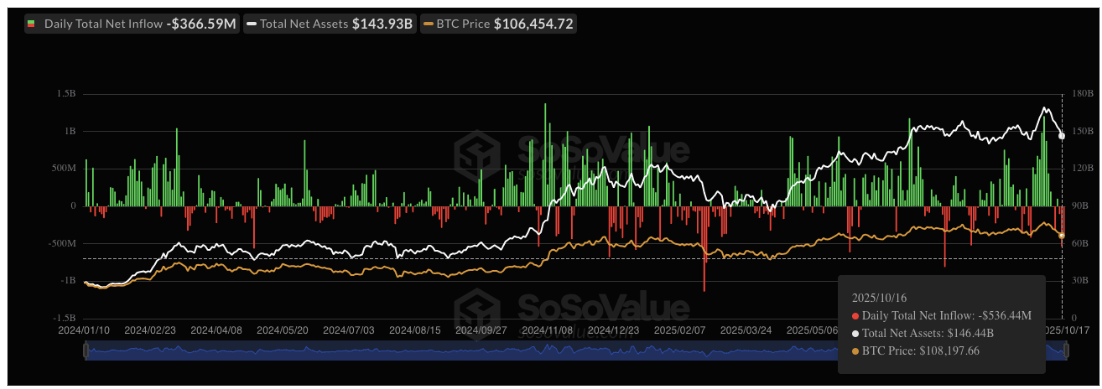

My dear darlings, gather ’round, for the cryptocurrency market has once again decided to throw a tantrum, and what a spectacle it is! 🌪️ Bitcoin and Ethereum, those darling darlings of the digital realm, have taken a nosedive so dramatic, it would make even the most seasoned trapeze artist blush. With a staggering $536 million fleeing Spot Bitcoin ETFs in a single day, one can’t help but wonder if the crypto gods have developed a sudden penchant for chaos. 🤑

ETF Outflows: The Culprits Behind the Crypto Calamity

Ah, the ETFs-those fickle creatures of finance. It seems they’ve decided to pack their digital suitcases and bid adieu, leaving Bitcoin and Ethereum in a state of utter disarray. Crypto analyst Jana, ever the dramatic soul, has dubbed this fiasco “Bloody Friday,” a moniker that, while slightly less theatrical than last week’s debacle, still manages to capture the essence of the carnage. Bitcoin, poor dear, has tumbled 13.3% in seven days, while Ethereum, never one to be outdone, has slid 17.8% in the past month. At last glance, Bitcoin was clinging to $106,940, and Ethereum was hovering around $3,870-both looking rather worse for wear. 😱

According to the ever-reliable SoSoValue, October 16th saw a jaw-dropping $536.4 million in net outflows from Spot Bitcoin ETFs, the largest single-day exodus since August 1st, when a cool $812 million decided to make a run for it. Out of twelve US Bitcoin ETFs, eight have been left sobbing into their digital hankies, with Ark & 21Shares’ ARKB leading the pack, shedding $275.15 million, followed closely by Fidelity’s FBTC, which lost $132 million. Even the likes of Grayscale, BlackRock, and Valkyrie have felt the sting of investor abandonment. 💸

And the bleeding hasn’t stopped, my dears. October 17th saw another $366.5 million vanish into the ether, marking the third consecutive day of outflows. It seems investor confidence is as fragile as a china teacup at a bullfight. Combine this with last Friday’s $19 billion liquidation extravaganza, and you’ve got a recipe for a market that’s about as stable as a unicyclist on a tightrope. 🪜

The Prophets of Doom Sound the Alarm

Oh, but the drama doesn’t end there! The experts, those ever-gloomy Cassandras of the crypto world, are predicting even more turmoil ahead. Polymarket, that bastion of bleak predictions, reports that 52% of participants expect Bitcoin to dip below $100,000 before the month is out. And who could forget Peter Schiff, the perennial pessimist, who warns of bankruptcies, defaults, and layoffs as the crypto industry faces its next great reckoning. One can almost hear the dramatic organ music swelling in the background. 🎻

Technical analysts, never ones to miss a chance to add to the melodrama, are pointing to Ethereum’s charts with grave concern. Crypto Damus, that modern-day Nostradamus, claims Ethereum has broken key weekly support and is teetering on the edge of a bearish abyss. The MACD, he warns, is about to “cross red,” a phrase so ominous it could send shivers down even the most hardened trader’s spine. 🦴

Marzell, another voice of doom, echoes these sentiments, declaring that Ethereum is nearing a “crash zone.” However, he does offer a glimmer of hope, suggesting that the $3,690 – $3,750 range could serve as a short-term demand area where buyers might stage a valiant comeback. One can only hope, my dears, for the sake of our poor, beleaguered portfolios. 🌟

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- 8 One Piece Characters Who Deserved Better Endings

- Who Is the Information Broker in The Sims 4?

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Engineering Power Puzzle Solution in Poppy Playtime: Chapter 5

2025-10-19 04:36