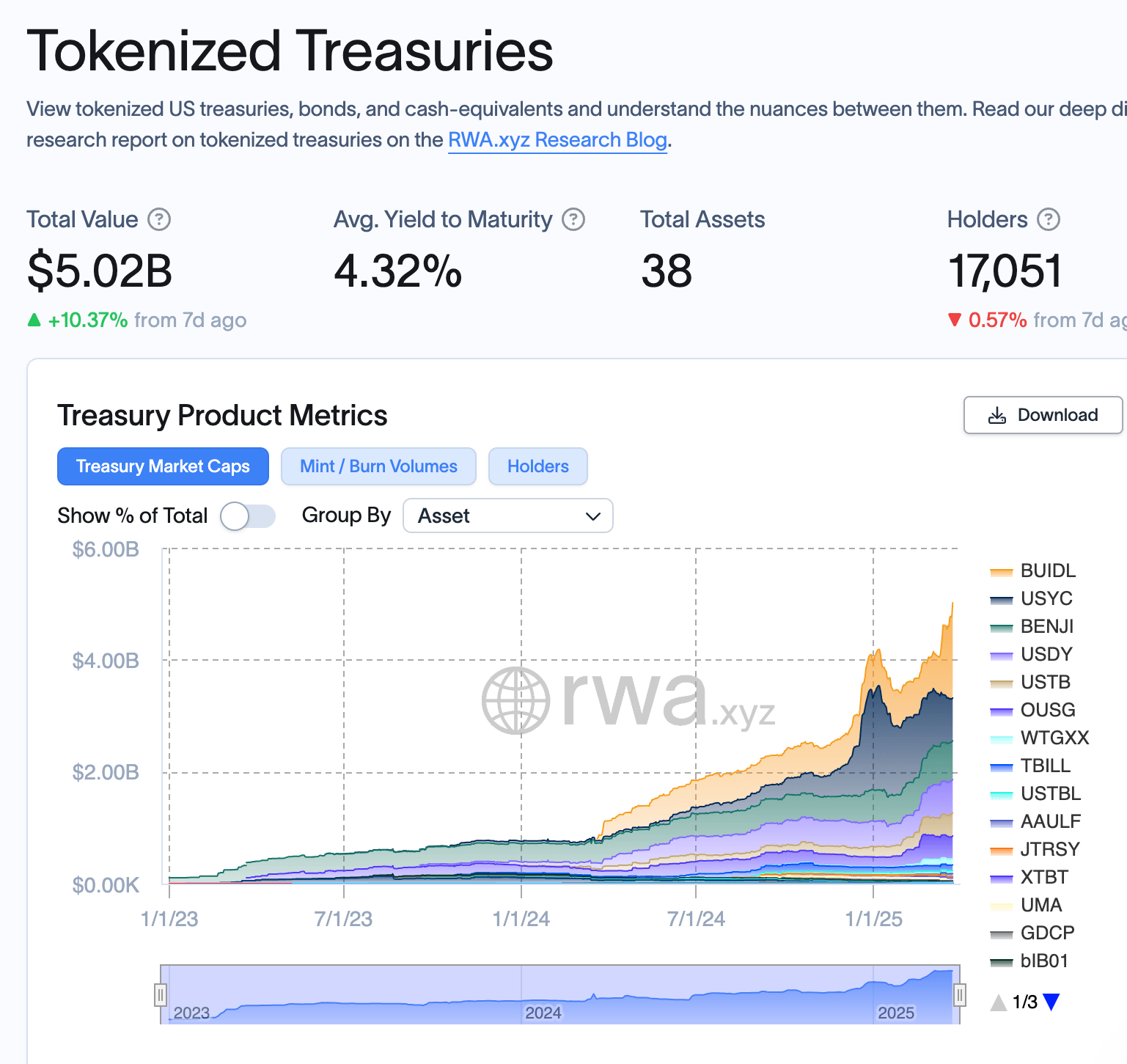

Imagine, if you will, a world where finance meets the blockchain—and not just in a casual, nodding-acquaintance kind of way, but in a full-blown, multi-billion-dollar love affair. That’s precisely the universe we’re living in, folks, as Blackrock and Securitize unveiled their latest digital darling: a new share class of their BUIDL tokenized treasury fund, now strutting its stuff on the Solana blockchain. And oh, did I mention this happened just as the fund ballooned to a cool $1.7 billion, riding the wave of a tokenized treasury market that’s hit a staggering $5 billion? 🚀💸

The BUIDL Brigade Marches onto Solana, Just in Time for the Market’s Grand Finale

Blackrock’s USD Institutional Digital Liquidity Fund (BUIDL), given a blockchain makeover by Securitize, has now set up shop on Solana. This move expands its dominion to seven networks, including Ethereum, Polygon, and Avalanche, because apparently, when it comes to blockchains, more is merrier. And let’s not forget the magical bridge that makes it all possible: Wormhole, the unsung hero facilitating seamless transfers across these digital realms.

BUIDL, the brainchild that emerged in March2024 as Blackrock’s first foray into public blockchain-based funds, offers institutional investors the chance to dip their toes into U.S. dollar yields, daily dividends, and24/7 peer-to-peer transactions—all with the kind of ease that makes you wonder why we ever bothered with paper money. Solana’s entrance onto the scene is like adding a turbocharger to a sports car; it’s all about speed, efficiency, and keeping those costs down.

With the tokenized treasury market hitting a mind-boggling $5 billion, it’s clear that institutional adoption is no longer just a trend—it’s the new normal. And with custodians like Anchorage Digital, Copper, and Fireblocks backing BUIDL, alongside Bank of New York Mellon taking care of the cash and securities custody, it’s like having a dream team of financial all-stars.

Securitize CEO Carlos Domingo couldn’t help but gush about the growing clamor for tokenized real-world assets (RWAs), with Solana’s technical prowess playing a starring role in making these assets more accessible than ever. Solana Foundation President Lily Liu chimed in, highlighting the network’s vibrant developer ecosystem and cost efficiency as the secret sauce for institutional adoption.

“Since BUIDL’s grand entrance, we’ve seen demand for tokenized real-world assets skyrocket, proving once and for all that bringing institutional-grade products onchain isn’t just a good idea—it’s a necessity,” Domingo declared, with the kind of enthusiasm usually reserved for finding a twenty-dollar bill in your coat pocket.

And let’s not gloss over the fact that BUIDL has casually crossed the $1 billion mark in assets under management (AUM), all while keeping its doors open exclusively to the VIP club of qualified investors. This expansion is more than just a footnote; it’s a neon sign flashing the message that traditional financial institutions are ready to embrace blockchain solutions with open arms, all in the name of better liquidity and reduced operational costs. BUIDL’s multi-chain strategy is like a masterclass in navigating the choppy waters of regulatory frameworks while catering to the diverse whims and fancies of investors.

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nvidia Reports Record Q1 Revenue

- AI16Z PREDICTION. AI16Z cryptocurrency

2025-03-25 22:29