Minecraft: How To Get Firefly Bush

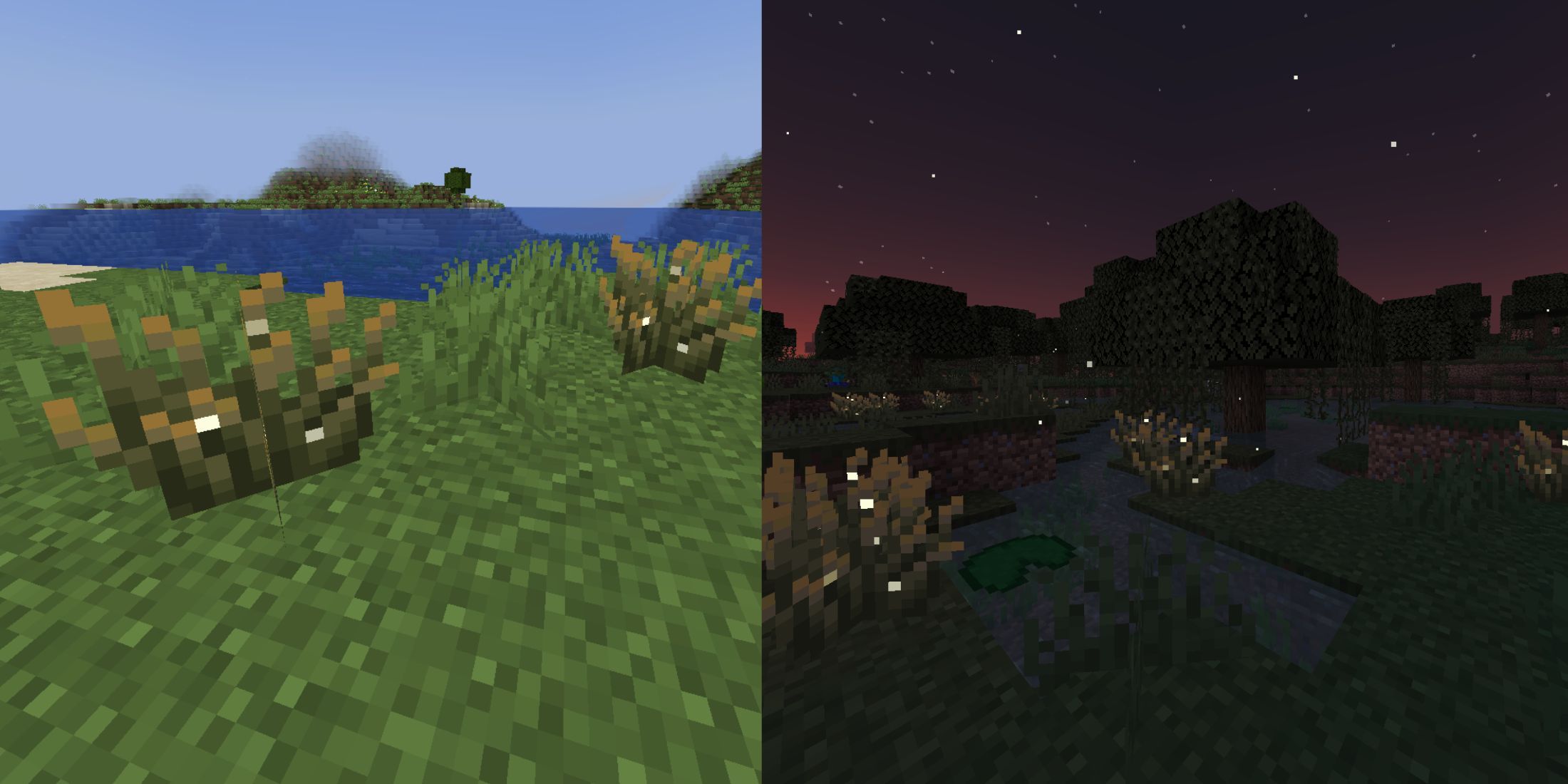

Firefly Bushes primarily serve an ornamental purpose, casting a warm, inviting glow in your surroundings. In the realm of Minecraft, where wandering through a swamp at night reveals tiny glimmering specks floating about, those could very well be Firefly Bushes.