Pray, allow me to impart the latest manoeuvres of the enigmatic Ark Invest, a firm of no modest repute, whose assets exceed six billion pounds. In these trying times of market tumult, they have seen fit to adjust their portfolios with a discernment that might provoke both admiration and mirth.

A Decline in the Digital Coin

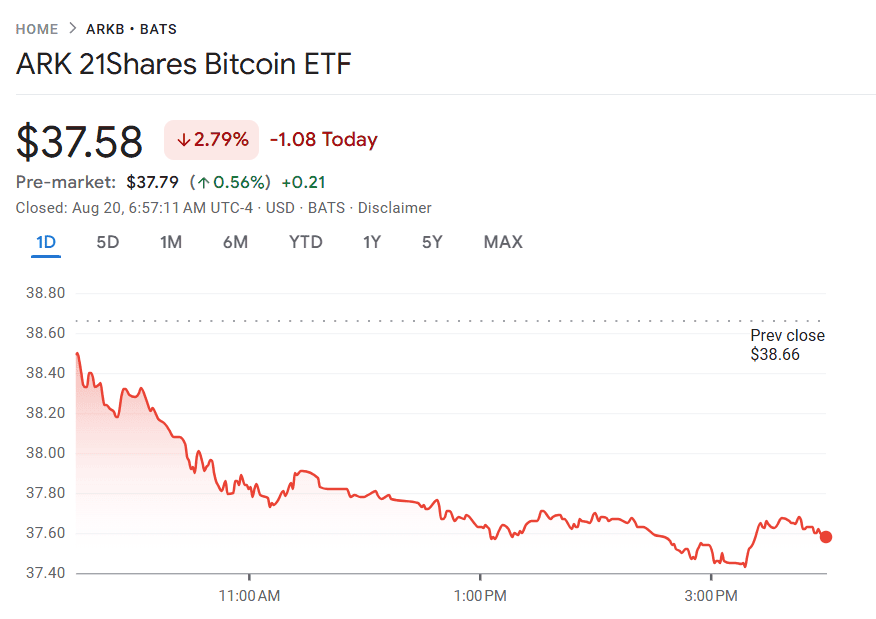

Ark Invest, that bastion of financial acumen, has reduced its holdings in the ARKB (ARK 21Shares Bitcoin ETF) by a staggering 559.85 BTC, or some sixty-four million pounds, as reported by the ever-watchful Whale Insider. The crypto sphere, ever prone to dramatics, has responded with a mélange of sentiments-some attributing it to mere rebalancing, while others have taken to questioning and even ridiculing the decision. 😏

