As a seasoned analyst with over two decades of experience in the tumultuous world of finance, I can confidently say that Monday’s crypto market bloodbath was just another day in this rollercoaster ride we call the digital asset industry. However, amidst the sea of red, there were a few diamonds that shimmered brightly – XRP, HBAR, and IOTA. These enterprise-focused cryptocurrencies bucked the trend, showing resilience and growth in the midst of market chaos.

Monday started with blood on the cryptocurrency market. According to data from CoinGlass, more than $500 million in long and short positions in crypto asset futures were liquidated over the past 24 hours. Interestingly, however, even in this tsunami of liquidations, there were some cryptocurrencies that showed not only stable but even discouraging price behavior. Over the past 24 hours, there were three such crypto assets – XRP, HBAR and IOTA.

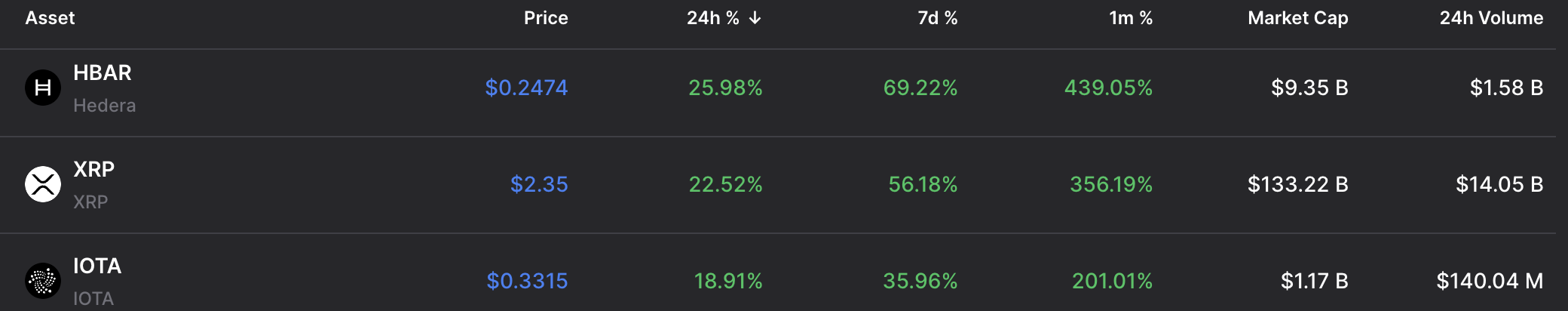

Based on Dropstab’s list of high-achievers, these cryptocurrencies saw an average growth of approximately 22% within this timeframe. Notably, each of these digital currencies stem from projects that primarily cater to business interactions and cryptocurrency solutions tailored for institutional investors.

Over the past month, XRP, which experienced an astounding increase of several hundred percent, appears to have significantly influenced the revaluation of various assets. This surge has added more than $100 billion to its market capitalization, placing it as the third largest cryptocurrency in existence today.

Currently, XRP is often referred to as the star performer among the category of business-focused cryptocurrencies. Notably, these digital assets generally experience price increases during periods when market volatility rises as well.

Market chooses to be “serious”

