Author: Denis Avetisyan

This review explores how bringing real-world assets onto the blockchain can unlock new levels of liquidity and security for next-generation communication networks.

A comprehensive analysis of RWA tokenization, decentralized network frameworks, and a dynamic spectrum allocation case study.

While next-generation communication networks promise unprecedented reliability and connectivity, their deployment is hampered by significant liquidity and security challenges. This paper, ‘Real-World Asset Integration in Next-Generation Communication Networks: Fundamental, Framework, and Case Study’, proposes a novel framework leveraging Real-World Asset (RWA) tokenization to address these limitations by transforming network resources into digitally tradable tokens. Through a case study on dynamic spectrum allocation, we demonstrate that this approach not only enhances resource utilization but also exhibits resilience against malicious attacks under conditions of scarcity. Could RWA tokenization unlock a new era of decentralized, secure, and efficiently managed communication infrastructure?

The Inherent Fragility of Decentralized Systems

Decentralized networks, by distributing data and control across numerous nodes, demonstrably enhance resilience against single points of failure and offer a level of operational transparency previously unattainable in traditional, centralized systems. However, this very architecture introduces a distinct set of security vulnerabilities. Unlike fortified central servers, decentralized systems present a wider attack surface, as compromising even a small percentage of nodes can potentially disrupt network function or manipulate data. The absence of a central authority also complicates incident response; identifying and mitigating malicious activity requires sophisticated consensus mechanisms and cryptographic protocols. Furthermore, vulnerabilities in smart contracts-the self-executing agreements governing many decentralized applications-have proven to be costly exploits, highlighting the critical need for rigorous auditing and formal verification techniques to safeguard these emerging systems.

The transition away from centralized control structures demands the implementation of sophisticated defenses against bad actors and the preservation of data trustworthiness. Traditional security models, reliant on a single point of failure, prove inadequate in decentralized environments where consensus and distributed trust are paramount. Consequently, research focuses on cryptographic techniques – like zero-knowledge proofs and multi-signature schemes – alongside incentive mechanisms designed to reward honest participation and penalize malicious behavior. These approaches aim to create systems where data integrity isn’t guaranteed by a central authority, but rather emerges from the collective self-interest of network participants, fostering a resilient and tamper-proof digital landscape. The challenge lies in balancing security with usability and scalability, ensuring that these protective measures don’t stifle innovation or exclude potential users.

Current digital infrastructures often present bottlenecks that disproportionately affect smaller participants within decentralized networks, leading to significant liquidity challenges. These limitations stem from an inability to efficiently process a high volume of transactions-a problem known as scalability-and the associated high costs or complex technical requirements for accessing the network. Consequently, individuals or entities with limited resources find it difficult to engage in meaningful participation, hindering broader adoption and potentially concentrating power within larger, more established actors. This creates a paradoxical situation where the promise of democratization through decentralization is undermined by practical barriers to entry, emphasizing the critical need for innovations in layer-2 scaling solutions and user-friendly interfaces to truly unlock inclusive access and widespread liquidity.

Tokenization: A Formalization of Ownership

RWA Tokenization establishes a process for converting rights to physical assets – including real estate, commodities, artwork, and debt instruments – into digital tokens on a blockchain. This involves creating a digital representation of ownership, typically utilizing a blockchain network to record and verify transactions. The token itself functions as a claim on the underlying asset, enabling fractional ownership, increased liquidity, and potentially reduced administrative overhead compared to traditional ownership models. Tokenization does not transfer ownership of the asset itself, but rather represents a legal claim on it, which is typically enforced through legal agreements and jurisdictional frameworks.

Smart contracts are foundational to RWA tokenization, enabling the automated execution of asset management functions without intermediary involvement. Token standards such as ERC-20 facilitate the creation of fungible tokens representing fractional ownership, while ERC-777 introduces enhanced features like operator and data callbacks for increased flexibility and security. The ERC-3643 standard, specifically designed for tokenized representations of real-world assets, defines a standardized interface for managing underlying collateral and associated rights, including features for minting, burning, and transferring tokens based on verifiable ownership data. These standards ensure interoperability between different platforms and applications within the RWA ecosystem, and provide a secure and transparent framework for managing asset ownership and related processes.

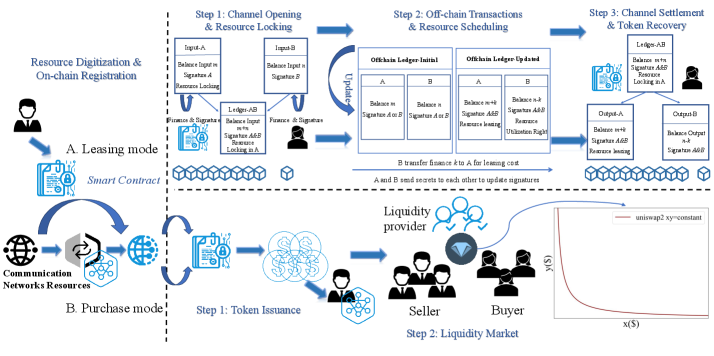

Scalability limitations and high transaction costs on Layer-1 blockchain networks present challenges for Real World Asset (RWA) tokenization, particularly for frequent trading. Layer-2 solutions address these issues through various mechanisms. State Channels enable off-chain transactions between parties, only settling the net result on the main chain, thereby reducing congestion and fees. Automated Market Makers (AMMs) facilitate decentralized exchange of RWA tokens with lower slippage and increased liquidity compared to traditional order book exchanges. These AMMs utilize liquidity pools funded by users, enabling continuous trading without reliance on centralized intermediaries. The combination of State Channels and AMMs allows for efficient and cost-effective RWA trading, improving accessibility and overall ecosystem performance.

