- ETH takes a tumble, down a whopping 47% since last year.

- Ethereum‘s ballyhooed challenge to Bitcoin turns into a sorry spectacle.

In the grand year of our Lord, 2025, Ethereum [ETH] has been having a bit of a doozy. Once poised to dethrone Bitcoin [BTC], it now finds itself lagging behind even the tiddlywinks of the crypto world.

This rather unseemly performance has caused a bit of a stir among the chaps who matter, and even the blighters in the mainstream media have taken note. A recent Bloomberg report suggests that Ethereum is facing its trickiest decade yet.

In a turn of events that would make a cat laugh, Ethereum developers are legging it, early fans are in a right old snit, and the token is trailing both BTC and its lesser-known brethren.

Despite being the second-largest crypto, with a market cap of $221 billion, ETH has taken a bit of a nosedive. From a lofty $3.6k in January 2025, it’s now a mere shadow of its former self at $1.8k.

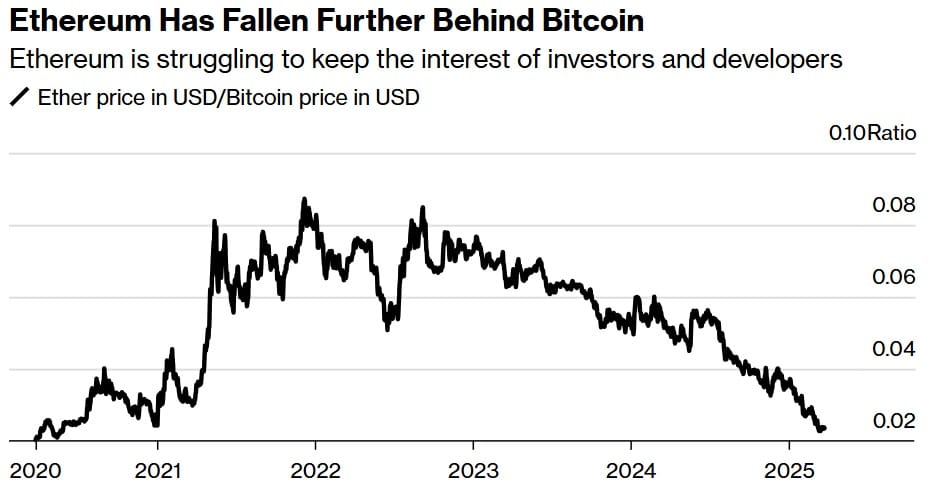

This dive is shaping up to be the worst quarterly bellyflop since the 2022 bear market. While BTC has soared by 30%, Ethereum has plumbed the depths with a 47% decline, losing its lead like a hound losing a rabbit.

Market dominance has taken a hit too, down to 7.9% from a once-impressive 17%. Meanwhile, its competitors are growing like weeds in a well-tended garden.

Take, for instance, the number of active developers on Ethereum-related software, which dropped by 17% in 2024. Meanwhile, Solana [SOL] saw a surge in developers, becoming the go-to spot for memecoins, with a year-to-year growth of 83%.

Ripple’s XRP is also having a jolly good time at Ethereum’s expense. While ETH has been on the decline, XRP has shot up by 249%, with its market cap blooming from $30 billion to $127 billion.

