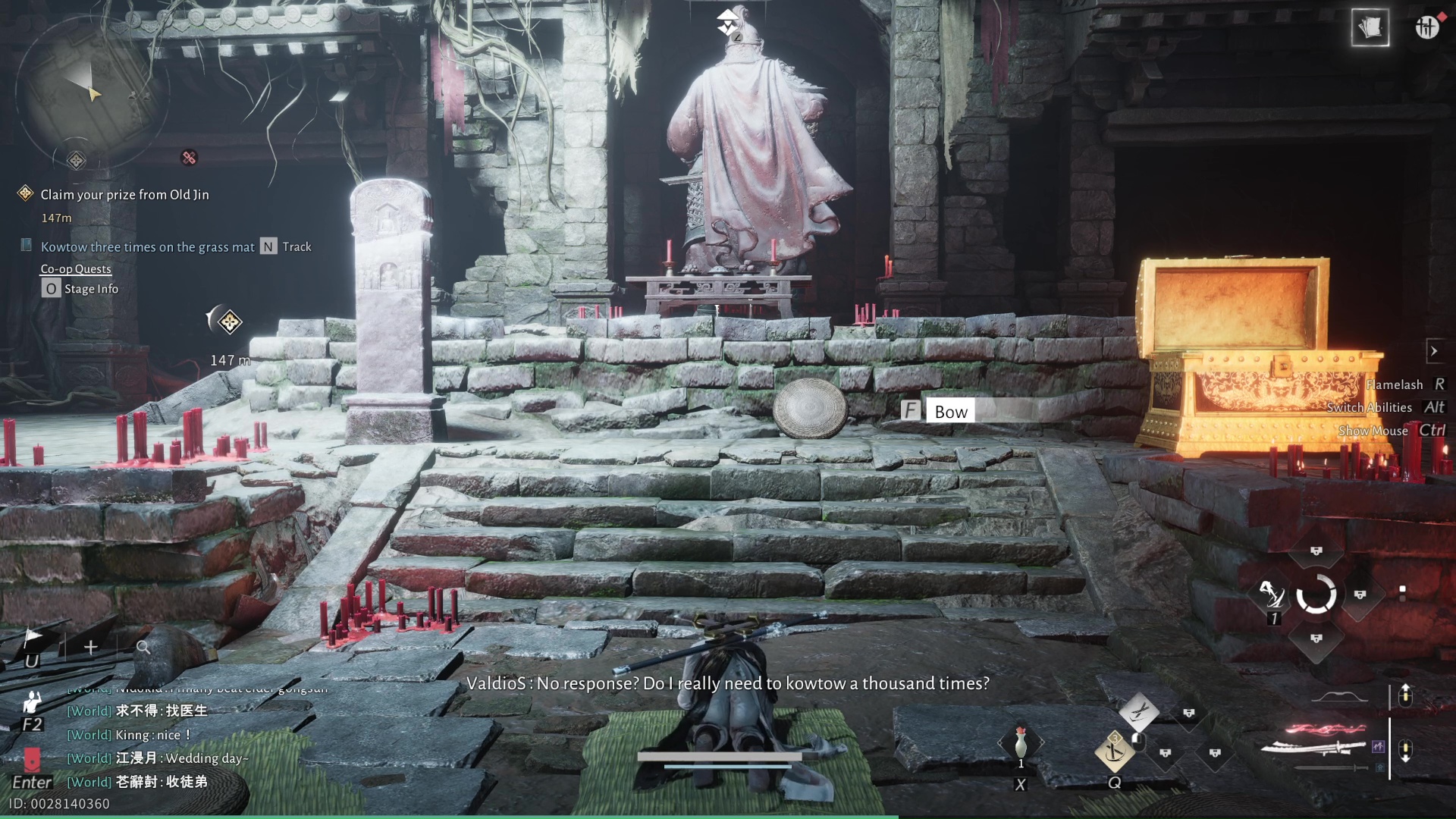

Wuxia MMO Where Winds Meet is full of AI chatbot NPCs, and people are doing all the standard obscene stuff to them: ‘I made him think that my character was pregnant with his child’

I haven’t encountered anything quite as problematic as the issues with Darth Vader in Fortnite, thankfully. These new characters aren’t based on famous deceased actors, and they haven’t said anything offensive. However, players are still finding ways to create glitches and generally mess around with the game’s storyline.