Oh, what’s this? Bitcoin, that ever-dramatic diva of the crypto opera, is making a valiant attempt at a comeback, as valiant as a chicken crossing the road. After days of sellers howling like hungry wolves and traders clutching their pearls, the coin now wobbles upward-though not without the grace of a drunk on a pogo stick. Support? Stability? Ha! The market’s about as predictable as a thunderstorm in a teacup. Yet, amid this circus, one man-nay, a legend-returns to the ring.

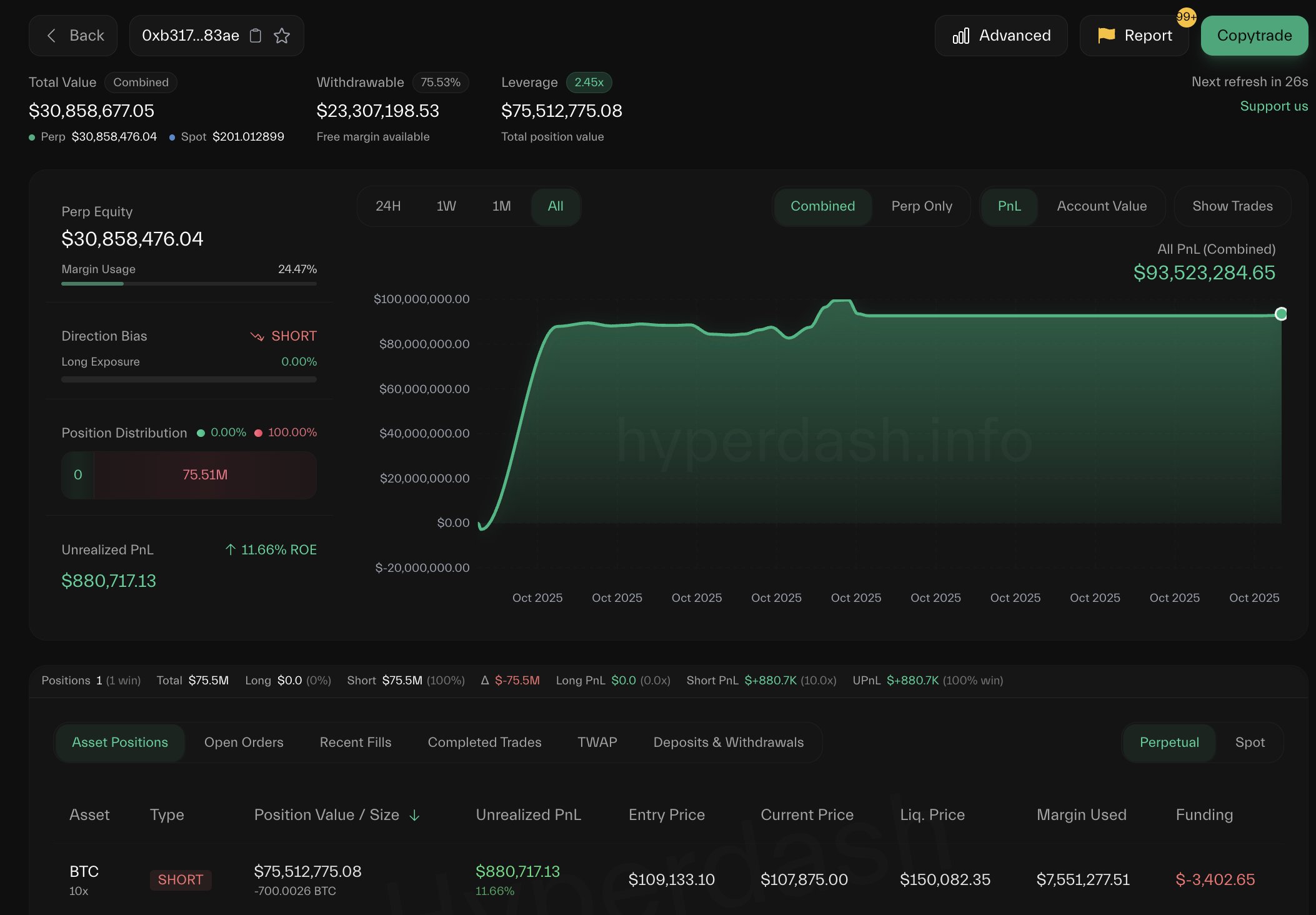

Enter BitcoinOG (1011short), the crypto equivalent of a folk hero who once made $197 million in a single flash crash. Imagine a man who bets like he’s robbing a tsar’s vault and wins. On-chain whispers say he’s just deposited $30 million in USDC to Hyperliquid-a currency so “stable” it’s basically Monopoly money-and opened a 10x short on 700 BTC. That’s $75.5 million of pure, unadulterated “I bet this thing crashes harder than my aunt’s fruitcake.” The crowd gasps. The bears salivate. The bulls… well, they’re just trying not to faint.

Now, you might wonder: Is this whale a prophet of doom or just a gambler with a death wish? BTC’s clinging to $110k like a cat to a curtains, but 1011short’s position is a cannon aimed at the hull. Will he fire? Will bulls rally? Or is this all just a tango of speculation, where everyone’s stepping on each other’s toes?

Whale’s Short in Profit as Market Tension Rises

According to the soothsayers at Lookonchain, our hero’s short is already laughing all the way to the bank, with $880k ($11%!) in unrealized gains. BTC’s feeble attempts to rally above $111k are about as effective as a screen door on a submarine. Investors? They’re sweating like a sinner in church. Traders? They’re eyeing exits like a mouse near a catnap.

But wait! Analysts warn this might be a tale with more twists than a barrel of pretzels. While 1011short’s track record glows brighter than a disco ball, on-chain data is about as reliable as a politician’s promise. How many other bets is he hiding? What’s his “strategy”-madness or genius? Reading his moves is like asking a goldfish to solve calculus.

The next few days? A coin flip. If he doubles down, BTC might plummet faster than a brick in a swimming pool. If he bails, bulls could rally like it’s Black Friday. Either way, volatility’s coming to town-buy popcorn.

Bitcoin Holds Weekly Support, but Resistance Looms

On the weekly chart, BTC clings to the 50-week MA like a lifeline, recovering from October’s flash crash low ($103k) to flirt with $111.2k. Buyers chant, “Not today, Satan!” as they defend this line harder than a fortress gate. But above? The $117.5k ceiling looms-a level so stubborn it could outlast a cockroach apocalypse.

Momentum? Neutral-to-bearish, like a crowd waiting for a bus that’s never coming. Bulls hesitate, still nursing wounds from weeks of liquidations. Yet, the weekly chart’s higher lows whisper sweet nothings of long-term hope-if BTC holds $106k-$107k. Break above $117.5k? Hello, $125k-$130k. Drop below? Cue the bear market orchestra.

So, dear reader, grab your popcorn and buckle up. With whales like 1011short in play, this ride’s about to get bumpier than a hayride through Chernobyl. 🚀💸

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- God Of War: Sons Of Sparta – Interactive Map

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Who Is the Information Broker in The Sims 4?

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- How to Unlock all Substories in Yakuza Kiwami 3

2025-10-20 20:31