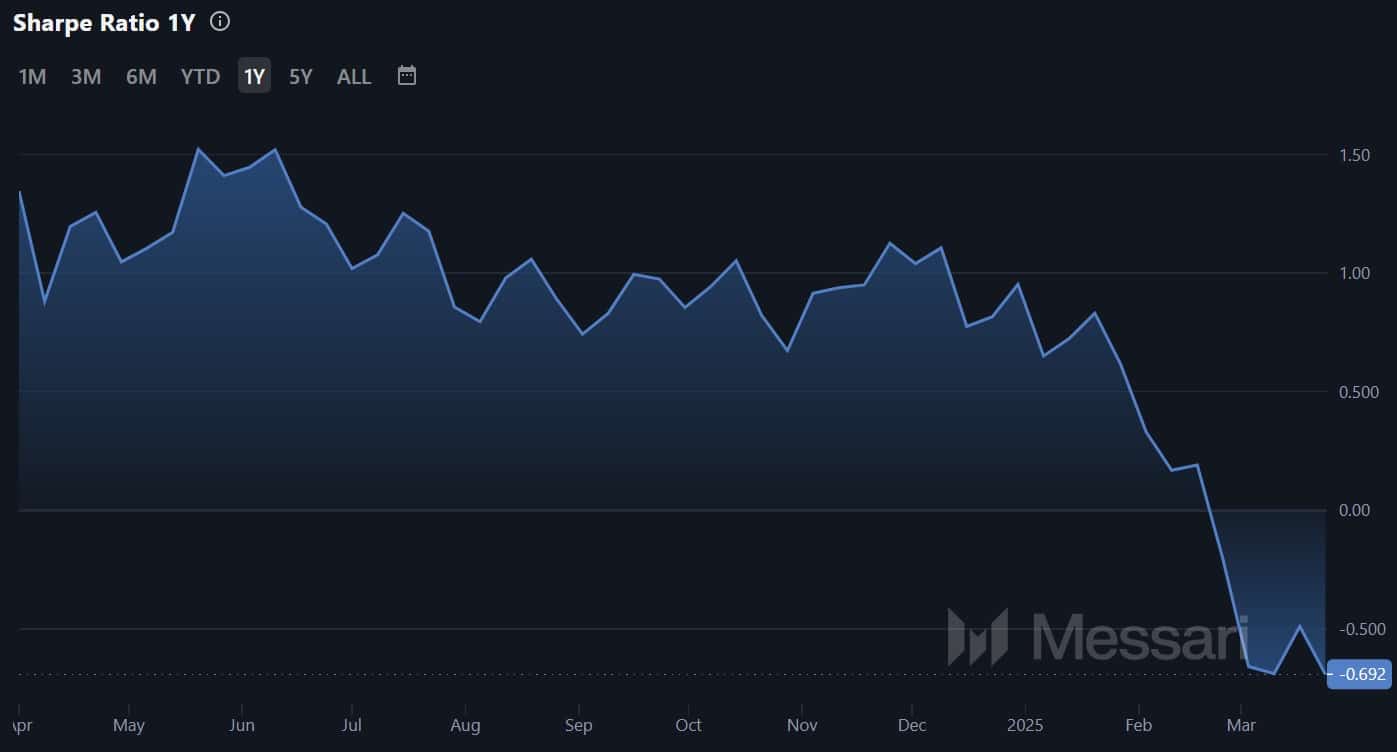

ETH’s woeful performance has made it about as attractive to investors as a wet weekend in Bognor Regis. Its Sharpe ratio over the past year has plummeted to -0.69, indicating that not only are returns dwindling, but it’s riskier than a game of Russian roulette with a fully loaded gun.

What’s the Rumpus with Ethereum?

According to the bigwigs, Ethereum’s fundamental challenge is leadership. Ryan Watkins, in his analysis, pointed out that Ethereum’s leaders have botched the job of capitalizing on past momentum.

“It’s all about growth and leadership — If the Ethereum ecosystem kept pace with, or outpaced, its peers, none of these above would matter.”

Bloomberg, too, had a pop at Ethereum’s founder, Vitalik Buterin, for not adapting to change. Under his watch, Ethereum remains as decentralized as a one-man band, failing to cozy up to politicians and lobby in Washington DC.

Buterin’s vision of a fully decentralized blockchain has left him out in the cold, while other players are cosying up to governments like a cat to a saucer of cream.

What’s Next for ETH?

AMBCrypto’s analysis paints a rather gloomy picture. At press time, Ethereum was trading at $1839, down 2.11% over the past day. Weekly charts show an 8.39% decline, suggesting that the market is about as keen on ETH as a duck is on algebra.

The Stoch RSI is waving a red flag, indicating that the downtrend might continue. Since making a bearish crossover five days ago, Stoch has dropped to 14.6, which is about as encouraging as a wet blanket at a campfire.

If the current external factors persist, ETH could be in for a further dip. A continued slide could see it hit $1761. For a turnaround, ETH must reclaim and hold the $2k mark, or it’s curtains.

Read More

- Delta Force: K437 Guide (Best Build & How to Unlock)

- One Piece Episode 1129 Release Date and Secrets Revealed

- USD ILS PREDICTION

- Top 8 UFC 5 Perks Every Fighter Should Use

- Slormancer Huntress: God-Tier Builds REVEALED!

- AI16Z PREDICTION. AI16Z cryptocurrency

- Tainted Grail: The Fall of Avalon – Everything You Need to Know

- How to Unlock the Mines in Cookie Run: Kingdom

- Nine Sols: 6 Best Jin Farming Methods

- REPO’s Cart Cannon: Prepare for Mayhem!

2025-03-31 07:10