As a seasoned crypto investor with battle scars from multiple market cycles, I’ve learned to read between the lines of such data. The recent surge in Shiba Inu (SHIB) large holder outflows doesn’t necessarily mean doom and gloom. It could be a strategic move by whales, perhaps cashing out to buy the dip or diversify their portfolios.

Based on information from IntoTheBlock, there was a significant transfer of approximately 2.75 trillion Shiba Inu (SHIB) coins by large holders over the past day. This outflow is part of a broader pattern, as the total volume of large transactions involving SHIB reached 6.37 trillion SHIB within the last 24 hours.

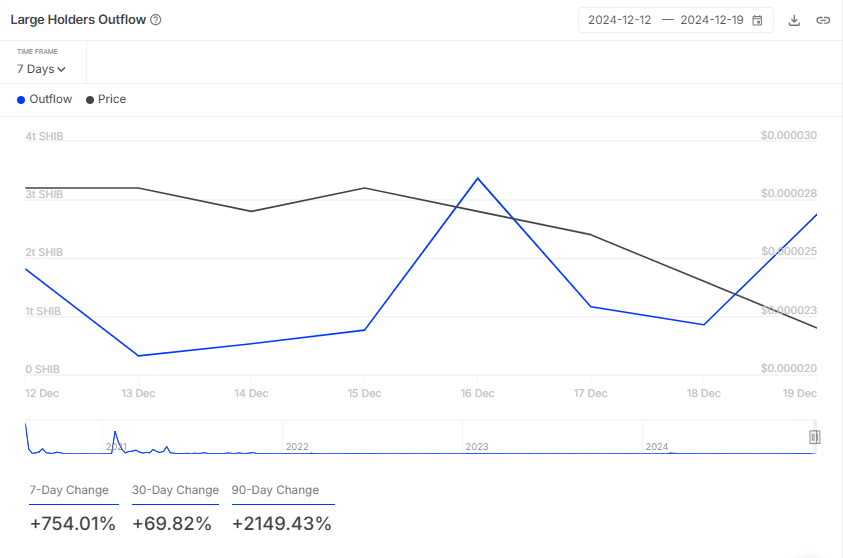

As an analyst, I’ve noticed some significant shifts in the Shiba Inu (SHIB) market recently. Over the past seven days, there’s been a staggering 754% increase in SHIB outflows, with approximately 2.75 trillion SHIB moving out. On a more optimistic note, within the last 24 hours, we’ve seen large holder inflows, or funds flowing into whale addresses, amounting to 1.9 trillion SHIB, which represents a 133% weekly surge. This influx indicates a rise in whale activity, and over the past 24 hours, Shiba Inu has experienced a 55.81% increase in large transaction volumes, suggesting heightened interest among these key players.

The surge in withdrawals corresponds with a wider cryptocurrency market dump this week, potentially causing significant token transfers by major SHIB investors.

As I’m typing this, SHIB has dropped by approximately 23.28% over the past 24 hours to reach $0.00001874. The persistent selling could be the reason behind more money being withdrawn than deposited.

As a crypto investor, I’ve noticed that the general market mood seems to be turning bearish lately. The substantial withdrawals hint that perhaps some of the big players, or ‘whales’, are choosing to cash out in response to the broader market instability we’re experiencing.

What it means

Tracking Funds Departure monitors the money leaving wallets owned by significant investors, often referred to as “whales.

Identifying Instances of Market Anxiety can be beneficial, and a surge in outflows could indicate two possible scenarios: mass selling by significant investors or transfers from cryptocurrency exchanges. Moving funds off exchanges may be due to safety concerns, such as transferring to cold storage, which is generally seen as a bullish sign.

As a researcher, I’ve observed that significant asset holders might choose to offload their assets during highly volatile market conditions as a precaution against potential liquidation. Interestingly, since exchanges themselves hold substantial assets, massive withdrawals could frequently represent funds being withdrawn from these exchanges rather than a widespread selling spree among investors.

Great news! The Shiba Inu community is teaming up with Chainlink. This partnership enables tokens like SHIB, BONE, and LEASH within the Shiba Inu ecosystem to utilize the CCT standard. Additionally, Shibarium has incorporated Chainlink’s CCIP as its main cross-chain infrastructure, using it for swift market data streams.

Read More

- REPO: All Guns & How To Get Them

- Unlock the Ultimate Armor Sets in Kingdom Come: Deliverance 2!

- Top 5 Swords in Kingdom Come Deliverance 2

- One Piece 1142 Spoilers: Loki Unleashes Chaos While Holy Knights Strike!

- LUNC PREDICTION. LUNC cryptocurrency

- REPO: How To Play Online With Friends

- 6 Best Mechs for Beginners in Mecha Break to Dominate Matches!

- Unleash Willow’s Power: The Ultimate Build for Reverse: 1999!

- How to Reach 80,000M in Dead Rails

- BTC PREDICTION. BTC cryptocurrency

2024-12-20 18:16