As a seasoned researcher who has navigated the cryptocurrency market for years, I find the recent surge in stablecoin inflows particularly intriguing. This trend, as highlighted by CryptoQuant author Axel Adler Jr, could indeed have a significant impact on Bitcoin’s trajectory.

Recent data indicates a surge in the inflows of Tether (USDT) and USD Coin (USDC). Here’s how this trend might impact Bitcoin:

Stablecoins Are Observing Higher Than Usual Inflows Right Now

According to Axel Adler Jr’s latest post on X, there’s been an uptick in the regular monthly flow of the leading stablecoins, USDT and USDC, into exchanges as of late.

In simpler terms, “exchange inflow” is a measurement that counts the overall quantity of a specific digital asset being transferred into the wallets linked to centralized trading platforms.

When the level of this metric is significantly increased, it indicates that a substantial number of deposits are being made into these exchanges at present. This pattern hints at a strong desire among crypto holders to convert their digital currencies for trading purposes.

Alternatively, a low indicator suggests that investors may be deciding to keep their coins rather than trading them frequently, since there’s less activity of moving their coins to exchanges.

As a seasoned investor with over two decades of experience in the volatile and ever-evolving world of cryptocurrency, I have learned to read between the lines when it comes to market trends. The influx of investors depositing funds into volatile assets like Bitcoin can often serve as a bearish indicator for me. This is because, based on my own observations, such transfers are frequently made in anticipation of selling. When large sums of money start moving into an asset that is notoriously unpredictable and prone to rapid fluctuations, it sets off alarm bells in my head. It’s a situation I’ve seen many times before, and it usually means the price could be heading downward. That being said, as with any investment, it’s essential to do your own research and make informed decisions based on your risk tolerance and financial goals.

For assets like USDT and USDC (stablecoins), it’s essential to note that deposits might indicate investors wishing to sell these tokens. However, selling these stablecoins doesn’t directly impact their values since they are inherently stable in worth. Despite this, they play a significant role within the broader market.

As a researcher examining investment trends, I’ve observed that many investors often prefer to secure their funds in stablecoins to shield them from the unpredictable fluctuations experienced with cryptocurrencies like Bitcoin. Yet, it seems that these investors who opt for this stability typically have a strategic intent to re-engage in the volatile crypto market at a later point.

In summary, the flow of USDT and other stablecoins being exchanged suggests that investors who have been holding back may be preparing to buy Bitcoin and the company’s tokens. This exchange could potentially lead to an increase in demand for these volatile assets, which might cause their prices to rise.