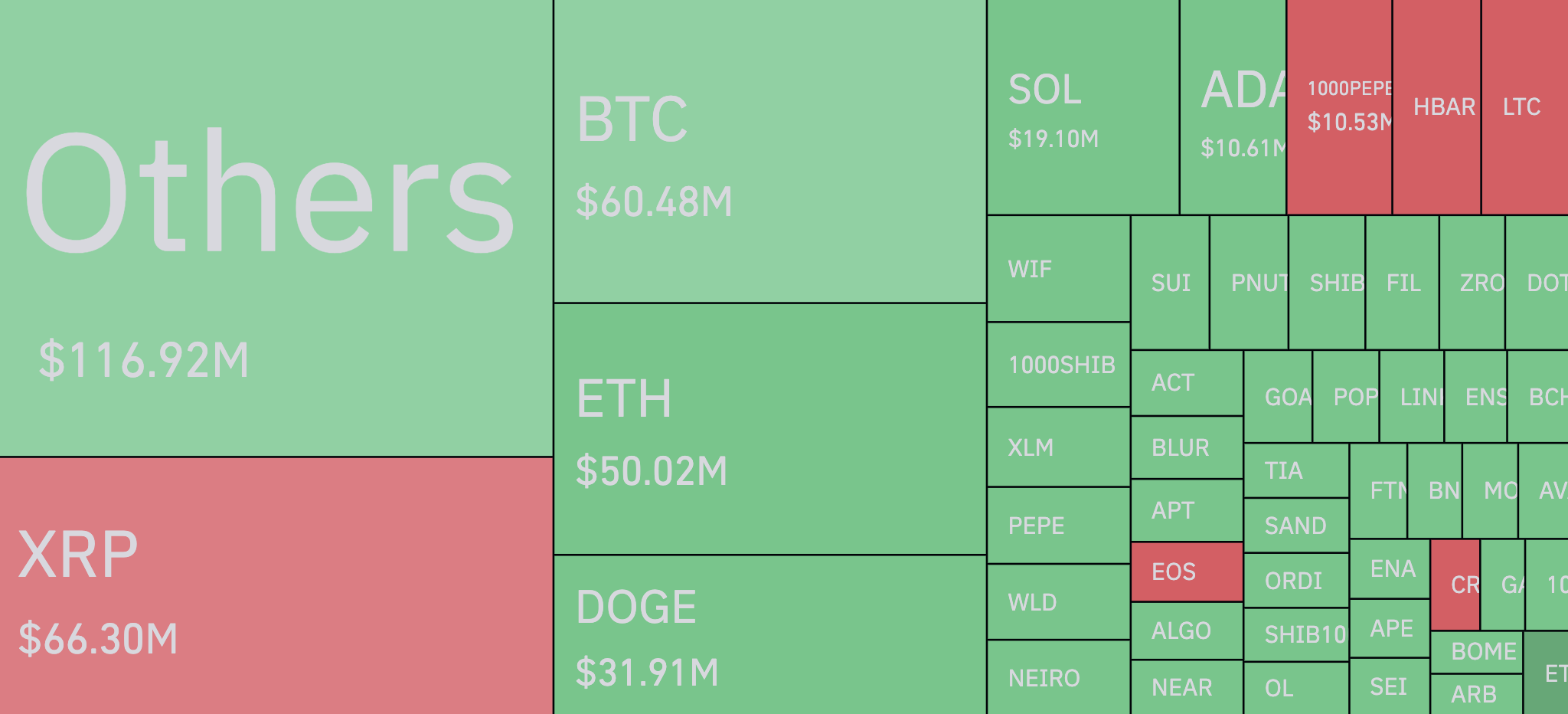

Looking at the CoinGlass heat map, it appears that liquidations in meme-based cryptocurrencies have been significantly impacted. Conversely, this trend seems to be favoring more established projects such as Hedera and Ripple (XRP), suggesting they are currently gaining traction.

Furthermore, it’s no wonder that Bitcoin (BTC) and Ethereum (ETH) are leading the pack, considering their significant roles as benchmarks or indicators in the cryptocurrency market.

From my perspective as a researcher, it appears that the recent $500 million wave of liquidation has predominantly impacted optimistic traders, who hold long positions. In fact, approximately 63.3% of the forced trades were long positions.

Read More

- March 2025 PS Plus Dream Lineup: Hogwarts Legacy, Assassin’s Creed Mirage, Atomic Heart & More!

- Esil Radiru: The Demon Princess Who Betrayed Her Clan for Jinwoo!

- Unleash Willow’s Power: The Ultimate Build for Reverse: 1999!

- 6 Best Mechs for Beginners in Mecha Break to Dominate Matches!

- XRD PREDICTION. XRD cryptocurrency

- Unlock the Ultimate Armor Sets in Kingdom Come: Deliverance 2!

- Top 5 Swords in Kingdom Come Deliverance 2

- EUR AUD PREDICTION

- USD DKK PREDICTION

- Eiichiro Oda: One Piece Creator Ranks 7th Among Best-Selling Authors Ever

2024-12-02 15:19