As an analyst with a background in finance and experience in the cryptocurrency market, I believe that Samson Mow’s perspective on Germany’s Bitcoin sell-off is worth considering. The German government’s decision to sell its seized Bitcoin holdings put significant selling pressure on the market, which contributed to the recent price correction. However, Mow’s proposal for a nation-state Bitcoin adoption strategy is an intriguing idea.

As a Bitcoin analyst, I’d like to express my perspective on Samson Mow’s recent comments regarding the German government’s decision to sell a significant portion of their national Bitcoin holdings. According to Mow, this massive sell-off imposed considerable selling pressure on Bitcoin’s price.

Germany was compelled to dispose of the Bitcoins it confiscated from an unlawful film piracy site, given their illicit origin.

Mow advocates that Germany should acquire approximately $50,000 worth of Bitcoin as a key component of his suggested national Bitcoin adoption strategy. He has also proposed drafting a plan for this implementation as soon as October this year.

Currently, the German government holds $1 worth of Bitcoin.

What is happening

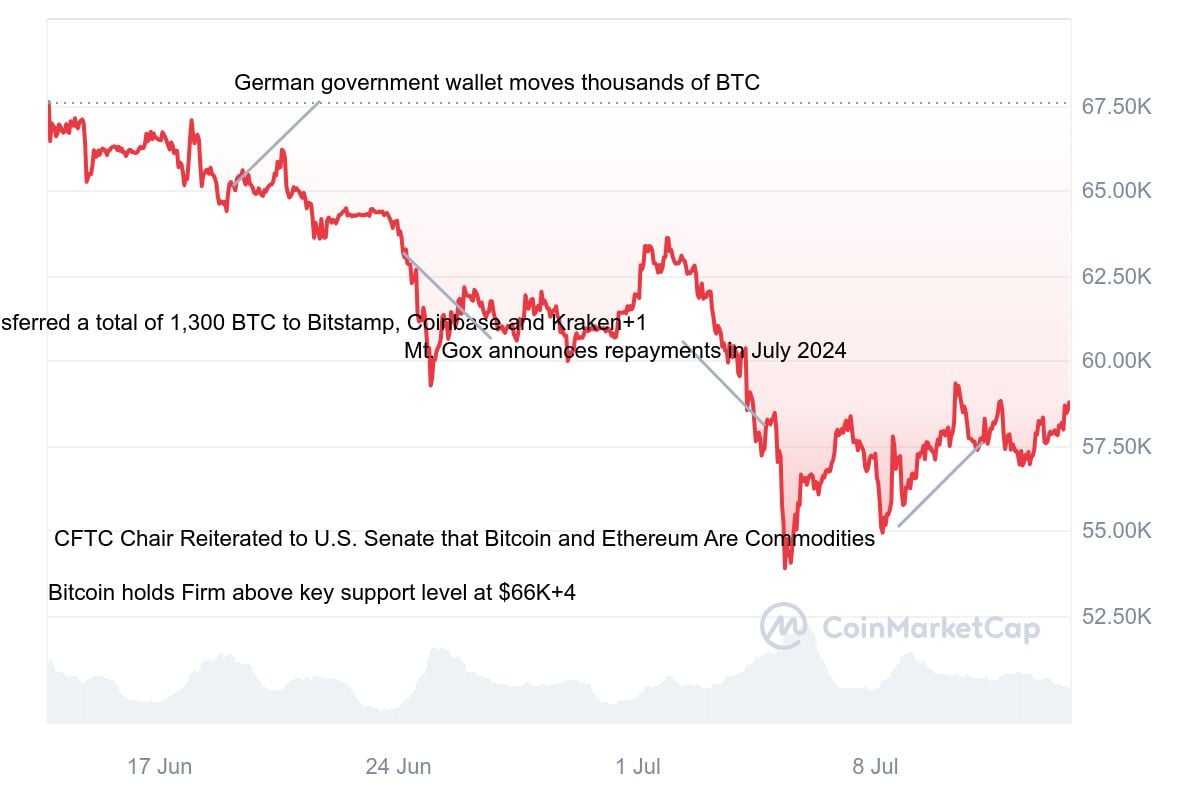

As a financial analyst, I can tell you that in late June, Germany began liquidating its substantial Bitcoin holdings, valued at nearly $3 billion, through prominent cryptocurrency exchanges. By this past Friday, this significant selling had come to an end. The magnitude of these sales placed immense downward pressure on the Bitcoin market, resulting in a price decrease of approximately 15% during the month of July.

According to data provided by Arkham, yesterday, Germany sold more than $550 million in BTC.

BTC ready for bull run?

In spite of valid apprehensions and the intense fear prevailing in the Bitcoin market currently, selling pressure has been encountering increasing demand originating from Bitcoin ETFs.

Germany 🇩🇪 can dispose of its seized Bitcoins (approx. 5,000 units) just once. Given their current pace, they may choose to liquidate this amount today. Surprisingly, Bitcoin ETF buyers have been snapping up these sell-offs as well – welcome aboard! 👍

— Adam Back (@adam3us) July 11, 2024

This Friday, the accumulated daily inflow of Bitcoin ETFs has surpassed $300 million, as indicated by Farside’s data. Nevertheless, the German government’s Bitcoin sell-off is just one element influencing the current cryptocurrency market correction.

Some experts believe that even if the Bitcoin price experiences further corrections, institutions are presently amassing resources to purchase at lower prices.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- EUR ILS PREDICTION

- CKB PREDICTION. CKB cryptocurrency

- USD COP PREDICTION

- PRIME PREDICTION. PRIME cryptocurrency

- Best Turn-Based Dungeon-Crawlers

- REF PREDICTION. REF cryptocurrency

2024-07-13 19:05