As an analyst with over a decade of experience in the cryptocurrency market, I’ve seen my fair share of trends and fluctuations. The recent surge in fund flows into Solana ETPs is certainly catching my attention. While Ethereum has been a staple in investment portfolios for quite some time, Solana seems to be rapidly gaining ground, especially with its impressive 63% price increase over the past week.

Last week, there was a significant increase in investments flowing into Exchange-Traded Products (ETPs) tied to Solana (SOL), a widely recognized alternative cryptocurrency and one of the most buzzed-about digital assets this year, alongside Bitcoin.

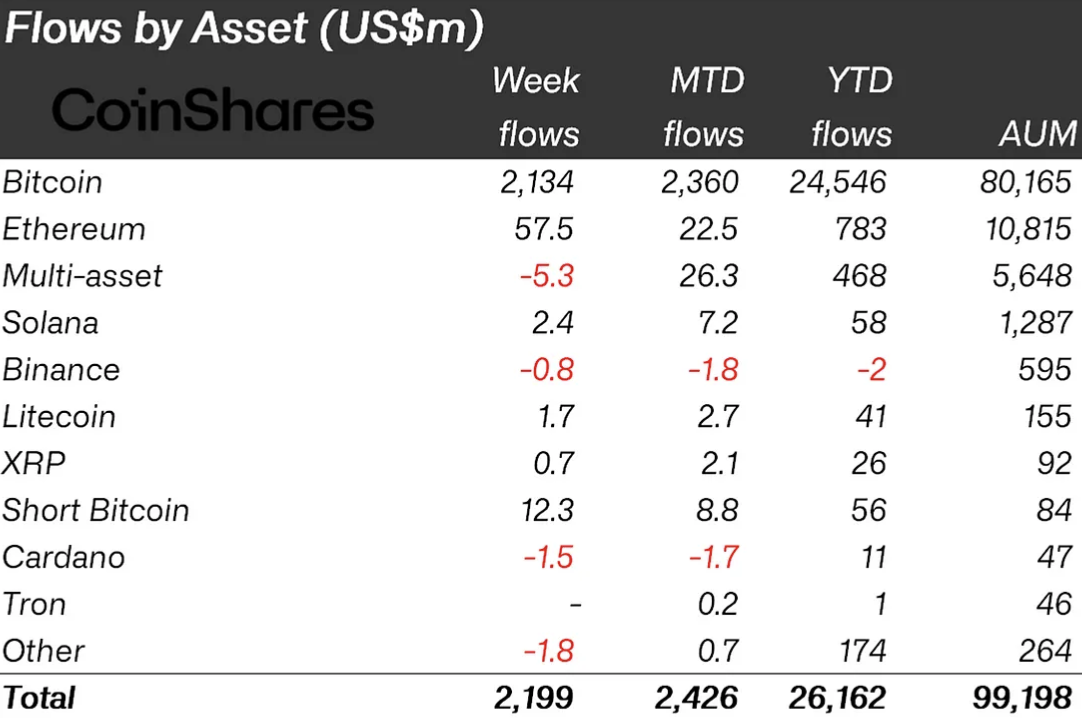

Based on recent findings by CoinShares, there was a significant surge of 400% in investments linked to the SOL token during the past week, accumulating approximately $2.4 million.

The gain adds to the total inflows into Solana ETPs, which have reached $58 million year-to-date. This is far less than its two main counterparts, Bitcoin (BTC) and Ethereum, but still more than any other altcoin.

Despite Solana’s price increase of more than 63% compared to Ethereum‘s rise of only 19%, the disparity in their fund inflows is striking, with Ethereum seeing a flow 1,350% greater than Solana – a situation that appears disproportionate.

What may change this perspective is the Solana ETF solution, which is heating up as the year draws to a close, with applications for such an investment vehicle already being made by the likes of Bitwise and VanEck.

When Solana ETF?

Launching the ETF might open up more investment possibilities within the market, making it easier to invest in these types of products. This could potentially lead Solana to tap into larger capital sources, broader markets, and increased liquidity.

According to the current inflows, there’s evident demand. What’s needed now is the go-ahead from regulators, specifically the SEC, as they have turned down initial 19b-4 forms because of potential classification of the SOL token as a security. Once this issue is resolved, we might witness the approval of the Solana ETF, and it will be interesting to see how the supply and demand balance between SOL and ETH shifts afterwards.

Read More

- EUR ARS PREDICTION

- EUR CAD PREDICTION

- CHR PREDICTION. CHR cryptocurrency

- EUR MYR PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- XRP PREDICTION. XRP cryptocurrency

- USD BRL PREDICTION

- POL PREDICTION. POL cryptocurrency

- ULTIMA PREDICTION. ULTIMA cryptocurrency

- SAFE PREDICTION. SAFE cryptocurrency

2024-10-21 15:49