As a researcher with a background in financial markets and cryptocurrencies, I find the recent price movements in Bitcoin and Ethereum to be quite intriguing. The surge in prices, particularly Ethereum’s, was not an expected development, especially given the potential approval of the Ethereum ETF. However, the most recent news suggests that we might see this approval sooner than anticipated.

The unexpectedly large increase in Ethereum’s value took many by surprise, despite the possibility of an Ethereum ETF being approved. However, with the latest developments, this could happen earlier than anticipated. As investors shifted from a negative to a positive outlook, over $250 million in Ethereum short positions were closed within a day.

From a technical perspective, Bitcoin’s latest advancement has shattered important resistance thresholds, conveying a robust message to investors. According to the daily chart, Bitcoin has convincingly exceeded the $67,000 threshold, which previously served as a substantial barrier. This achievement paves the way for Bitcoin to target the $70,000 mark – a notable milestone that could bolster its standing in bullish markets.

As a crypto investor, I’ve noticed that Ethereum‘s price chart tells an encouraging story. It has successfully surpassed both its 50-day moving average and 200-day moving average, indicating a robust uptrend. Furthermore, the trading volume has significantly increased, which is a clear sign of heightened investor interest and optimism regarding Ethereum’s future potential.

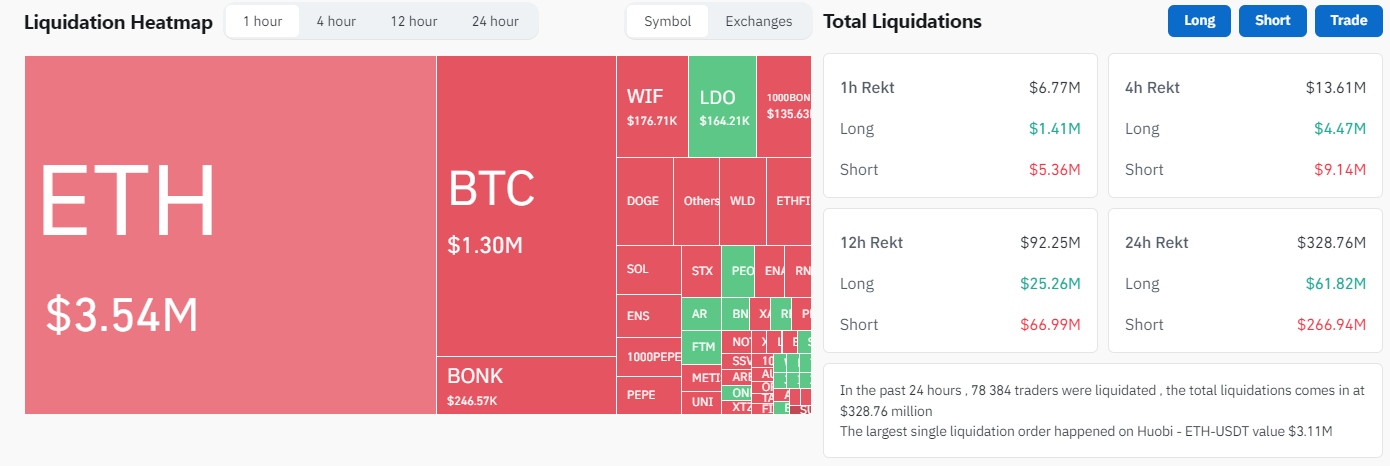

The significant price surges have had a substantial effect on the larger market. Reports indicate that over $250 million in short positions were terminated as traders hurriedly covered their positions due to the bullish trend. This extensive liquidation has served to intensify the rally, driving prices further up.

As a crypto investor, I’ve noticed an intriguing trend in the liquidation data. The vast majority of these liquidations were based on short positions held by traders before the Ethereum ETF announcement. This suggests that the market was predominantly bearish in its outlook prior to this news.

Over the past 24 hours, a staggering $328.73 million worth of assets have been sold off, with approximately $267.06 million being attributed to short positions. At present, there are strong indications that the market could pick up speed and move into the second stage of the bull run in 2024.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD COP PREDICTION

- BICO PREDICTION. BICO cryptocurrency

- USD ZAR PREDICTION

- USD PHP PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- USD CLP PREDICTION

- PLI PREDICTION. PLI cryptocurrency

2024-05-21 17:12