In the grand pageant of digital currency, Bitcoin has once again donned its tiara and sashayed back above the $105,000 mark. A recovery most triumphant, or a prelude to a market melodrama? One must ponder…

Oh, the drama! Bitcoin, that tempestuous tart, began the week with a rather ungraceful stumble towards the $98,000 mark. Yet, like a phoenix rising from the ashes of its own making, it has soared back to the giddy heights of $105,000. Such resilience, or is it mere bravado?

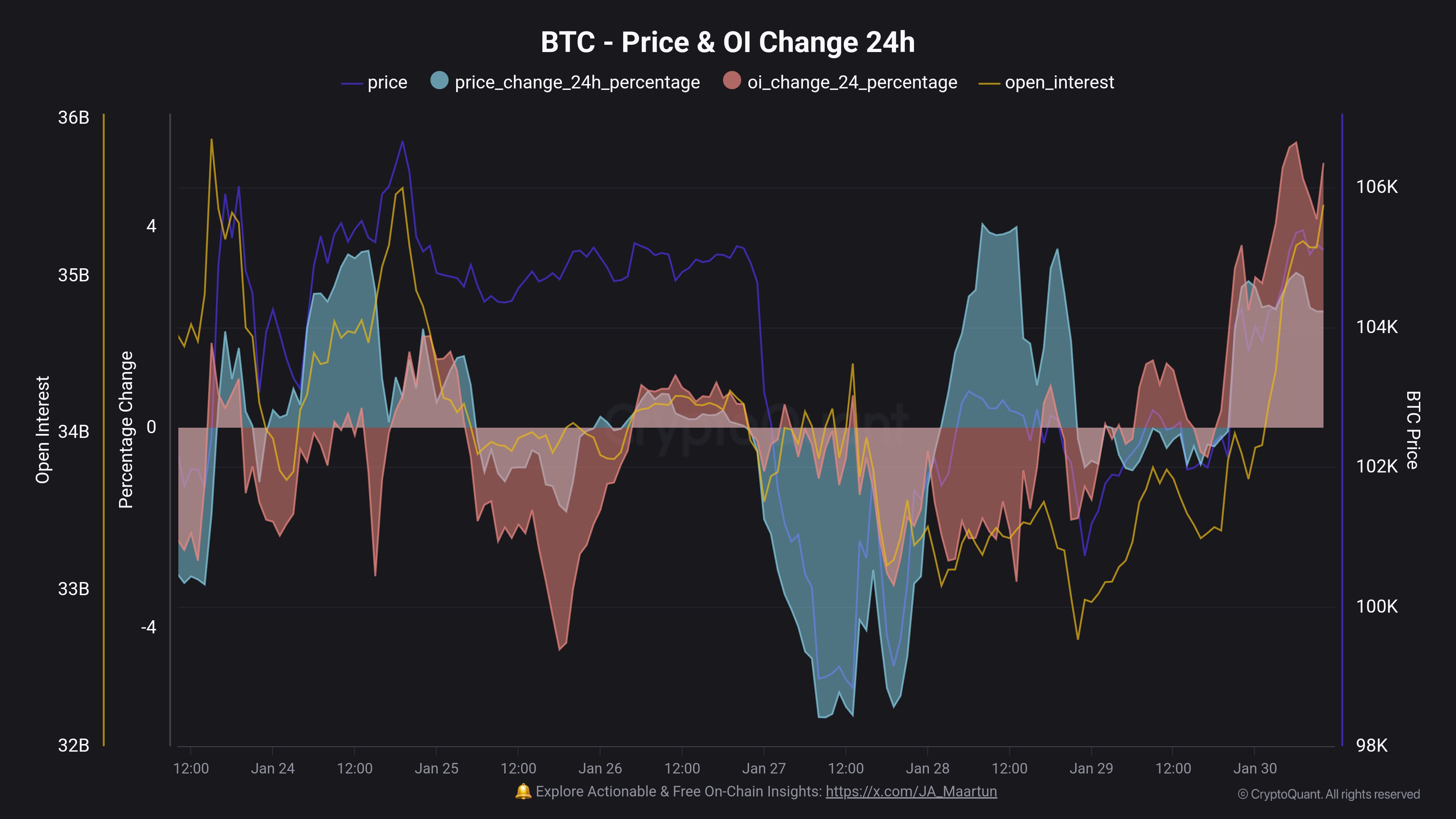

Observe, if you will, the below chart which details the asset’s recent trajectory. A veritable rollercoaster of fortune, wouldn’t you say?

As the graph so brazenly displays, Bitcoin even dared to flirt with the $106,000 level earlier today before retreating to its current abode of $105,700. A modest pullback, but still, BTC is up a cheeky 4% in the last 24 hours. Such a tease!

But let us not get too carried away, dear investor. The question on everyone’s lips: will this recovery last? Ah, the variables, the variables! Yet, one indicator in particular might be raising an eyebrow or two – the Open Interest.

The Curious Case of the Soaring Open Interest

CryptoQuant’s own Maartunn, a sleuth of the digital markets, has highlighted a rather intriguing development. The Bitcoin Open Interest has experienced a most rapid ascent, hot on the heels of the cryptocurrency’s price rally.

“Open Interest,” for the uninitiated, is a rather clever metric that keeps tabs on the totality of BTC-related positions currently open across all centralized derivatives exchanges. A veritable barometer of market enthusiasm, or a ticking time bomb? Time will tell.

When this value swells, it suggests that derivatives users are gleefully opening fresh positions. More leverage, more excitement, more volatility! Conversely, a decline might imply a more tranquil market ahead. But who wants tranquility in the crypto game?

Behold the chart shared by Maartunn, a visual feast that depicts the Open Interest trend and its 24-hour percentage change. Gaze upon it and marvel!

As the graph so vividly illustrates, the Bitcoin Open Interest has skyrocketed over the past day. Investors, it seems, have thrown caution to the wind and opened a veritable floodgate of positions on the derivatives market.

The scale of this increase is nothing short of spectacular, as evidenced by the 24-hour percentage change. Maartunn notes that this leverage-driven rally may not bode well for the longevity of the price move. Ah, the perils of excess!

History has a knack for repeating itself, and such market conditions have historically been a recipe for rather violent liquidation events. Will the rally continue unfazed, or will a squeeze lead to a temporary retreat? Only time, that fickle mistress, will reveal all.

Read More

- Unlock the Magic: New Arcane Blind Box Collection from POP MART and Riot Games!

- Top 8 UFC 5 Perks Every Fighter Should Use

- How to Reach 80,000M in Dead Rails

- Unlock the Best Ending in Lost Records: Bloom & Rage by Calming Autumn’s Breakdown!

- Unlock Roslit Bay’s Bestiary: Fisch Fishing Guide

- Jujutsu Kaisen Shocker: The Real Reason Gojo Fell to Sukuna Revealed by Gege Akutami!

- Unaware Atelier Master: New Trailer Reveals April 2025 Fantasy Adventure!

- How to Unlock the Mines in Cookie Run: Kingdom

- REPO: How To Fix Client Timeout

- MHA’s Back: Horikoshi Drops New Chapter in ‘Ultra Age’ Fanbook – See What’s Inside!

2025-01-31 15:15