Ah, Bitcoin, that capricious diva of the crypto stage, recently flirted with a new all-time high, brushing past $124,000 like it owned the place. But, as fate would have it-or perhaps its own inflated ego-it stumbled into a 9% nosedive shortly after. Truly, the theater of the absurd never sleeps!

Amidst this rollercoaster ride, market sage Miles Deutscher took to X (née Twitter) to muse on August’s potential legacy: not as a triumph but as a sinister trap for the unsuspecting investor. Let us now peer into his crystal ball, shall we?

Two Acts for Bitcoin’s Fate

Deutscher begins his soliloquy by noting an unsettling shift. Ethereum, Bitcoin’s younger yet increasingly charismatic rival, has stolen the spotlight. Since early July, BTC has been showing signs of structural weakness-like an aging actor trying to recapture their glory days.

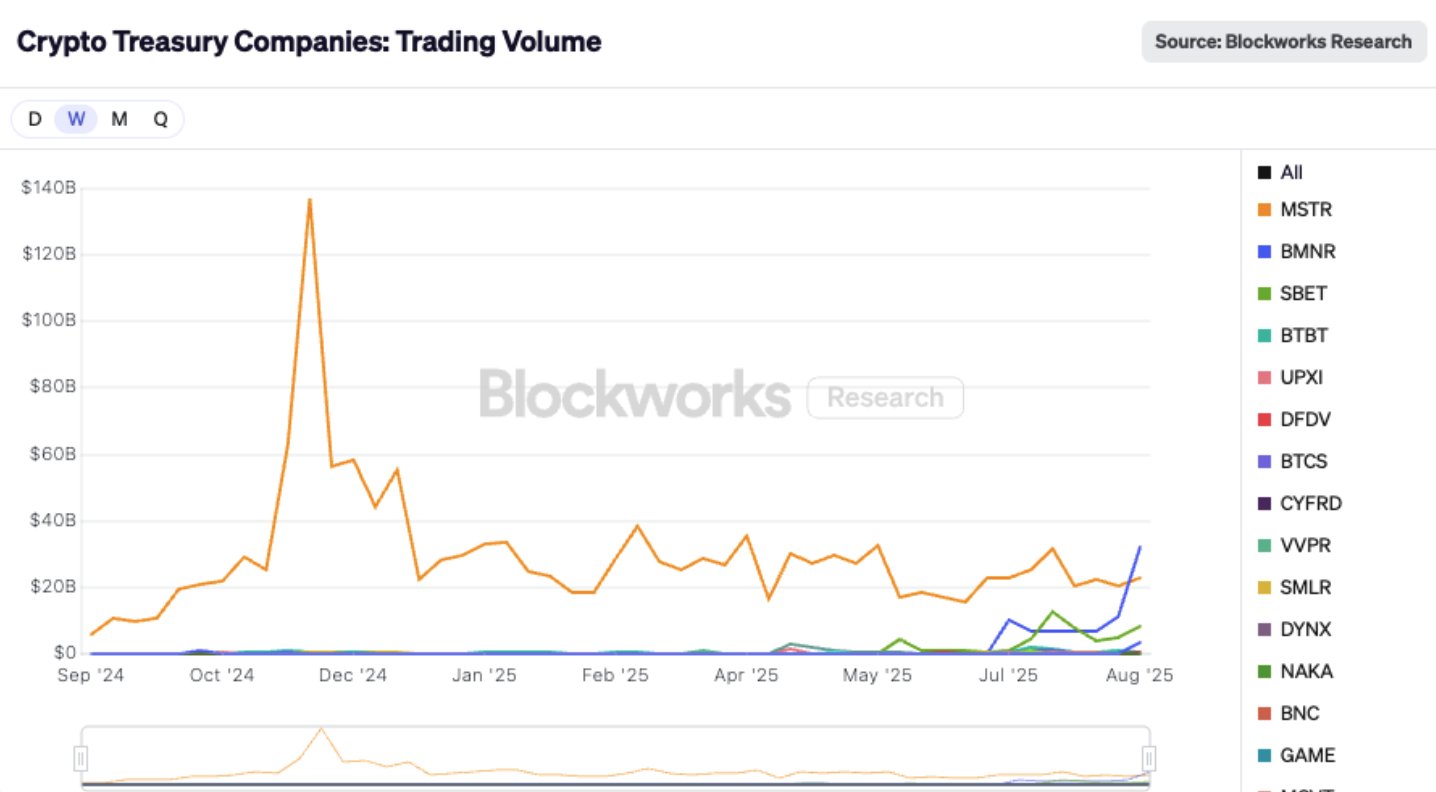

Why this sudden decline in stardom? According to our expert critic, one culprit is MicroStrategy’s waning treasury purchases, which previously propped up Bitcoin like a loyal understudy. Now abandoned, BTC finds itself languishing, waiting for macroeconomic cues to reignite its passion.

Deutscher sketches two possible endings for Bitcoin’s current act. In Scenario One, BTC dips to $111,000-a fate as grim as forgetting your lines mid-performance. Meanwhile, Ethereum clings to its critical support at $4,000, refusing to exit stage left.

In Scenario Two, however, Bitcoin regains composure around $115,500, setting the stage for a triumphant encore. Alas, such optimism comes with no guarantees, much like trusting a mime to deliver Shakespearean dialogue.

Meanwhile, Ethereum basks in applause, buoyed by $27 billion in sidelined capital ready to invest in DATs. Altcoins too join the standing ovation, proving more resilient than ever before. Could this be the dawning of a new era where Bitcoin plays second fiddle?

Ethereum Takes Center Stage

Indeed, ETH has begun outshining BTC even in trading volume among treasury companies. Deutscher quips that Ethereum remains a less saturated trade-a fresh-faced ingenue compared to Bitcoin’s weathered veteran.

This resilience extends beyond Ethereum alone; altcoins refuse to crumble under pressure. Unlike previous corrections where they folded faster than a bad poker hand, today’s altcoin market stands tall, defiantly bullish. Perhaps there’s hope for these supporting characters after all.

But let us not forget the villain lurking backstage: macroeconomic uncertainty. The Federal Reserve’s impending Jackson Hole speech and hot Producer Price Index data have sent investors scrambling for exits, fearing a hawkish twist. It seems everyone wants to sell before intermission.

Yet Deutscher offers a glimmer of hope. Once the dust settles post-Jackson Hole-and assuming the Fed doesn’t pull a plot twist-the market may rally once more. Until then, brace yourselves for September’s historical volatility, because if anything defines Bitcoin, it’s its flair for the dramatic.

As I pen these words, BTC clings precariously to $113,000, nursing its wounds 9% below its recent peak on August 14. Will it rise again, or fade into obscurity? Only time-and perhaps another tweet from Deutscher-will tell.

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Who Is the Information Broker in The Sims 4?

- 8 One Piece Characters Who Deserved Better Endings

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

2025-08-22 05:13