As a seasoned analyst with over two decades of experience in financial markets, I’ve seen my fair share of market whipsaws and unexpected turns. The recent surge in Dogecoin (DOGE) has caught many traders off guard, and this imbalance in liquidations speaks volumes about the current market sentiment.

Looking at the numbers, it appears that the majority underestimated the power of DOGE’s price surge, with shorts getting hit particularly hard. This trend is not exclusive to DOGE but seems to be a broader market phenomenon, with more short positions being liquidated compared to long ones.

Trading cryptocurrencies, and especially perpetual futures, can be a rollercoaster ride, and the new year has already shown us that the market can take unexpected turns at any moment. So, my fellow traders, let’s keep our eyes wide open and our risk management tight as we navigate through these volatile waters.

It’s worth noting that with many people still enjoying their weekend, the market is thinner than usual. However, it seems that the general consensus among traders leans towards a continuation of the bull market, especially after what happened in November.

On a lighter note, let me leave you with this: Always remember, trading is like a game of chess – sometimes the queen gets taken, but if you’re smart, you’ll have another one ready to take its place! So, keep learning and adapting, and you’ll find success in this unpredictable market. Happy trading!

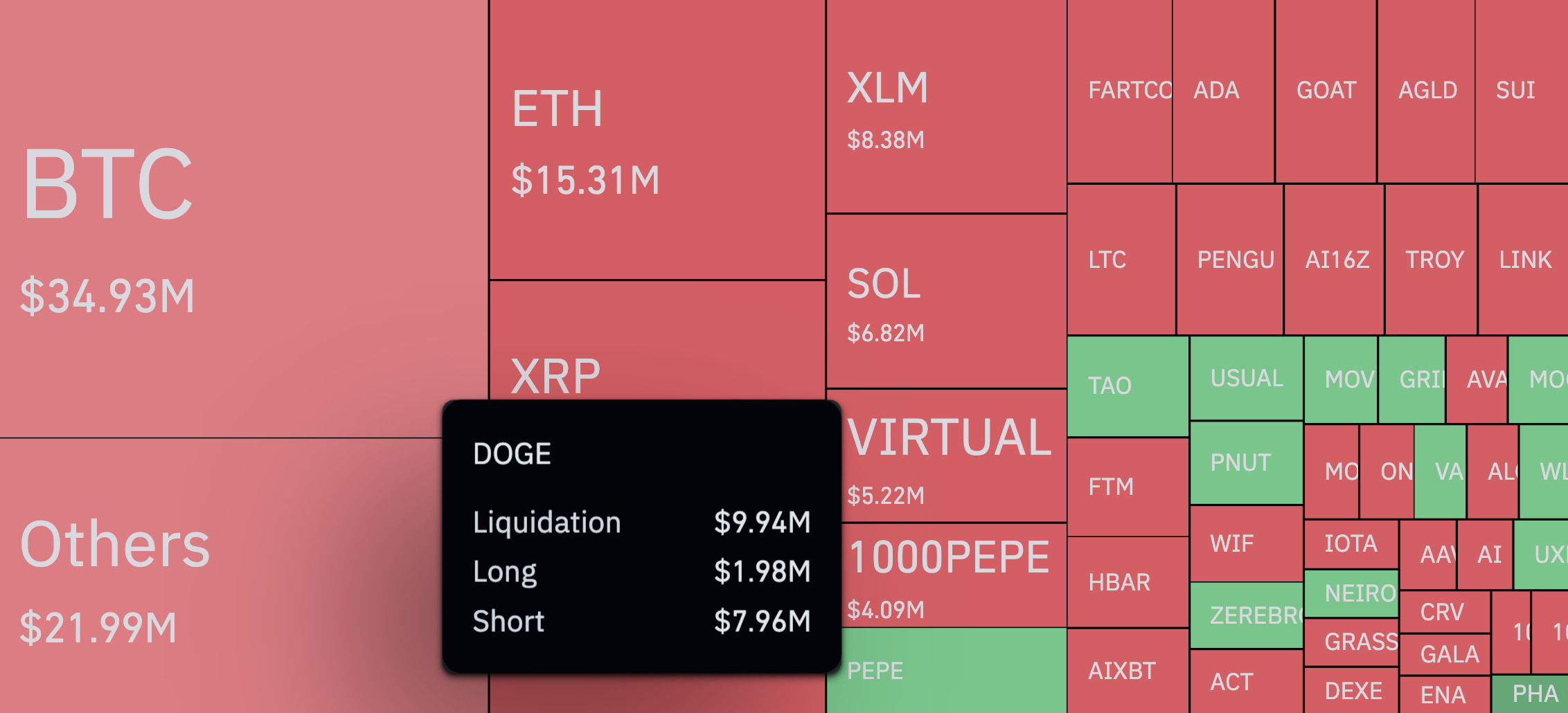

As someone who has been actively trading cryptocurrencies for several years now, I have learned to keep a keen eye on unusual market activity. Recently, I noticed some abnormal trading patterns surrounding Dogecoin (DOGE), one of the major meme cryptocurrencies in the market. The data from CoinGlass revealed an extraordinary imbalance in liquidations of DOGE perpetual futures positions, with short liquidations outpacing long positions by a staggering 400%.

This level of imbalance is quite rare and can often indicate significant price movements or potential manipulation in the market. As someone who has witnessed both bull and bear markets, I know that such instances usually demand extra caution from traders. In light of this development, I would advise fellow investors to carefully monitor their positions and be prepared for potential volatility in the DOGE market.

In other words, when considering positions that were liquidated, approximately $1.98 million were in long (buy) positions, while a significant $7.96 million were in short (sell) positions. This imbalance can be attributed to the notable 6% increase in Dogecoin’s price over a 24-hour period.

It seems that most people didn’t think the well-known meme coin would make such a significant shift and instead, they wagered on a downward trend.

In various markets, it’s often observed that shorter positions (betting on a price decrease) tend to incur greater losses than longer positions (betting on a price increase), as demonstrated by the recent 24-hour period where $201.55 million was liquidated. Out of this total, around $139.74 million can be attributed to short positions, while only about $61.81 million is associated with longs. This trend isn’t exclusive to DOGE; it’s a broader market phenomenon.

Bulls in control

It appears these sudden fluctuations in price – rebounds and spikes – in the crypto market, particularly with perpetual futures, indicate a high level of risk currently. As we step into the new year, traders ought to exercise caution since the market can shift rapidly without warning, potentially resulting in substantial financial losses.

It’s clear that the digital asset market remains relatively small, as many individuals are currently taking advantage of their weekends by spending time away from monitoring market trends.

As a cryptocurrency investor, it’s evident to me that the general consensus among market players currently favors the continuation of the bull market. Given the events of November, it feels reasonable to expect a similar trend in January, marking a potential second wave of growth.

Read More

- March 2025 PS Plus Dream Lineup: Hogwarts Legacy, Assassin’s Creed Mirage, Atomic Heart & More!

- Esil Radiru: The Demon Princess Who Betrayed Her Clan for Jinwoo!

- Unleash Willow’s Power: The Ultimate Build for Reverse: 1999!

- 6 Best Mechs for Beginners in Mecha Break to Dominate Matches!

- Top 5 Swords in Kingdom Come Deliverance 2

- XRD PREDICTION. XRD cryptocurrency

- Unlock the Secret of Dylan and Corey’s Love Lock in Lost Records: Bloom & Rage

- Unlock the Ultimate Armor Sets in Kingdom Come: Deliverance 2!

- USD DKK PREDICTION

- 8 Best Souls-Like Games With Co-op

2025-01-02 18:28