As a seasoned crypto investor with over a decade of experience, I have seen my fair share of market ups and downs. September has traditionally been a challenging month for Bitcoin, but this year might be different. The trends may not always hold true for cryptocurrencies, but the fact that nearly 43% of years with negative Augusts have been followed by positive Septembers is an interesting data point to consider.

September is often viewed as a challenging month for the cryptocurrency market and Bitcoin specifically. Typically, Bitcoin’s average return is about -6.18% and the median is at -4.43%. Although historical trends may not always hold true for cryptocurrencies, given that Bitcoin is a $1.2 trillion asset with more than 11 years of trading experience on the exchange, its price history carries some weight due to its extensive track record.

However, the experts at Spot On Chain refuse to just accept the high probability of a negative September and offer five key reasons why this time could be different for BTC.

As a researcher, I’ve noticed an intriguing pattern in historical data: approximately 43% of years with negative August performances tend to follow with positive September returns. While it’s common for the market sentiment to be negative at this time, these statistics offer a glimmer of hope that we might witness a market rebound.

Sellers out, holders in

A significant aspect to consider is the recent decrease in Bitcoin holdings by major players. For instance, the German government, Mt. Gox, and Genesis Trading have offloaded a substantial amount of Bitcoin in the past two months, accumulating to more than 170,000 BTC in July and August alone.

It’s noteworthy to point out that the U.S. government owns approximately 203,000 Bitcoins, and it has been tactful in its recent transactions, preferring private sales to limit market disruption. This strategy might contribute to maintaining a steady market condition by reducing selling pressure.

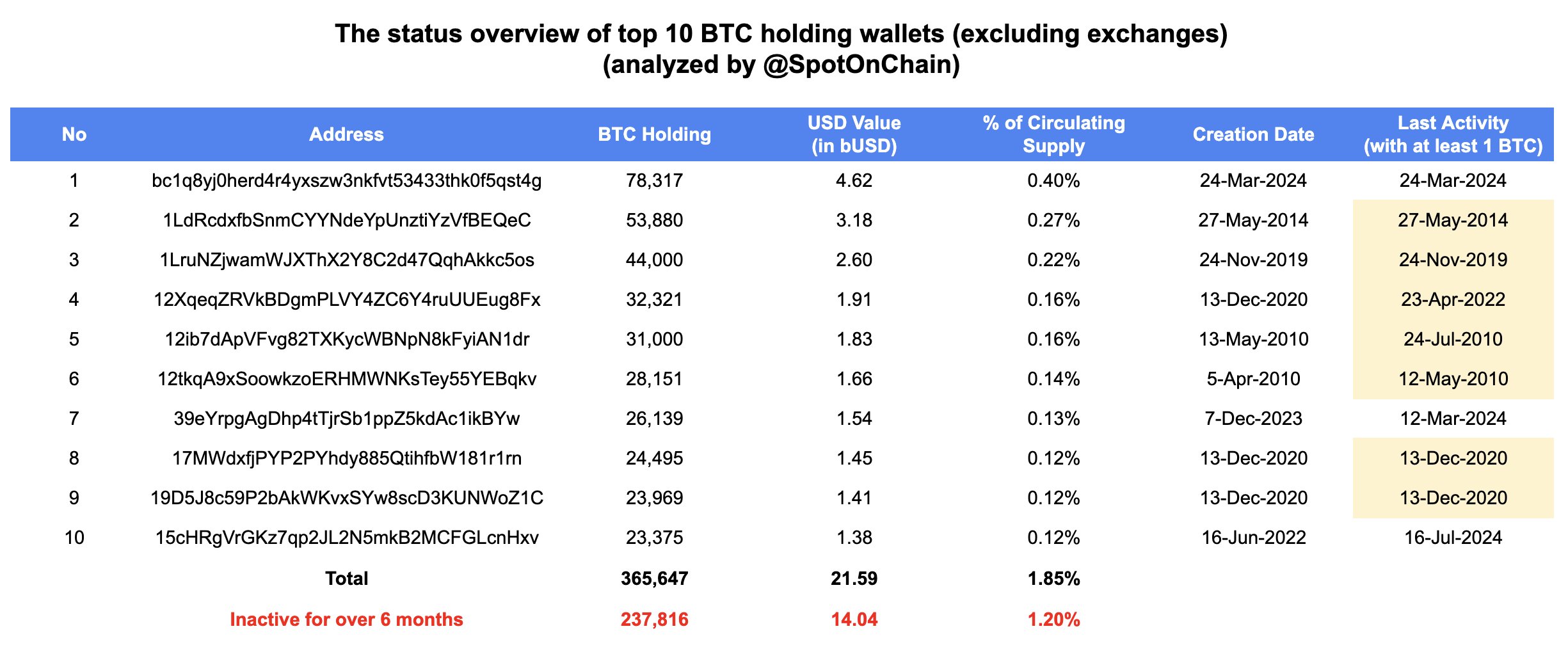

In August, long-term investors continued to show their faith in Bitcoin by purchasing an additional 262,000 coins, increasing their holdings significantly. These long-term holders now possess around 75% of the total supply, indicating a strong belief in the asset’s future potential. Moreover, large, unidentified wallets containing substantial amounts of Bitcoin have remained dormant, decreasing the probability of sudden mass sell-offs.