![Various token standards, ranging from Non-Fungible Tokens (NFTs) to Real World Assets (RWAs), utilize distinct features as detailed in Ethereum Improvement Proposals [A1-A3] (https://eips.ethereum.org/EIPS/eip-777, https://eips.ethereum.org/EIPS/eip-1450, https://eips.ethereum.org/EIPS/eip-3643).](https://arxiv.org/html/2602.11798v1/x1.png)

Network Infrastructure: The Bedrock of Tokenized Systems

Reliable Real World Asset (RWA) tokenization is fundamentally dependent on sufficient network infrastructure. This necessitates scalable server capacity to handle transaction volume and data storage related to asset ownership and history. Adequate bandwidth is crucial for timely data transmission between nodes, oracles, and users, ensuring efficient processing of asset-related events. Furthermore, the availability of radio spectrum is a key consideration for assets utilizing IoT devices or real-time location services, as these require consistent and secure wireless communication channels for data reporting and verification of the physical asset’s status; limitations in any of these areas directly impact the scalability, security, and overall viability of RWA tokenization platforms.

Integration of Digital Twins with Real World Asset (RWA) tokens enables continuous, automated verification of asset condition and performance. These virtual representations of physical assets receive data from IoT devices, sensors, and other data streams, updating their state in real-time. This data is then cryptographically linked to the corresponding RWA token, providing an immutable record of the asset’s history and current status. This linkage facilitates trust and transparency, allowing stakeholders to independently verify claims about the underlying asset, such as operational efficiency, maintenance records, or location. The resulting system allows for dynamic adjustments to token value or automated execution of smart contract terms based on verifiable, real-time asset data.

Non-fungible tokens (NFTs) leveraging the ERC-721 and ERC-1155 token standards enable the representation of ownership in unique or divisible real-world assets (RWAs) on blockchain networks. ERC-721 is primarily used for unique assets – such as real estate or artwork – providing verifiable digital proof of ownership. ERC-1155 allows for the creation of both fungible and non-fungible tokens within a single contract, facilitating the fractional ownership of assets like commodities or intellectual property. This tokenization process transforms illiquid assets into tradeable digital representations, increasing market accessibility and potentially lowering transaction costs by removing traditional intermediaries. The standards define metadata fields that can link the token to specific asset details and ownership records, creating an auditable trail of provenance.

The Inevitable Convergence: Tokenized Assets and Future Networks

Tokenizing Real-World Assets (RWAs) offers a novel approach to building the infrastructure for next-generation communication networks by transforming essential resources – such as bandwidth, computational power, and storage – into programmable, tradable tokens. This system moves beyond static resource allocation, enabling dynamic and efficient distribution based on real-time demand and market value. By representing these resources as tokens on a blockchain, the framework allows network participants to directly trade access, incentivizing optimal utilization and fostering a more liquid, accessible market for critical infrastructure. This granular control and tradability not only lowers barriers to entry for innovators but also unlocks previously untapped economic potential within the network itself, paving the way for a more resilient and adaptable communication landscape.

Tokenizing network resources as readily tradable assets dramatically alters the landscape of access and innovation in future communication networks. Historically, acquiring bandwidth or computational power demanded substantial upfront investment and complex negotiations, effectively barring many potential entrants and limiting experimentation. However, a liquid market for these resources, enabled by tokenization, allows smaller entities and individual developers to acquire only the capacity they need, precisely when they need it. This fractionalization lowers the barriers to entry, fostering a more competitive environment and accelerating the pace of innovation as developers can rapidly prototype and deploy new applications without being constrained by resource availability. The resulting increase in accessibility not only empowers a broader range of participants but also unlocks the potential for novel network applications and business models previously considered impractical due to logistical or financial constraints.

Tokenized assets offer a fundamentally new approach to securing and verifying access to network resources, fostering trust in decentralized infrastructure. By representing resources as unique, traceable tokens on a blockchain, the system establishes an immutable record of ownership and usage rights. This transparency dramatically reduces the potential for fraud and disputes, as all transactions are publicly verifiable. Furthermore, the cryptographic security inherent in blockchain technology protects against unauthorized access and manipulation of these assets. This combination of transparency and security is critical for attracting wider participation and investment in next-generation networks, as it alleviates concerns about reliability and accountability that often hinder the adoption of decentralized systems. Consequently, the enhanced trust facilitated by tokenized assets encourages a more robust and inclusive ecosystem for network resource allocation and utilization.

