As the world holds its breath for the Federal Open Market Committee’s (FOMC) grand revelation on January 29, our dear crypto investors find themselves teetering on the edge of a precipice. After the historic crypto executive order from the great and powerful President Donald Trump, and the recent DeepSeek price debacle, macroeconomics have once again stolen the spotlight.

Crypto Market FOMC Preview

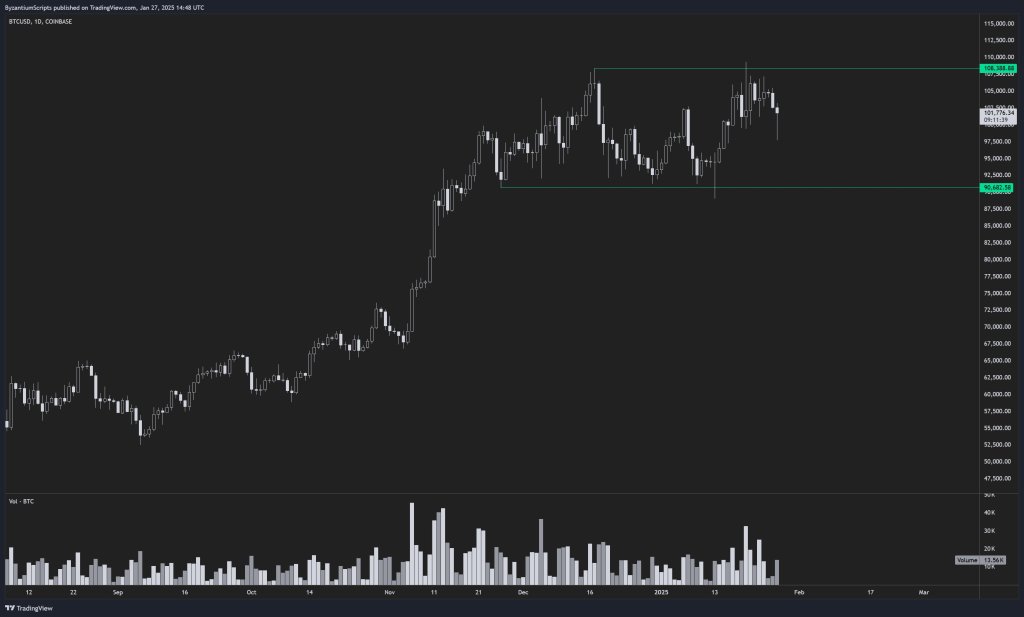

Our astute crypto analyst, Byzantine General (@ByzGeneral), has meticulously carved out a consolidation range for Bitcoin between $90,682 and $108,388. He foresees a period of stagnation before the FOMC meeting, envisioning three potential fates for the market once the Fed concludes its deliberations: “As I proclaimed in my thread yesterday, we’re merely consolidating within this range ($90,682 – $108,388). Expect nothing earth-shattering until Wednesday’s FOMC. Then, behold the three possibilities with only two outcomes…FOMC surprise dovish -> break out of range, FOMC neutral -> chop in range for longer, FOMC hawkish -> chop in range for longer”

Crypto market participants, those modern-day soothsayers, often view a dovish stance—signaling interest rate cuts or an extended pause—as a blessing for risk-on assets like Bitcoin. A surprise dovish twist could be the spark needed to break the current trading range, according to Byzantine General. Conversely, a neutral or hawkish outlook might sentence us to an extended period of sideways price movement.

In their wisdom, the banking behemoth ING has laid bare the broader macroeconomic landscape that could sway the Fed’s decision and projections for 2025. According to ING: “Federal Reserve set for an extended pause. After 100bp of rate cuts, the Fed has signaled it needs evidence of economic weakness and more subdued inflation to justify further policy loosening. President Trump’s low tax, light-touch regulation policies should be a boon for growth, while immigration controls and trade tariffs add fuel to the price fire, suggesting a long wait for the next cut.”

The December FOMC saw a modest 25bp rate cut, but the subsequent commentary hinted at a slower, more leisurely path of easing for 2025, potentially totaling just 50bp for the year. ING points out that robust economic performance and stubborn inflation pressures offer little incentive for the Fed to rush into rate cuts. The bank also drops a bombshell, suggesting the Fed might be even more hawkish than they’ve let on:

“In fact, the risk is that the Fed is actually more hawkish than they indicated… However, with President Trump securing re-election and his policy plans being a stark contrast to President Joe Biden’s, Fed Chair Jay Powell acknowledged that some felt the need to incorporate the potential policy shifts into their December 2024 projections ahead of time. Not all did, and since his inauguration, there’s been no sign of Trump moderating his key policy thrust.”

ING’s economists also note that market participants largely expect no policy change on January 29, while the bank itself previously anticipated a March rate cut—an event it now sees as increasingly unlikely: “That means no change to monetary policy is a certainty on 29 January, making our previous call of a March rate cut look unlikely – currently just 6bp of a 25bp move is discounted by financial markets.”

However, ING still forecasts three rate cuts for 2025, contingent on a gradual cooling of the labor market and moderating wage pressures. They emphasize that rising Treasury yields, higher borrowing costs, and a stronger dollar could conspire to tighten financial conditions, ultimately forcing the Fed’s hand later in the year: “Therefore, we believe the Fed may need to push harder and cut rates a little further than currently priced by markets, but that’s more likely to be a second half of 2025 development.”

On the balance sheet reduction (quantitative tightening, or QT), ING sees the Fed possibly ending QT in 2025 if excess liquidity shrinks to uncomfortable levels. The bank pegs $3 trillion in reserves as a critical threshold: “We are currently at US$3.5tn. So

Read More

- Unlock the Ultimate Arsenal: Mastering Loadouts in Assassin’s Creed Shadows

- REPO: How To Fix Client Timeout

- 10 Characters You Won’t Believe Are Coming Back in the Next God of War

- Unaware Atelier Master: New Trailer Reveals April 2025 Fantasy Adventure!

- Unlock Wild Cookie Makeovers with Shroomie Shenanigans Event Guide in Cookie Run: Kingdom!

- 8 Best Souls-Like Games With Co-op

- All Balatro Cheats (Developer Debug Menu)

- BTC PREDICTION. BTC cryptocurrency

- How to Reach 80,000M in Dead Rails

- Classroom of the Elite Year 3 Volume 1 Cover Revealed

2025-01-28 18:44