As a researcher with years of experience in the crypto space, I must say that the rise of Arbitrum is nothing short of remarkable. Having witnessed the scalability issues plaguing Ethereum for far too long, it’s heartening to see a solution like Arbitrum come to the forefront and make such significant strides.

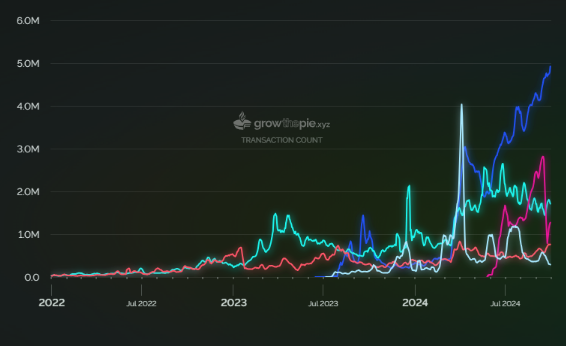

As a researcher delving into the world of blockchain technology, I’ve been closely following the remarkable strides made by Arbitrum. Recently, they’ve managed to surpass a significant milestone in the decentralized finance (DeFi) sphere – executing an impressive 1 billion transactions. This figure is truly monumental within our industry. Interestingly, data from GrowThePie indicates that DeFi operations alone account for over 20% of all these transactions. This underscores Arbitrum’s relevance as a layer 2 scaling solution, particularly in relation to Ethereum.

The Rise Of Arbitrage

As a researcher delving into the realm of blockchain technology, I’ve come across Arbitrum – a groundbreaking solution developed by Offchain Labs. Arbitrum is designed to tackle Ethereum’s scalability challenges, particularly through an innovative method known as Optimistic Rollup. This mechanism streamlines transaction processing, reducing latency and lowering fees, which has made it a go-to choice for both developers and users alike.

Arbitrum One just hit 1 billion transactions!

Onwards to the next billion.

— Arbitrum (,) (@arbitrum) September 30, 2024

Since its beginnings, the platform has expanded significantly, transforming from an idea funded by venture capital into one of the busiest Layer 2 chains within the ecosystem. Arbitrum, over time, has become a well-liked destination for numerous Decentralized Finance (DeFi) applications such as lending platforms and farming procedures for yield generation.

The transaction data show an outstanding pattern of expansion for Arbitrum. Initially handling fewer than 100,000 transactions daily, it now processes over 2 million transactions per day. A significant factor contributing to this growth is its compatibility with Ethereum’s programming language, Solidity. This integration allows existing Ethereum projects to transition smoothly to Arbitrum with only minor modifications.

Arbitrum: DeFi Activity Flourishes

On Arbitrum, DeFi activity is thriving, as platforms for lending and borrowing are growing in popularity. With these platforms, users can lend their assets to generate income, while those needing funds can use them for trading or investments. The reduced gas fees compared to Ethereum’s mainnet make these services more affordable, particularly for individual investors who might have shied away due to high costs in the past.

Moreover, it’s worth noting that emerging platforms like Pendle Finance have seen a surge in activity on the Arbitrum network. Pendle is primarily concerned with yield trading and ensuring liquidity, offering enticing incentives for users to engage with its system. As a result, Arbitrum has successfully drawn in massive liquidity – over $3.29 billion – not just from major DeFi projects like Aave V3, but also from smaller ones that have managed to thrive alongside them.

Future Prospects

As a crypto investor, I’m excited about the future of Arbitrum. Its continuous integration of innovative features and expansion of its ecosystem is promising. The recent addition of DIA oracles has significantly boosted the platform’s potential to offer transparent price data for various assets. This upgrade not only enhances the existing functionality of the bridge but also makes all current DeFi applications more valuable and even inspires new projects to launch on Arbitrum.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD COP PREDICTION

- BICO PREDICTION. BICO cryptocurrency

- USD ZAR PREDICTION

- USD PHP PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- USD CLP PREDICTION

- PLI PREDICTION. PLI cryptocurrency

2024-10-01 17:42