Research detailed in the paper reveals a novel framework for resource allocation – Real World Asset (RWA) tokenization – consistently achieves complete, or 100%, utilization of network resources, even when those resources are limited. This stands in stark contrast to traditional mechanisms which typically struggle with inefficiency and waste, particularly under conditions of scarcity. The study demonstrates that by representing network access as tradable tokens, the framework incentivizes optimal allocation and prevents underutilization. This isn’t merely theoretical; simulations consistently show complete resource absorption, highlighting a significant improvement in network efficiency and paving the way for more robust and sustainable next-generation communication infrastructure.

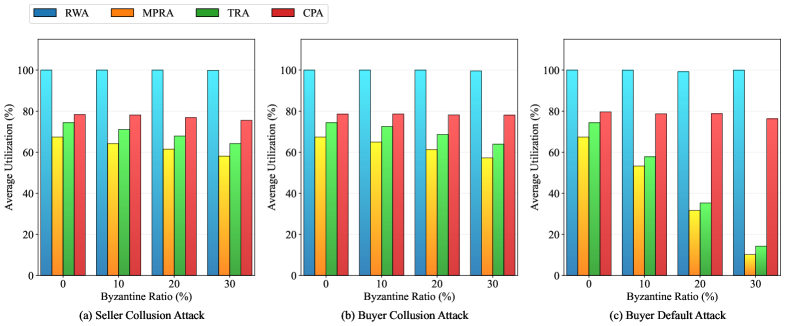

Resilience against malicious activity represents a key advantage of the proposed Real-World Asset (RWA) framework for network resource allocation. Rigorous testing under simulated attack conditions – encompassing scenarios like buyer and seller collusion, as well as instances of participant default – revealed the RWA scheme consistently maintained near 100% resource utilization. In stark contrast, competing mechanisms – including those based on Market-based Priority Resource Allocation (MPRA), Threshold-based Resource Allocation (TRA), and Centralized Priority Allocation (CPA) – experienced substantial declines in efficiency when subjected to the same attacks. This sustained performance suggests that tokenizing network resources as RWAs not only optimizes utilization in ideal conditions, but also significantly bolsters the stability and reliability of next-generation communication networks even amidst adversarial behavior.

Rigorous testing reveals that a tokenized asset framework for network resource allocation consistently outperforms conventional methods – specifically, MPRA, TRA, and CPA – in maximizing resource utilization. This advantage is particularly pronounced under conditions of scarcity, where traditional approaches falter. The research demonstrates that while other schemes experience substantial declines in efficiency as resources become limited, the proposed framework maintains near-optimal performance. This superior resilience stems from the programmability and tradability inherent in tokenized assets, allowing for dynamic allocation and incentivizing efficient use even when demand exceeds supply, ultimately paving the way for more robust and sustainable next-generation communication networks.

“`html

The pursuit of verifiable systems, as outlined in the paper regarding RWA tokenization and next-generation networks, echoes a fundamental tenet of computational correctness. Alan Turing famously stated, “Sometimes people who are unhappy just want to be heard.” Though seemingly unrelated, this sentiment highlights the need for transparent and auditable processes – akin to a system’s ‘voice’ – to ensure reliability. The article’s focus on blockchain and smart contracts directly addresses this need, providing a provable record of transactions and asset allocation. Just as understanding a complaint requires clear communication, a robust network demands deterministic and reproducible results, particularly when dealing with the complexities of dynamic spectrum allocation and real-world asset liquidity.

Beyond the Token: Charting a Course for Minimalist Networks

The presented work, while demonstrating the feasibility of RWA tokenization within next-generation communication networks, merely scratches the surface of a far more fundamental challenge: reducing systemic complexity. The elegance of representing assets on a blockchain is overshadowed by the inherent overhead of maintaining consensus – a computationally expensive solution to a problem created by the lack of inherent trust. Future investigations must prioritize minimizing this reliance on distributed consensus, exploring deterministic alternatives wherever possible. Every smart contract, every layer of abstraction, introduces a potential failure point – an abstraction leak waiting to manifest.

The case study on dynamic spectrum allocation, while pragmatic, skirts the core issue of provable resource allocation. Simply achieving efficiency is insufficient; the system must be demonstrably, mathematically optimal. The current approach, reliant on market mechanisms driven by tokenized assets, introduces unpredictable variables. A truly robust network will derive its efficiency not from incentivized participation, but from a logically sound, verifiable algorithm.

Consequently, research should shift focus from the application of blockchain to the development of fundamentally secure and efficient communication protocols. The goal is not to digitize assets, but to eliminate the need for centralized control and the associated vulnerabilities. The pursuit of “decentralization” is a distraction if it simply replaces one complex system with another. True progress lies in minimalism, in finding the simplest, most mathematically pure solution.

Original article: https://arxiv.org/pdf/2602.11798.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- EUR USD PREDICTION

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- TRX PREDICTION. TRX cryptocurrency

- Xbox Game Pass September Wave 1 Revealed

- Best Ship Quest Order in Dragon Quest 2 Remake

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

2026-02-14 00:13