Oh, lookie here! Arkham Intelligence just dropped a little nugget: turns out, the big Bitcoin ETF kahunas are snatching up BTC like it’s on sale. $220 million worth of inflows yesterday? Someone’s got a crystal ball, and it’s not me.

Bitcoin’s been doing the hokey-pokey with its price, but these institutional bigwigs seem to be saying, “TradFi market, who?”

Why the Bitcoin Love Fest?

The crypto world’s having a yard sale today with all these liquidations, and everyone’s talking recession like it’s the next big hit on Broadway. Trump’s tariffs? Higher than my blood pressure after watching C-SPAN. Crypto’s following the stock market’s lead, and it’s not a pretty dance.

But hey, the US spot Bitcoin ETFs are like, “We got this.” Institutional demand? It’s baaack.

“Trump tariffed the globe, and what happened? Grayscale’s buying, Fidelity’s buying, Ark Invest is buying. Bitcoin’s the new black,” Arkham Intelligence quipped on the ‘gram.

Arkham’s not the only one with eyes on this Bitcoin ETF party. Price volatility? Yeah, but Bitcoin’s like a boomerang; it keeps coming back.

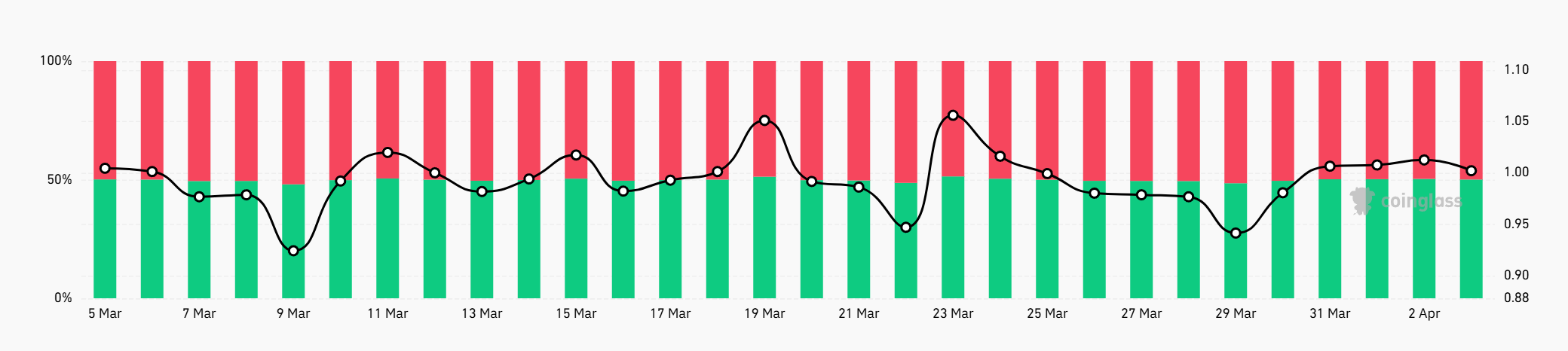

Last week’s long-short ratio was like a seesaw, but now it’s 50-50. Investors are playing it cool, like they just don’t care. No more bearish bias, just a big shrug.

Market sentiment’s chill now, maybe because everyone’s waiting for the next big sign before they go all in. Bitcoin investors are playing hard to get.

And the Bitcoin ETFs? They’re the prom kings. $220 million in net inflows? That’s like Trump announcing his own holiday and the market’s like, “We’ll celebrate with more BTC!”

Today’s market chaos? Who knows what it did to the Bitcoin ETFs. But Arkham’s saying these issuers are putting their money where their mouth is.

If ETF inflows keep up, it’s like institutional investors are placing their bets on BTC to be the cool cucumber in this economic sauna. Questions, questions, so many questions. But one thing’s clear: Bitcoin’s the belle of the ball.

Read More

- Top 8 UFC 5 Perks Every Fighter Should Use

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Tainted Grail The Fall of Avalon: How To Romance Alissa

- Nine Sols: 6 Best Jin Farming Methods

- AI16Z PREDICTION. AI16Z cryptocurrency

- USD ILS PREDICTION

- Rick and Morty S8 Ep1 Release Date SHOCK! You Won’t Believe When!

- Slormancer Huntress: God-Tier Builds REVEALED!

- Delta Force: K437 Guide (Best Build & How to Unlock)

- One Piece Episode 1130: The Shocking Truth Behind Kuma’s Past Revealed!

2025-04-04 02:46