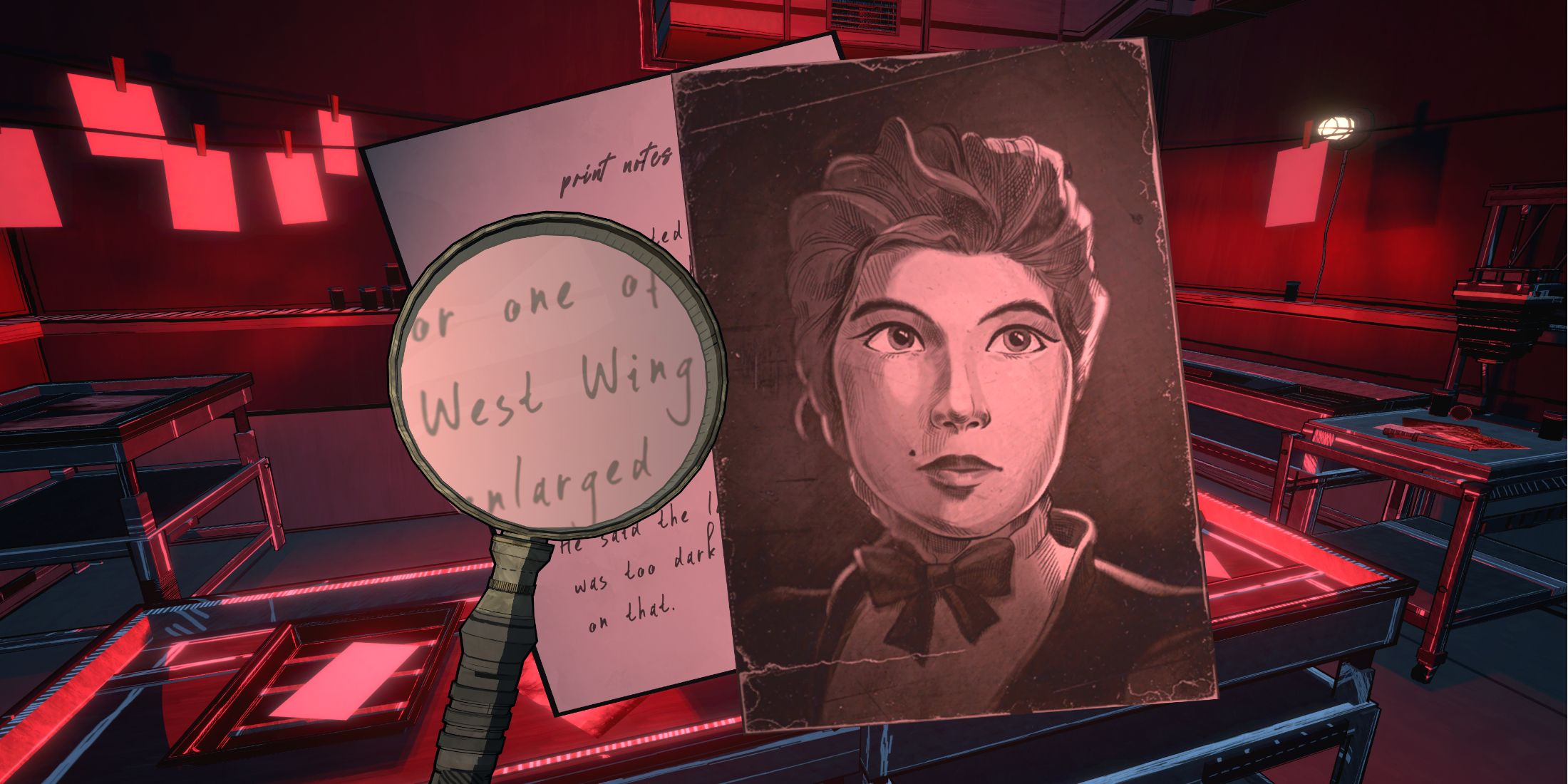

Who Is Axel Gilberto? The Mystery Behind Lazarus’ 888-Year Prisoner

In the initial episode of “Lazarus,” though their backgrounds remain largely unspoken, various elements are skillfully employed to give each main character a distinct and intriguing persona that complements the storyline. Particularly noteworthy is Axel Gilberto, whose elusive nature seems to only intensify as his personality becomes strikingly apparent in this premiere installment. As such, I find myself pondering: what can be gleaned about the fifth member of the Lazarus organization from this first glimpse?