As an analyst with over two decades of experience in the financial markets, I find myself intrigued by WisdomTree’s recent moves in the cryptocurrency space. Having witnessed the rise and fall of numerous market trends, I can’t help but notice the strategic significance of this transaction.

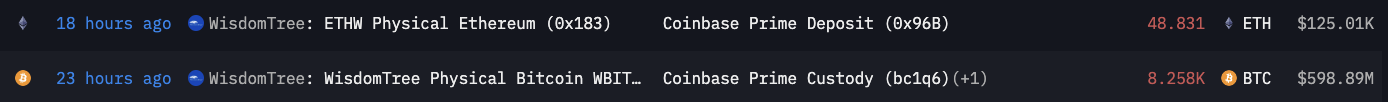

Over the last 20 hours, a significant ETF provider in the U.S., known as WisdomTree, completed a substantial trade. This transaction involved moving about 8,258 Bitcoins, worth around $600 million, and approximately 48.83 Ethereum, valued at close to $125,000, to the Coinbase trading platform.

By January 2024, the global assets managed by WisdomTree, based in New York, will be approximately $99.5 billion. These assets are diversified across various asset classes and countries. Notably, their investments extend to digital currencies such as Bitcoin, Ethereum, and certain alternative coins, which are managed through cryptocurrency-related funds.

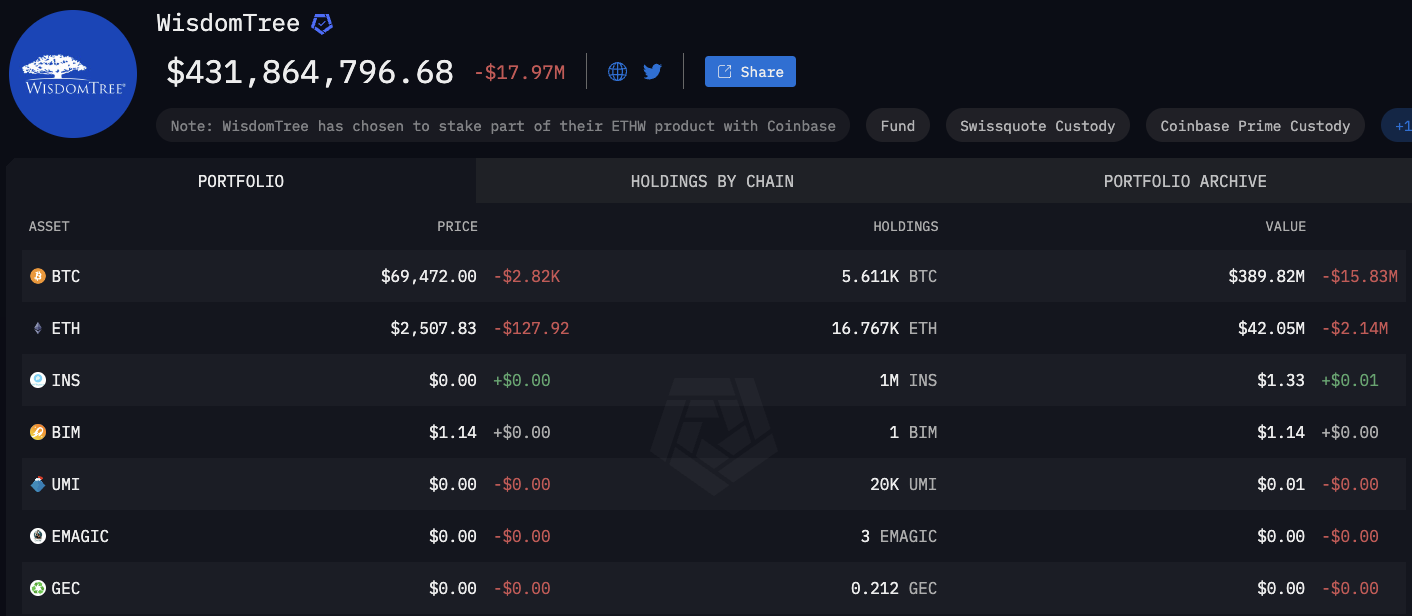

Following the latest exchange, WisdomTree continues to possess around 5,611 Bitcoins, worth roughly $388 million, and approximately 16,767 Ethereum valued at nearly $41.9 million. These transactions have sparked debate over potential modifications to the company’s cryptocurrency investment plans.

In simple terms, WisdomTree’s latest moves in the crypto market contribute to the storyline, as they pulled back their application for a regular Ethereum ETF without providing clear explanations. This action has sparked speculation that WisdomTree believes there is not much interest in this particular product.

In simpler terms, the WisdomTree Bitcoin ETF that already exists has a total value of approximately $217 million. However, it ranks as one of the smaller Bitcoin ETFs available in the United States when compared to others in the same market.

It seems WisdomTree might be adopting a more conservative strategy for investments in cryptocurrencies, possibly due to their recent actions regarding Coinbase and changes in ETFs. Some speculate that this major shift in Bitcoin could signal the firm’s intention to decrease its direct cryptocurrency holdings, aligning them with overall net inflows or outflows of ETFs.

Read More

- FIS PREDICTION. FIS cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- Tips For Running A Gothic Horror Campaign In D&D

- Luma Island: All Mountain Offering Crystal Locations

- EUR CAD PREDICTION

- DCU: Who is Jason Momoa’s Lobo?

- XRP PREDICTION. XRP cryptocurrency

- OSRS: Best Tasks to Block

- How to Claim Entitlements In Freedom Wars Remastered

- The Best Horror Manga That Debuted In 2024

2024-11-01 15:00