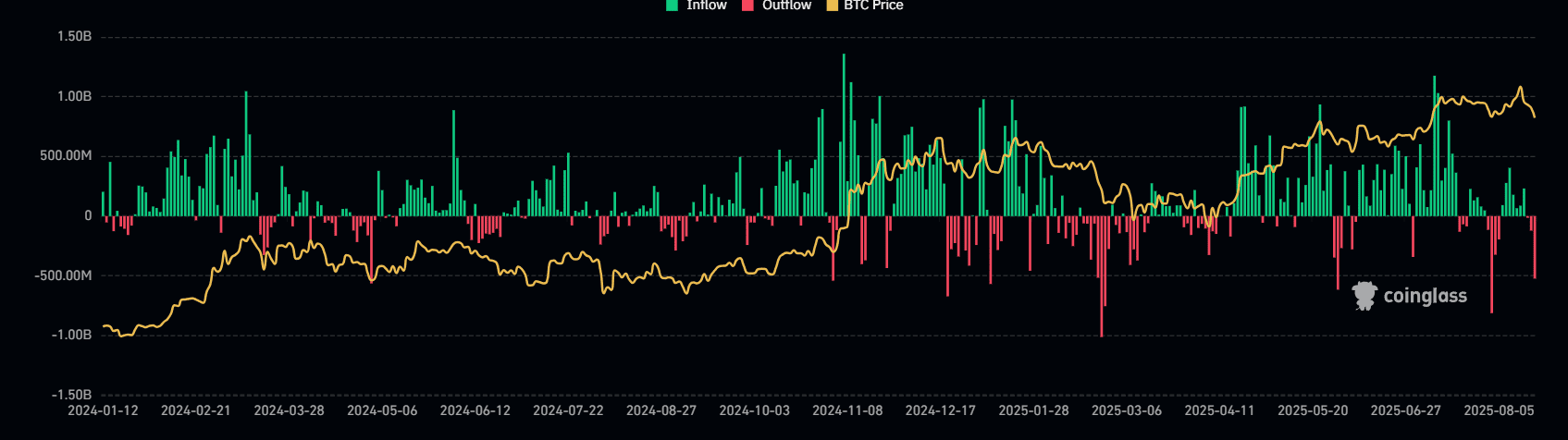

Data from CoinGlass reveals a wave of sell-offs across exchange-traded funds, coinciding with the recent plunge in the leading cryptocurrency’s price, which had previously soared to an unprecedented height of over one hundred and twenty-four thousand pounds. A most precipitous fall, indeed!

The ARKB stock, ever sensitive to such machinations, has reacted with a 2.79% daily decline, as noted by Google Finance. A most unwelcome development, one might say. 📉

A Buying Spree of Note

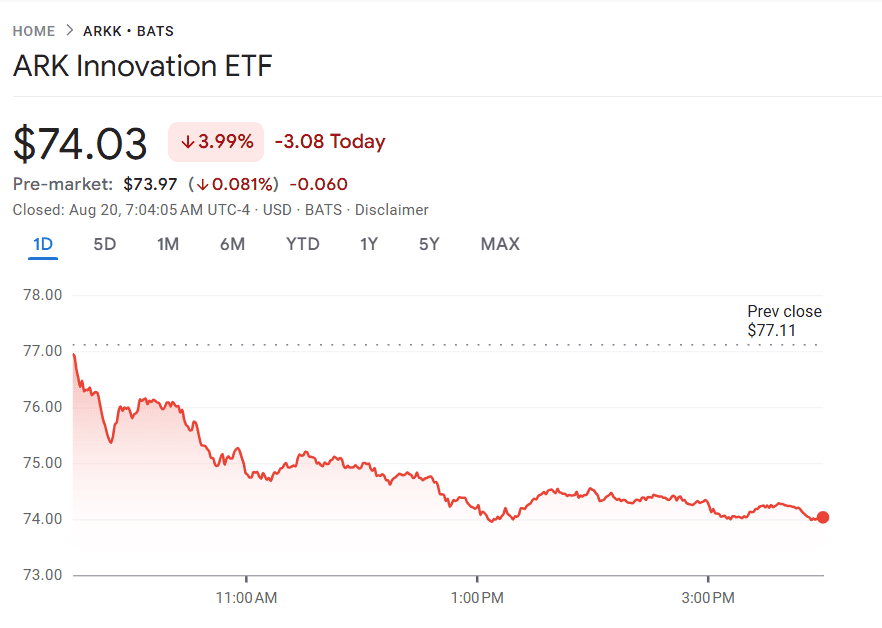

Yet, it would be remiss to suggest that Ark Invest has been solely divesting. Today, the ARKK (ARK Innovation ETF) acquired 356,346 shares of Bullish, at an estimated cost of twenty-one million pounds, and 150,908 shares of Robinhood Markets, valued at approximately sixteen million pounds. A most ambitious endeavour, one might observe. 🛍️

This follows last week’s acquisition of 2.53 million Bullish shares, worth a staggering one hundred and seventy-two million pounds, subsequent to the exchange’s debut on the NYSE, and several purchases of Robinhood stock, the last two amounting to fourteen million and nine million pounds, respectively. A veritable shopping spree, if ever there was one!

Alas, the fund’s stock has not been immune to the prevailing market unease, posting a 3.99% daily drop, in keeping with the current volatility. Investors and institutions alike await with bated breath the forthcoming Fed speech at the Jackson Hole symposium, which promises to set the tone for the markets in the weeks and months ahead. A most pivotal moment, indeed! 🌪️

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Who Is the Information Broker in The Sims 4?

- 8 One Piece Characters Who Deserved Better Endings

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

2025-08-21 06:35