Title Update 1 for Monster Hunter Wilds has just been released, bringing a host of new features to the game. Capcom has added new mechanics, monsters, and fixed bugs in this update. Players will now have access to various equipment materials that were not available before, such as Pinnacle Coins. This guide will show you where to find these Pinnacle Coins in Monster Hunter Wilds and how to use them effectively.

Firstly, let’s discuss the location of the Pinnacle Coins. These coins can be found throughout different areas of the game world, hidden within various monsters or hard-to-reach places. To increase your chances of finding them, keep an eye out for shiny objects that seem out of place or explore every nook and cranny in each area.

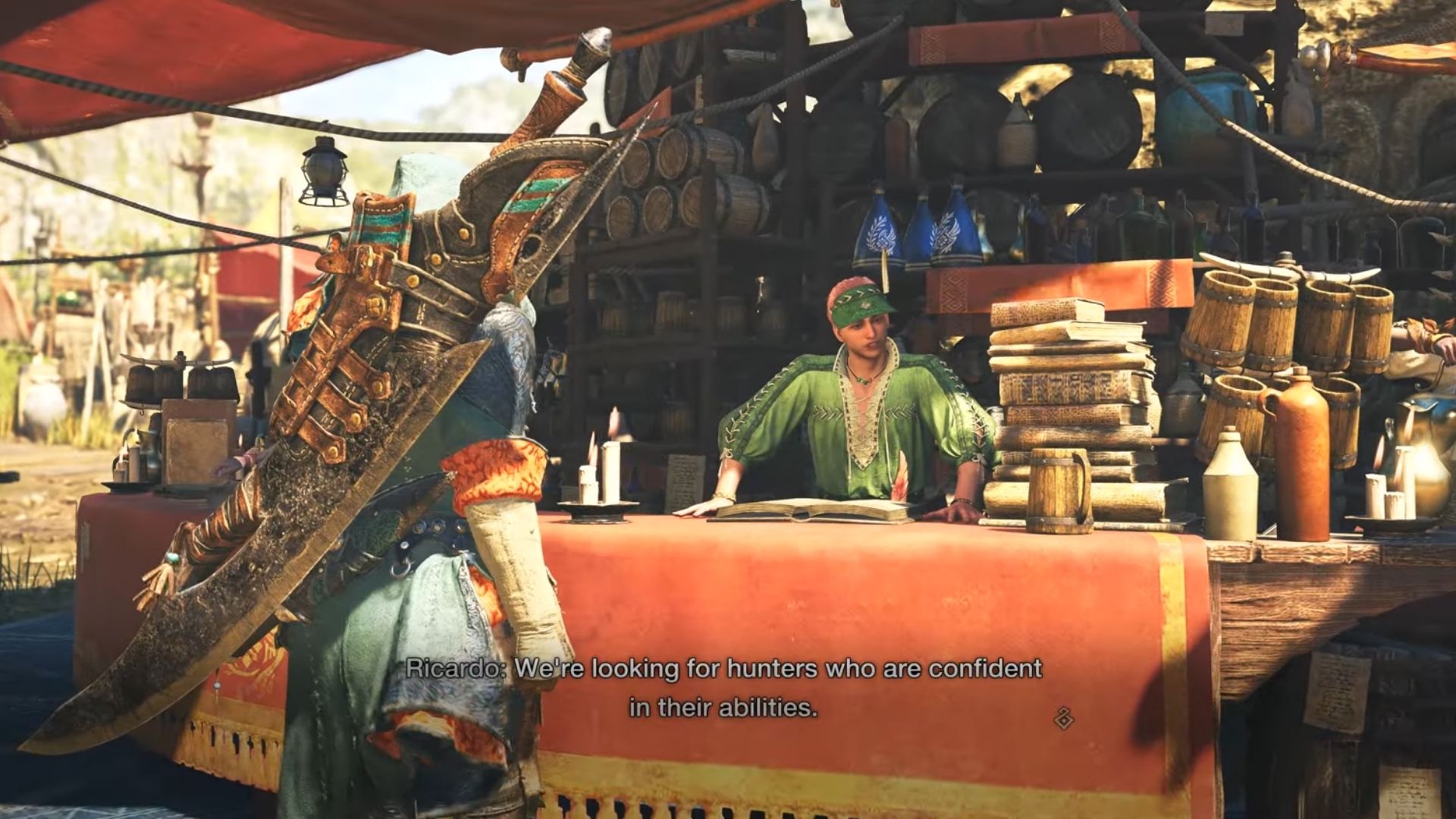

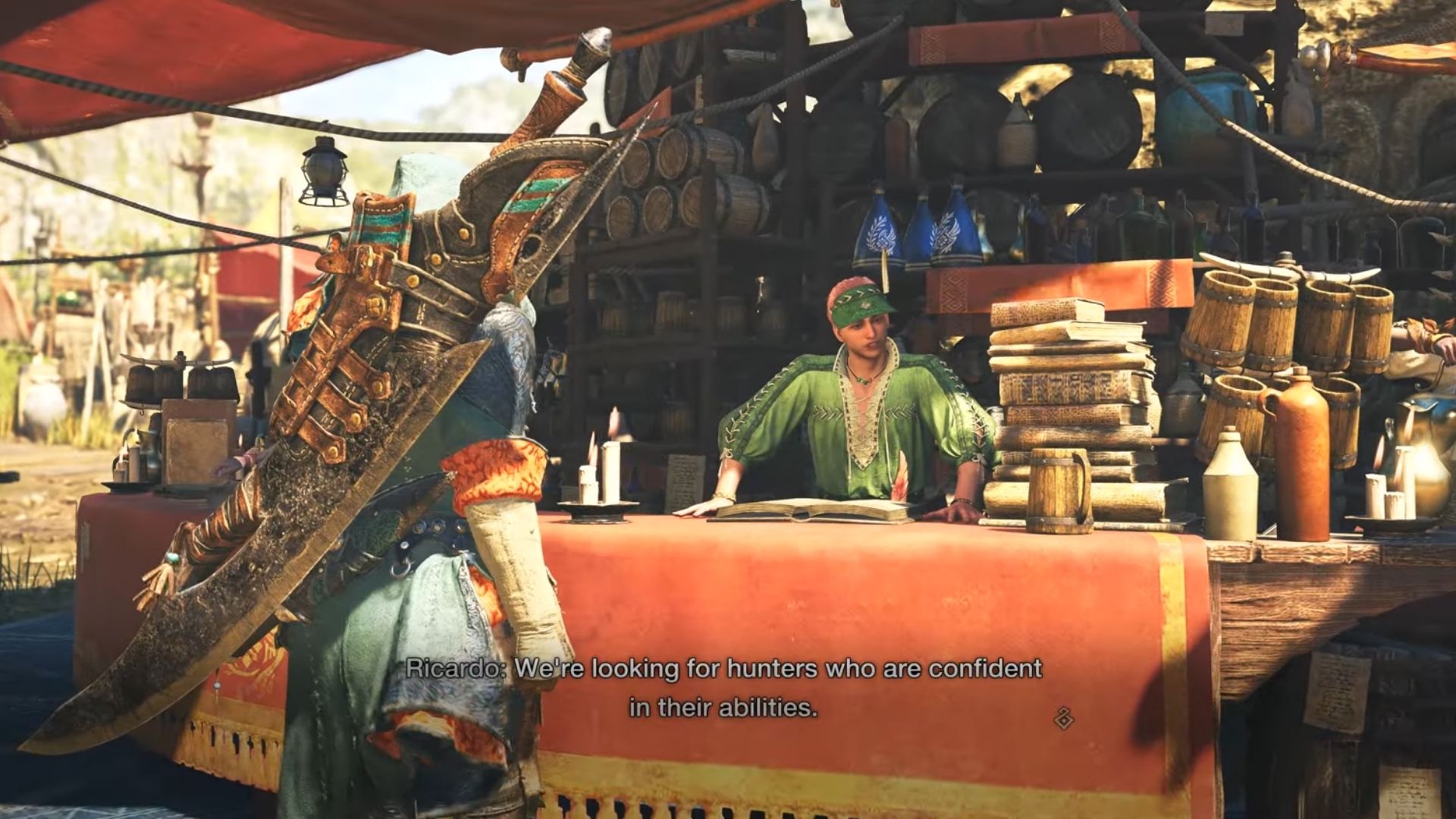

Once you’ve managed to obtain some Pinnacle Coins, you can use them to purchase exclusive equipment items from the new vendor located in one of the game’s major hubs. These items will significantly boost your character’s stats and abilities, making them indispensable for players who want to progress quickly through the game.

Remember that Pinnacle Coins are a valuable resource, so be sure to spend them wisely and prioritize purchasing equipment that best suits your playstyle and current level of progression in Monster Hunter Wilds. Enjoy hunting, hunter!