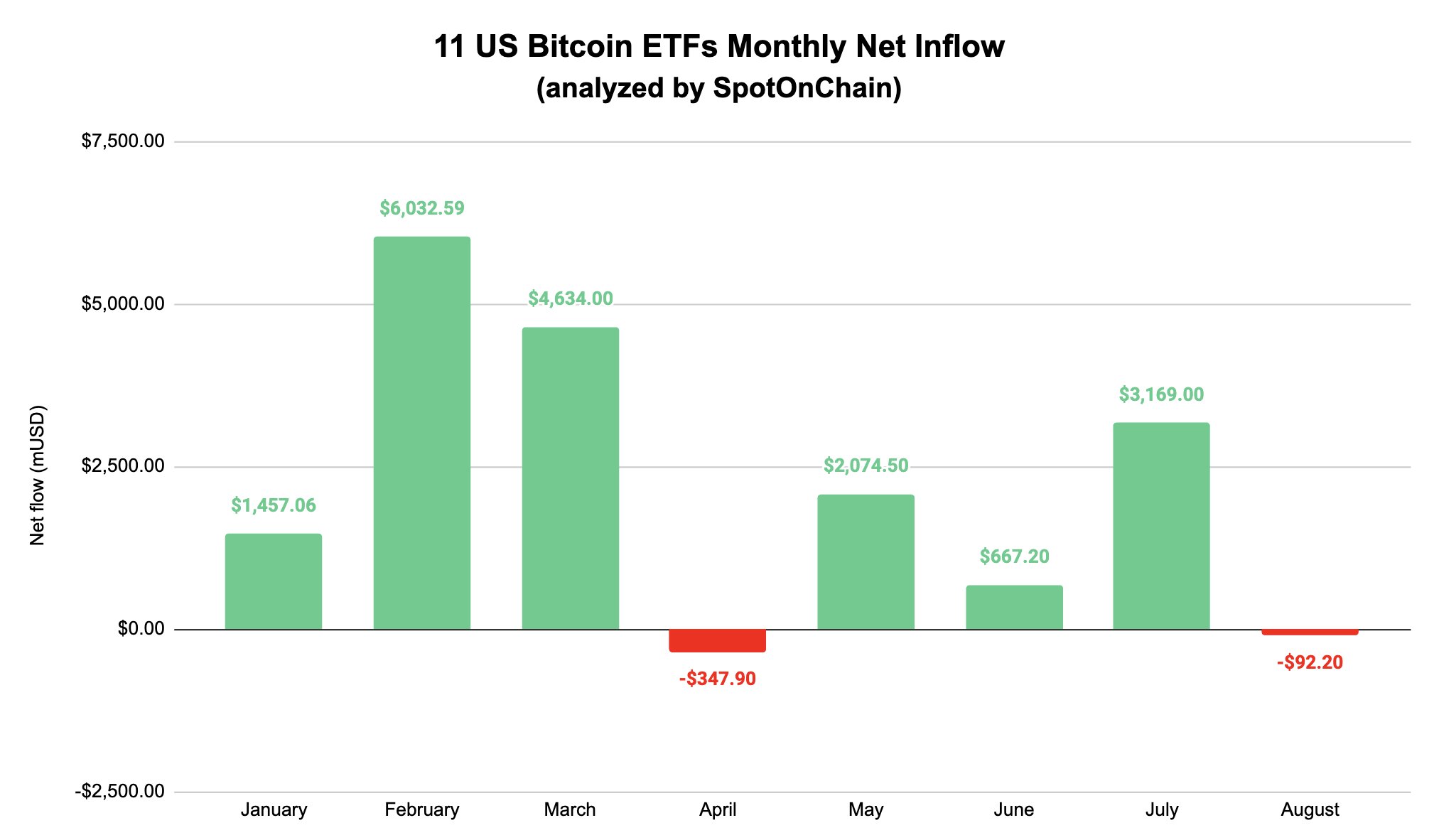

Bitcoin ETF inflows expected

Additionally, there might be an upcoming surge in investments for Bitcoin ETFs, strengthening the optimistic outlook. Following a minor decrease in funds influx during August, predictions suggest that September could witness a significant inflow ranging from $500 million to $1.5 billion, according to typical trends of alternating favorable and unfavorable months.

Additionally, various factors might influence the market. The potential reduction of interest rates by the Federal Reserve and FTX repaying $16 billion in cash could spur increased interest in Bitcoin. Furthermore, a rise in political backing for cryptocurrency-friendly regulations in the United States may increase investor confidence, potentially propelling Bitcoin even higher this September.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- VANRY PREDICTION. VANRY cryptocurrency

- USD ZAR PREDICTION

- USD COP PREDICTION

- USD CLP PREDICTION

- USD PHP PREDICTION

- G PREDICTION. G cryptocurrency

2024-09-01 18:25