Untangling MRAM Cache Errors: A Novel Approach to Reliability

Researchers have identified and mitigated a hidden failure mechanism in STT-MRAM caches caused by accumulating read disturbances, offering a path to significantly improved data retention.

Researchers have identified and mitigated a hidden failure mechanism in STT-MRAM caches caused by accumulating read disturbances, offering a path to significantly improved data retention.

The 3.0 update for Animal Crossing: New Horizons changes the game’s peaceful nature, but not through a major overhaul or new downloadable content. Instead, it introduces a subtle yet impactful feature that changes how players connect with their homes, remember past experiences, and view the entire Animal Crossing series.

Although it might seem like there will be fewer updates for The Sims in early 2026 compared to previous years, this could be a deliberate choice. With Project Rene on the horizon, ongoing speculation about Sims 4, and Maxis wanting to manage expectations, the coming months appear to be a period of preparation for significant changes, rather than a slowdown. Here’s a look at what the future holds for this popular life simulation game.

A new analysis reveals critical vulnerabilities in the widely used RAFT consensus algorithm, demonstrating its susceptibility to malicious attacks.

LEGO Creator 3-in-1 sets are designed for both building and displaying. These sets aren’t usually based on existing franchises like movies or TV shows, and they feature versatile LEGO bricks that can be used in many different ways, letting you build three different models from one set. The first Creator 3-in-1 sets came out in 2006, and dozens of different designs have been released since then.

It’s easy to judge things with the benefit of time. When you buy a gaming system after it’s no longer being made, you can often find a great deal and choose only the best games released for it. Plus, you can look back and fairly assess which consoles had the strongest game collections – and that’s what we’re doing here today.

A new review delves into the mathematical properties of quantum polylogarithms, revealing their intricate connections to classical multiple polylogarithms.

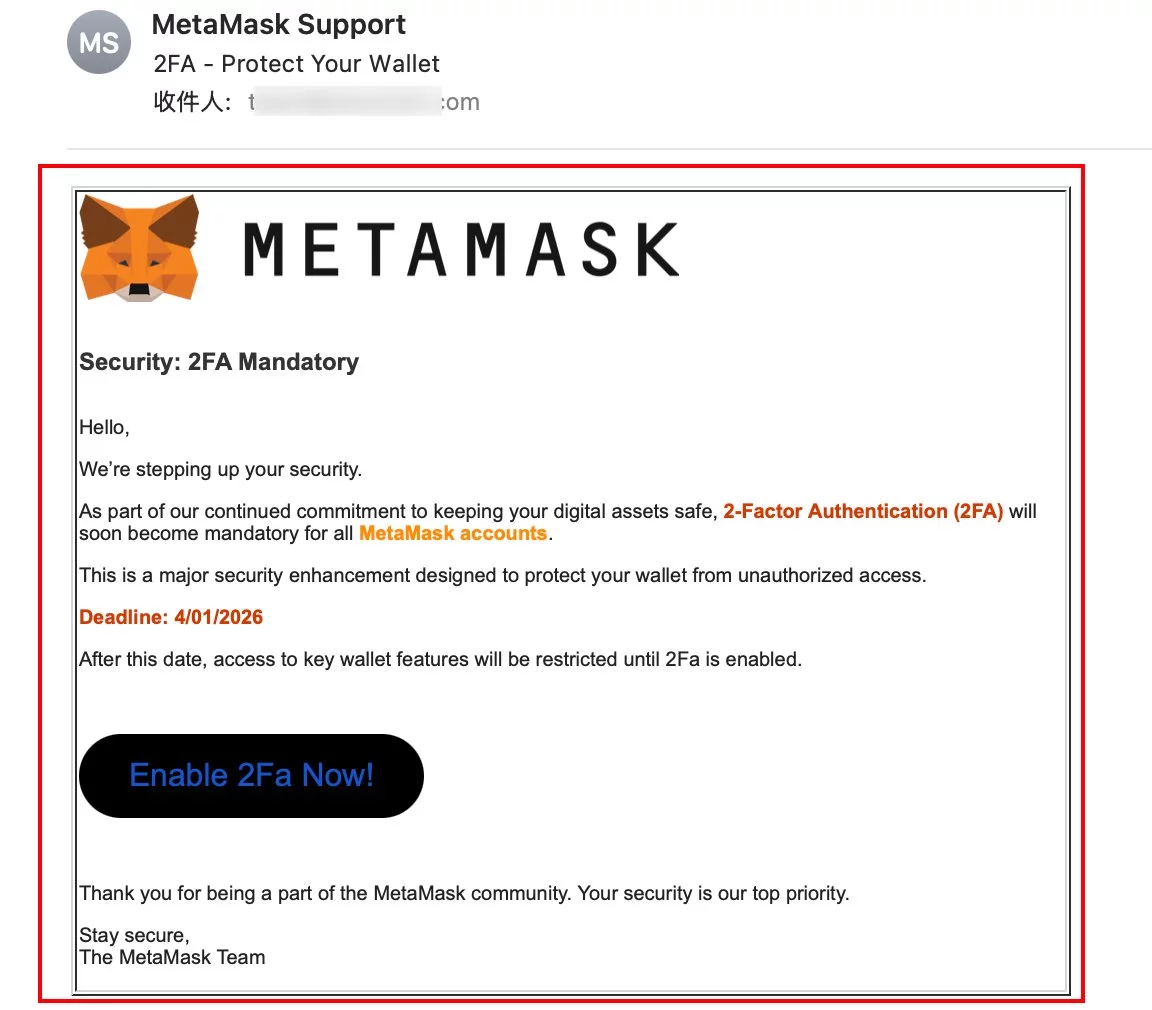

According to the folks at SlowMist-who apparently have nothing better to do than keep an eye on these scams-MetaMask users have been receiving emails that scream urgency. The kind of urgency that makes you feel like you’re late for a date with your bank account. The emails are decked out in MetaMask branding, so they look almost convincing at first glance. (See below for some real artistry.)

Key Takeaways (A Sardonic Oration)

Paul Griggs, U.S. senior partner of Pricewaterhousecoopers (PWC), casually dropped in an interview with the Financial Times that the firm is “leaning in” to cryptocurrency work. Because apparently, years of caution weren’t paying the bills 💸. With the Trump administration’s unexpected love affair with digital assets and the Genius Act (because who doesn’t love a bit of legislation that sounds like it belongs in a sci-fi movie?), PWC is now diving headfirst into crypto audits, consulting, and tax services. Who knew accountants could get so wild? 🤯