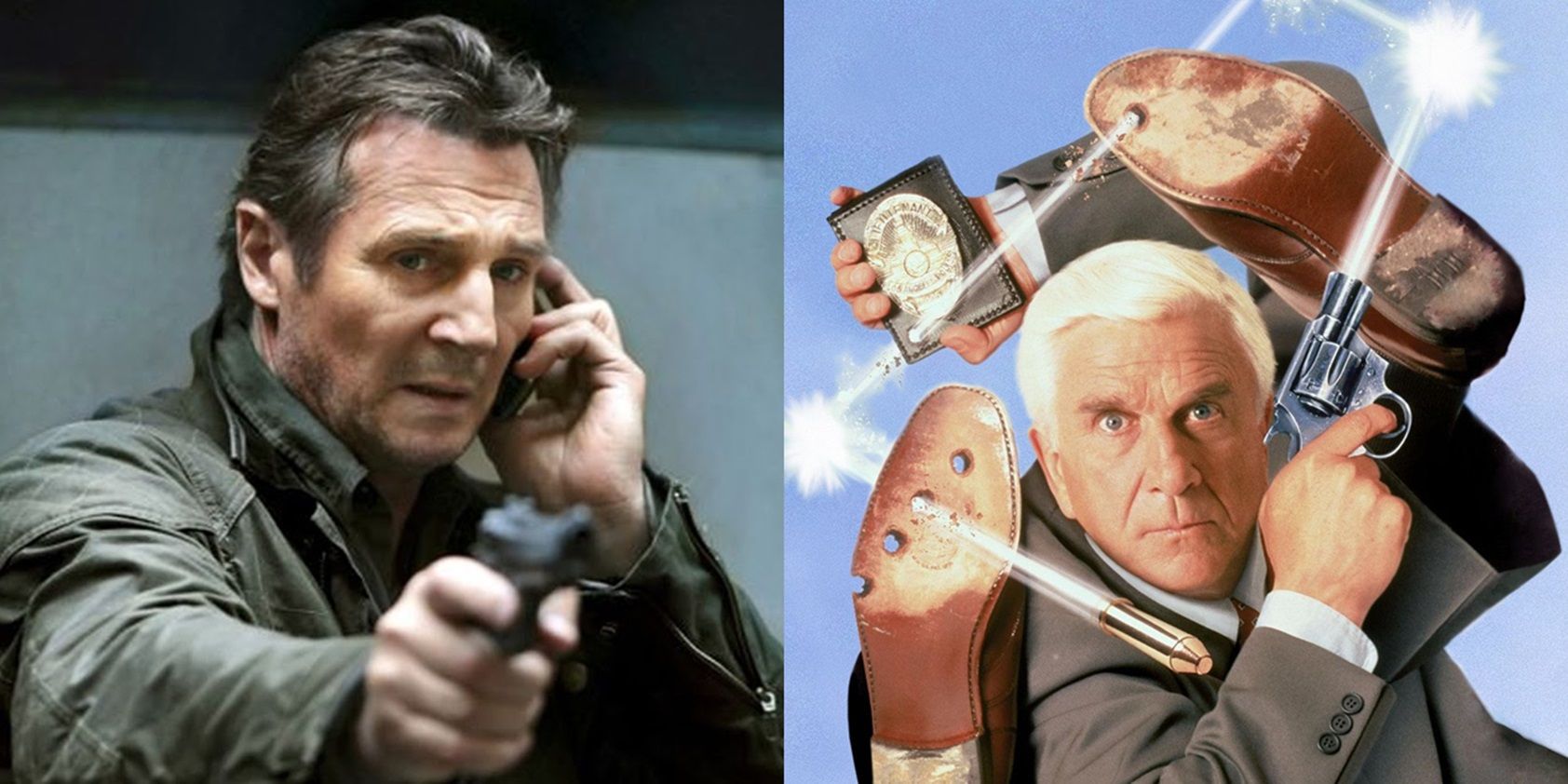

Original Naked Gun Director Reacts Negatively To Liam Neeson’s Reboot

After a prolonged development period, the much-anticipated revival of “The Naked Gun” is set to hit theaters in August. Paramount Pictures has recently unveiled the trailer for the upcoming movie featuring Liam Neeson. The new film manages to preserve the original’s humorous essence while presenting a fresh take, presumably thanks to Akiva Schaffer of The Lonely Island directing this time. David Zucker, who helmed the first installment and is renowned for his slapstick, absurd humor, rapid-fire gags, has expressed his thoughts on the reboot’s trailer.