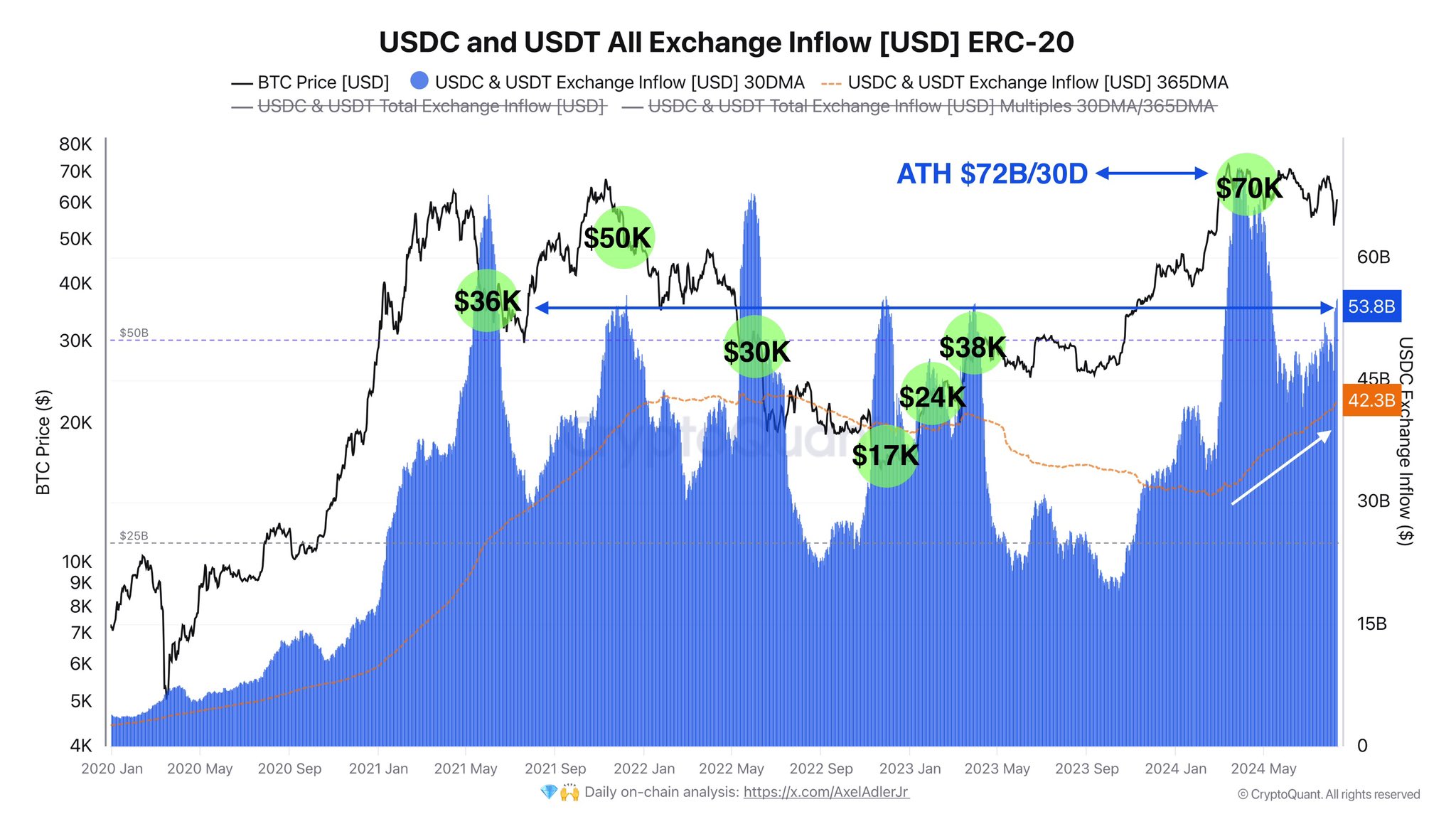

As a seasoned data analyst with years of experience under my belt, I have come to appreciate the value of visualizing trends in financial markets using moving averages (MAs). Recently, I’ve been analyzing the inflow trend for USDT and USDC exchange over the past few years. Here’s a chart that displays the 30-day and 365-day MAs for these digital assets. From my perspective, understanding this data can help me make informed decisions about investment strategies or market timing in the crypto space. I find it crucial to keep an eye on such trends as they can provide insights into the overall health of the market and potential shifts in investor sentiment.

Over the past month, I’ve noticed a significant surge in the daily inflow of USDT and USDC into exchanges, particularly as Bitcoin approached its latest record high. This influx indicates that there has been strong interest among investors to acquire more of this digital asset, which is an encouraging sign for the market.

Amidst this spike, the deposit gauge hit an unprecedented high of $72 billion per day. However, after a subsequent dip, the figure experienced a significant cooling off. Lately, though, it’s been trending upward again.

To date, the value has surpassed approximately $53.8 billion daily, an impressive feat. Should the new stablecoin deposits be aimed at investing in the volatile sectors like Bitcoin and others, we might observe a positive trend or a bullish impact on their values.

BTC Price

Earlier today, Bitcoin dipped below $58,000, but it subsequently surged and exceeded $60,000, indicating a recovery.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD COP PREDICTION

- BICO PREDICTION. BICO cryptocurrency

- USD ZAR PREDICTION

- USD PHP PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- USD CLP PREDICTION

- NAKA PREDICTION. NAKA cryptocurrency

2024-08-13 11:42