In the dusty plains of the digital frontier, where numbers dance like tumbleweeds in a storm, the year 2025 brought a frenzy that even the wildest of speculators couldn’t have dreamed up. Global crypto exchange trading volume soared to a staggering $79 trillion, a figure so absurd it makes a farmer’s harvest look like pocket change. And what drove this madness? Futures and perpetual contracts, the wild stallions of the market, galloping ahead while spot trading trudged along like a mule with a broken hoof. 🌪️

Spot Trading: The Slowpoke in a Race of Rockets

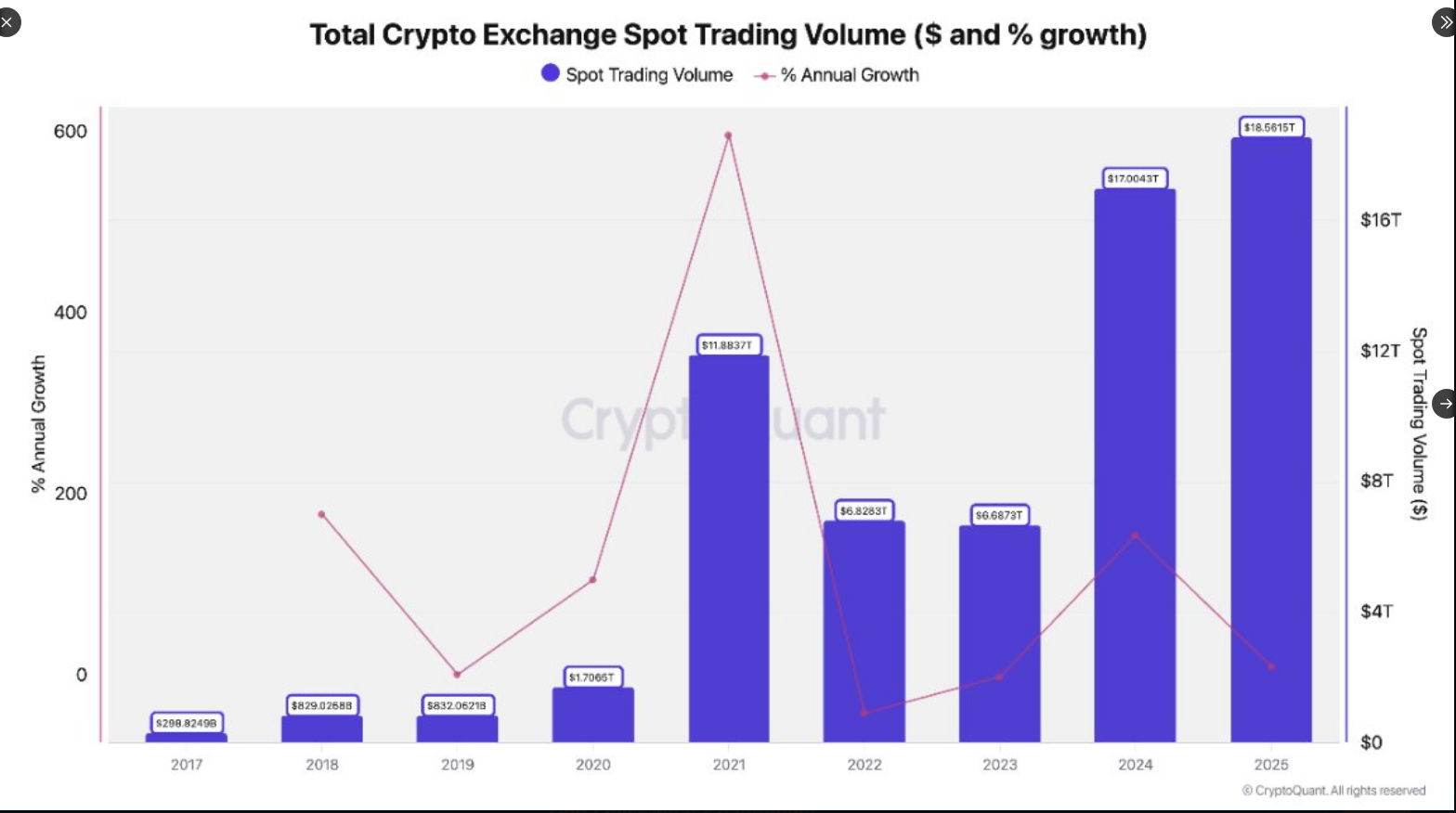

Spot trading, the honest laborer of the crypto world, managed to eke out a modest $18.6 trillion, a 9% increase from the previous year. But who’s counting? Certainly not the futures and perpetuals, which exploded to nearly $62 trillion, claiming a whopping 77% of the market’s activity. It’s like watching a tortoise try to keep up with a cheetah-pathetic, yet somehow endearing. 🐢🚀

Binance: The Sheriff in a Lawless Town

In this Wild West of numbers, Binance stood tall as the undisputed sheriff, herding $25.4 trillion in Bitcoin perpetual futures alone-a 42% chunk of the top 10 platforms’ volume. With stablecoin reserves deeper than a prospector’s gold mine, Binance left its rivals in the dust. OKX, Bybit, and Bitget trailed behind, forming a secondary posse in the futures showdown. 🏜️⚖️

2025 crypto exchange activity in review.

Spot volume: $18.6T (+9% YoY). Perpetuals: $61.7T (+29%). Binance: Still the king, wearing the crown and probably the boots too. 👑🤠

Growth is derivative-led, and the big fish just keep getting bigger. Whales, anyone? 🐳

– CryptoQuant.com (@cryptoquant_com) January 12, 2026

Not everyone counts their beans the same way. CoinGlass, for instance, claimed derivatives volume hit $85.7 trillion-a number so inflated it could only come from a market where reality is as fluid as a mirage. Differences in counting methods, product inclusions, and venue coverage turned the data into a game of telephone, with each source whispering a slightly different tale. 📈🤷♂️

Traders, those restless souls of the digital age, flocked to futures like gamblers to a riverboat casino. Hedging, speculating, and chasing price swings-it was all part of the dance. While spot trading is the steady plow of the market, futures are the fireworks, multiplying notional flow like a magician pulling rabbits from a hat. 🎩✨

But with great volume comes great risk. Regulators, the ever-watchful vultures, have warned that relying on a handful of exchanges is like building a house on quicksand. Outages, enforcement actions-one wrong move, and the whole thing could collapse. Yet, in 2025, the market doubled down, funneling even more volume through the biggest players. 🦅🏗️

The future, as always, is as clear as mud. Will spot trading catch up? Will regulators throw a wrench in the works? Institutional interest, regulated products, stablecoin rules-all could shake things up. But one thing’s certain: the numbers will keep dancing, and the headlines will keep spinning. Just don’t bet the farm on it. 🌪️🎢

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- God Of War: Sons Of Sparta – Interactive Map

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Who Is the Information Broker in The Sims 4?

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- All 100 Substory Locations in Yakuza 0 Director’s Cut

- How to Unlock all Substories in Yakuza Kiwami 3

2026-01-14 04:19