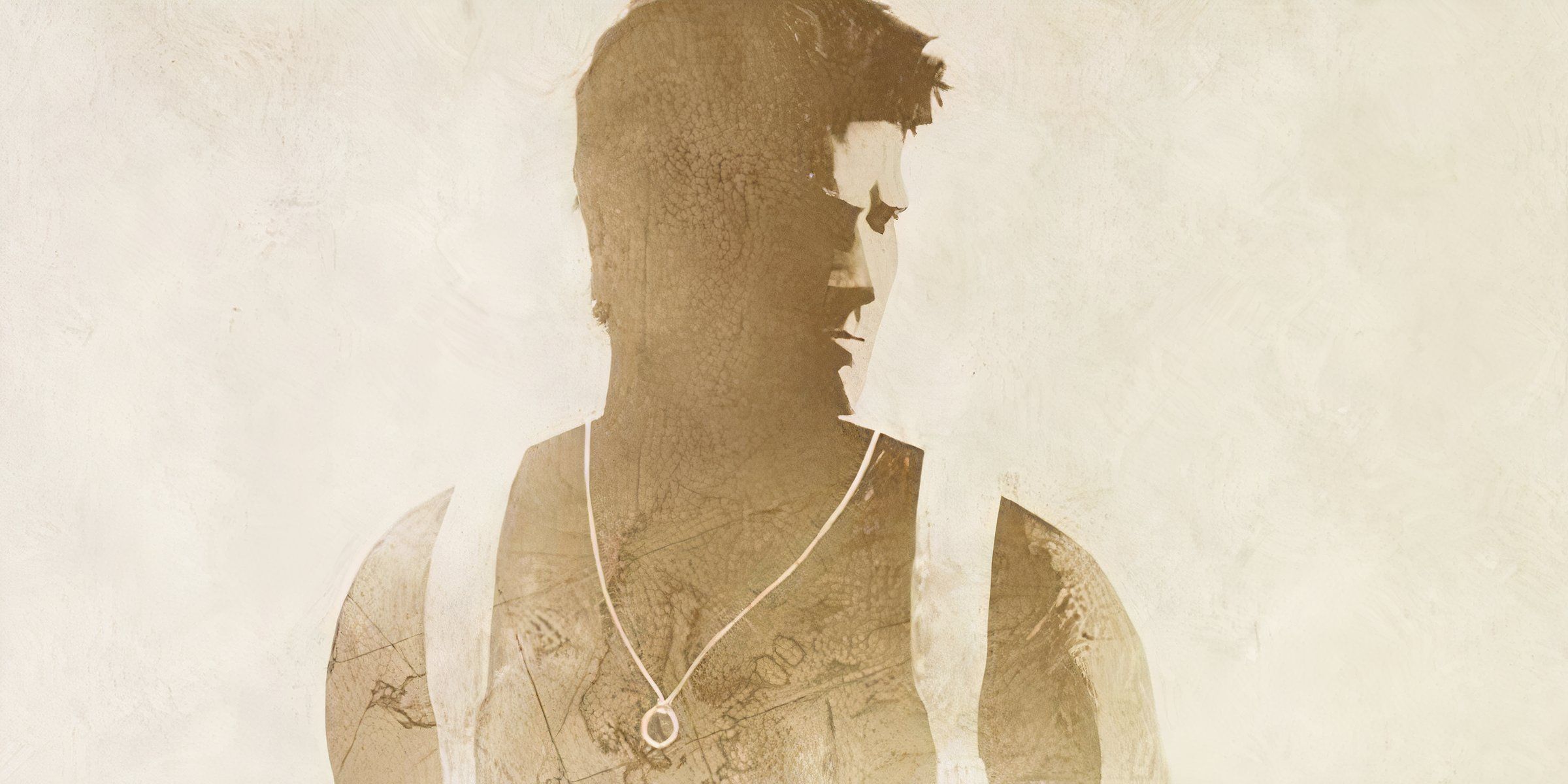

Unlocking the Secrets of Death Stranding 2: Beaches You Can’t Miss!

Based on the title “Death Stranding 2: On the Beach“, it’s reasonable to assume that this sequel will delve deeper into the theme and essence of beaches compared to its precursor. This could mean frequent visits to different beaches during the game’s narrative, as suggested by the subtitle. Since the subtitle implies that some part of the story unfolds on a beach, it’s intriguing to speculate which specific beaches “Death Stranding 2” might or even should explore, as this could provide insights into the people who inhabit those coastal areas.