of them to allow the plebeians a glimpse of their gilded cage.

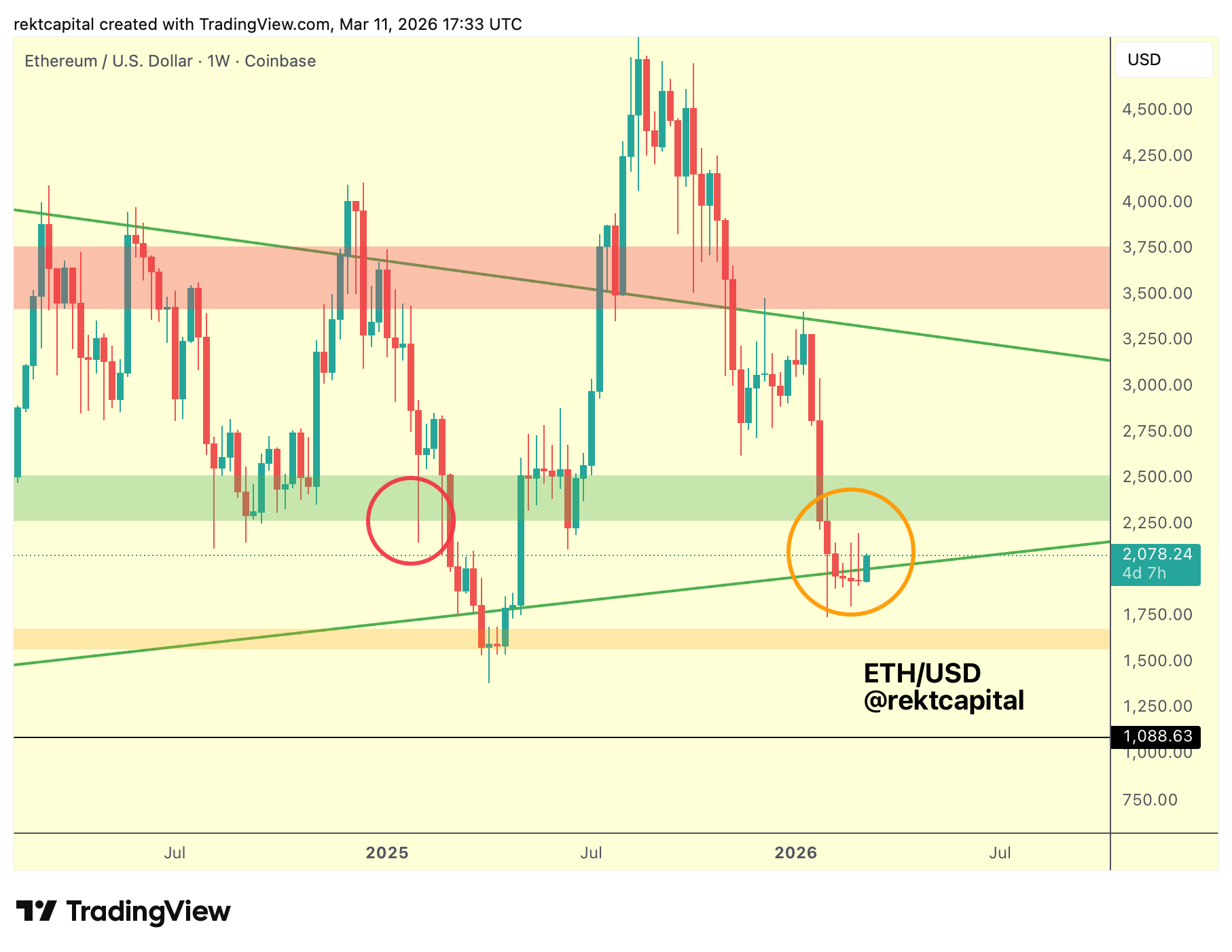

According to the oracles at crypto.news, Ethereum (ETH) price leapt nearly 6% to $2,144 during the mystical hours of Friday morning in the East, before settling like a sated cat around $2,100. At this valuation, the second-largest crypto asset by market cap sits 11% above its weekly low and a staggering 18% above its February nadir. A resurrection, if you will, from the ashes of despair.

Crypto futures open interest swelled 2%, now a bloated $102 billion. Yet, flat-to-negative funding rates whisper of a crowd more interested in playing it safe than chasing dreams. Traders, ever the pragmatists, are hedged and waiting-probably planning their next coffee break.

What makes this warning so peculiar? Well, Ethereum’s network is busier than a squirrel in a nut factory, yet its price is as flat as a pancake. It’s like watching a superhero lose their powers while their fans cheer louder than ever.