As a seasoned researcher with years of experience analyzing cryptocurrency markets, I find the latest interpretation of the Bitcoin Coinbase Flow Pulse by analyst Axel Adler Jr intriguing. The persistently bullish trend indicated by this on-chain indicator suggests that despite the recent pullback, the bull market may still be alive and well.

A researcher has outlined that, even with recent setbacks, the patterns in on-chain data might indicate that the positive trajectory for Bitcoin continues.

Bitcoin Coinbase Flow Pulse Is Still Signaling Bull Market

In a recent article on X, Axel Adler Jr from CryptoQuant discussed the current movement in Bitcoin related to the Coinbase inflow rate. The “Coinbase inflow rate” is a tool that monitors the total amount of Bitcoin being transferred from other major exchanges into Coinbase.

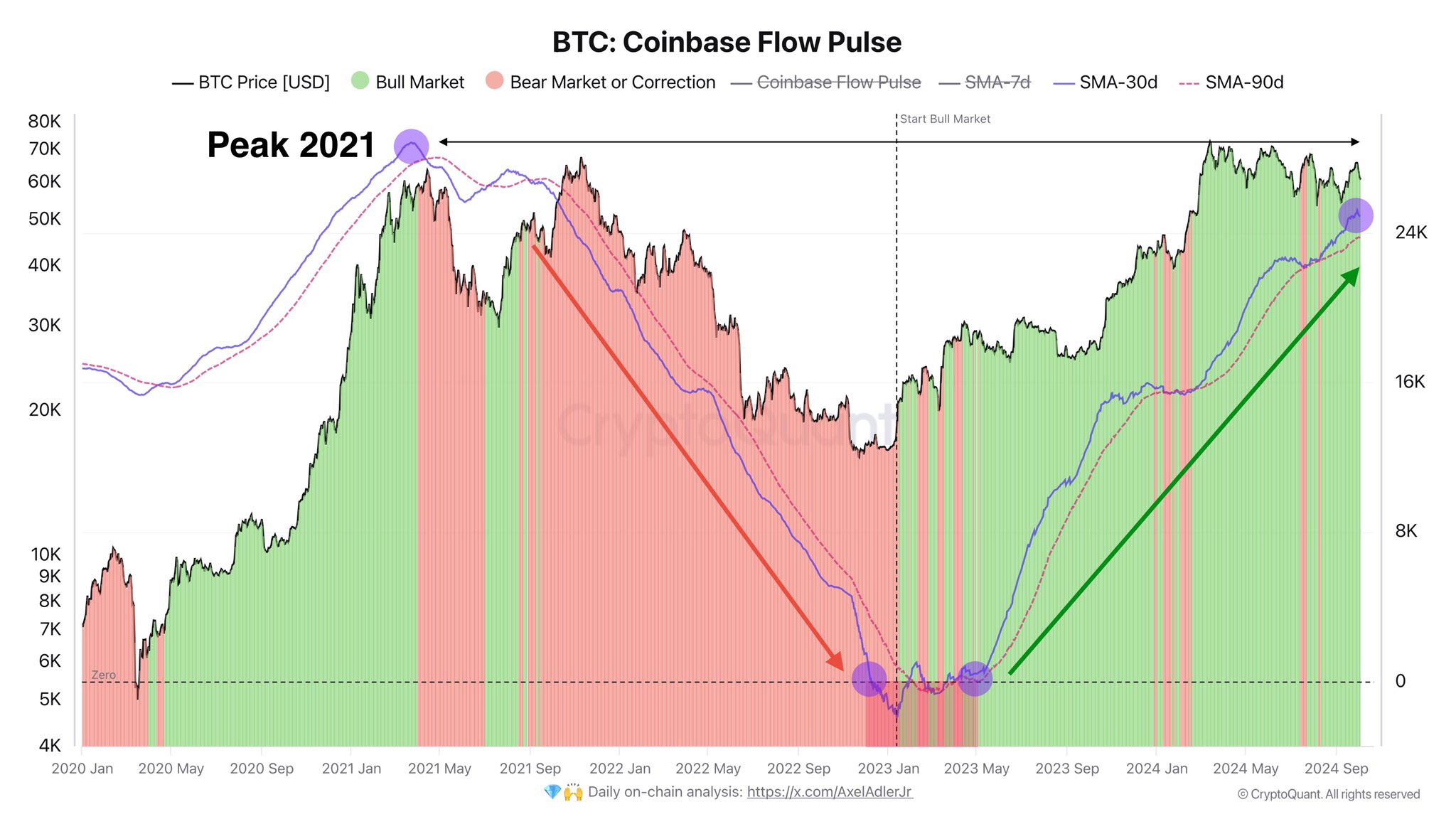

As a crypto investor, I’ve been closely observing the trends depicted in the chart provided. This graph displays the movement of the 30-day and 90-day Simple Moving Averages (SMAs) for this particular indicator over the past few years.

The graph shows us that since the beginning of 2023, both Simple Moving Averages (SMAs) related to Bitcoin’s Coinbase Flow have been rising, indicating a prolonged pattern of more Bitcoin being transferred to Coinbase from other platforms, suggesting an increase in long-term inflows.

Currently, the 30-day rate is higher than the 90-day, suggesting that the pace of inflows is increasing further. When these two rates are structured in this way, it implies that Bitcoin might be experiencing a bull market.

During the instances when this situation occurred, they’re marked as green sections on the graph. It seems that the indicator has undergone a downtrend or ‘bear’ phase only a limited number of times since the upward trend started, and each of these ‘bear’ phases were brief.

Over the past few days, Bitcoin’s price has exhibited significant downward pressure, yet it hasn’t displayed any signals suggesting a bearish crossover as of now. As per the analysis, however, the overall bullish trend remains intact.

The reason a transfer from other exchanges to Coinbase can be seen as bullish is due to the nature of the users who trade there. Coinbase mainly attracts investors based in the U.S., particularly large institutional investors, who are often key players influencing market trends.

When funds flow into Coinbase, it suggests an increase in demand from users, a trend that may influence the value of the cryptocurrency. While the Coinbase Flow Pulse serves as one tool for assessing American investors’ demand, there is also the Coinbase Premium Gap, which helps us understand short-term fluctuations in demand.

This measurement compares the costs of Bitcoin, as shown on Coinbase when paired with USD, and Binance when paired with USDT. Since Binance caters to a wide international user base, the value of this metric generally reflects the disparity in Bitcoin trading behavior between American and global users.

Here’s a chart presenting the 1-hour variation of the indicator as discussed by an analyst in their CryptoQuant Quicktake article.

According to the chart’s analysis by the quant, there’s been a surge in the 1-hour Bitcoin Coinbase Premium Gap, exceeding its daily level. This could indicate that Bitcoin purchases from Coinbase users are on the rise.

BTC Price

Bitcoin’s trajectory has shifted horizontally since its dip at the start of the month, with its current value hovering near the $61,300 mark.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD PHP PREDICTION

- USD ZAR PREDICTION

- BICO PREDICTION. BICO cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD COP PREDICTION

- USD CLP PREDICTION

- CVC PREDICTION. CVC cryptocurrency

- NXRA PREDICTION. NXRA cryptocurrency

2024-10-05 22:42