Although many had been eagerly betting on a US interest rate cut to lift Bitcoin to dazzling new heights, the poor thing remains curiously stationary. In an eye-catching little dance of decline, the futures trading volume on Binance Futures has diminished, causing a commotion among the discerning circle of analysts who regard it as a most regrettably “red flag.”

In a scintillatingly dull report published on a dreary Monday, CryptoQuant analyst Mignolet, whose insight is only surpassed by his lack of flair, opined that a marked fall in futures volume is more disconcerting than a gardener finding a weed on his prized chrysanthemums.

A Change in Market Behaviour

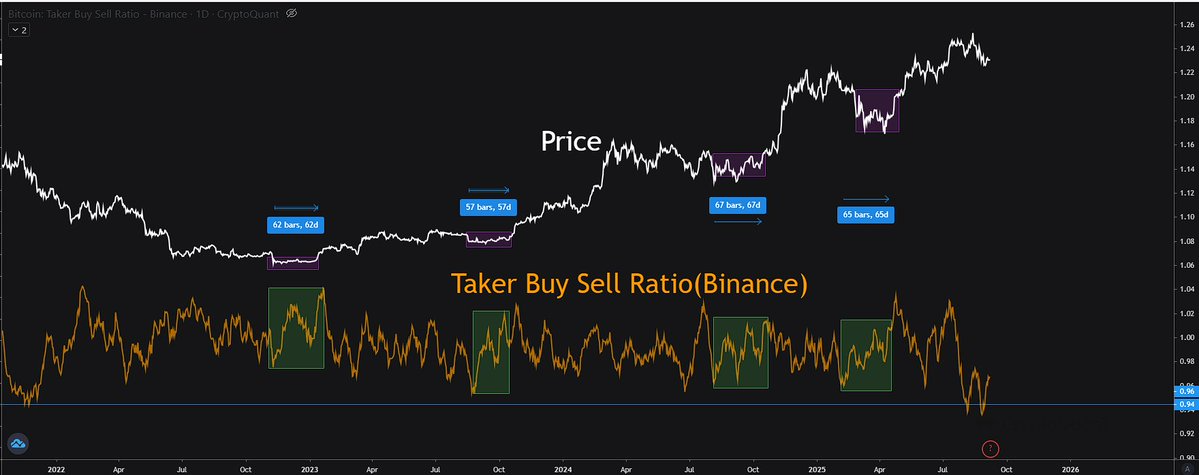

He elaborated with the drama of a telenovela, elucidating that during the present bull run-such an elusive creature-bullish divergence in the market buy/sell ratio on Binance’s futures market has often served as a faithful harbinger that the price was contemplating retirement or taking a brief nap.

A considerable congregation of market buys is akin to a royal garden party where an abundance of investors and capital are invited to lament or anticipate at a price increase. History, our charming yet strict companion, reliably gestures towards an upward trajectory in these markets.

Regrettably, the atmosphere has soured. Mignolet now believes the current intrigues are reminiscent of a 2021 market soiree, where he suggests not placing bets on simple bullish/bearish ratios, but rather on the much grittier aspect of actual trading volume.

Binance Futures Volume Needs a Touch of Rehabilitation

In a rather puzzling turn of events worthy of a mystery novel, Bitcoin’s price ascensions since 2020 have rather gleefully danced in tandem with a rise in Binance futures buy volume. Alas, this time, the story weaves a different path. As Bitcoin continues to flirt with new all-time highs, futures buy volume appears decidedly more frigid. Mignolet noted this disconcerting schism is eerily reminiscent of the market’s grand finale in 2021.

He enlightened us that while ETFs and MicroStrategy (MSTR) bestow spot market liquidity with an almost divine touch, the future of the futures market seems hopelessly tethered to Binance. Mignolet contests that a robust upward trek for Bitcoin seems an implausible dream absent a fierce rebound in the futures market.

Mignolet stopped just short of declaring the end of the current bull run, akin to holding the final act of a play hostage. “The problem,” he sighed with the elegance of a poet, “is that liquidity is waning overall.” He added, alluding to a twist, “Should trading volume return valiantly, the market could yet be seen as possessing vigor.”

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- 8 One Piece Characters Who Deserved Better Endings

- Who Is the Information Broker in The Sims 4?

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Mewgenics Tink Guide (All Upgrades and Rewards)

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- I Used Google Lens to Solve One of Dying Light: The Beast’s Puzzles, and It Worked

2025-09-08 12:21