As a seasoned analyst with years of market experience under my belt, I’ve seen my fair share of market turbulence. The recent $800 million wipeout in the cryptocurrency market, particularly the 1,000% imbalance in XRP liquidations, is a stark reminder of the wild, unpredictable nature of this space.

Over the last day, I’ve witnessed a massive wave of liquidations sweep through the crypto market, wiping out approximately $800 million in trader positions. A closer look at the data from CoinGlass reveals that an overwhelming 84% of these liquidations were from long positions. Notably, among the casualties was the derivatives trading on XRP, currently the third largest cryptocurrency, which has been significantly impacted by this recent market destruction.

In the past day, approximately $30.75 million in long positions and $10.94 million in short positions were cleared in the trading of XRP’s perpetual futures contracts. Interestingly, a significant increase in liquidations by pessimistic traders was observed solely within the last hour. Prior to this spike, the difference between liquidated trades had exceeded 1000%.

Currently, XRP holds the leading position in the market regarding liquidations. This indicates on one side growing enthusiasm for XRP as a trading asset, while on the other side it reflects its fluctuating price patterns.

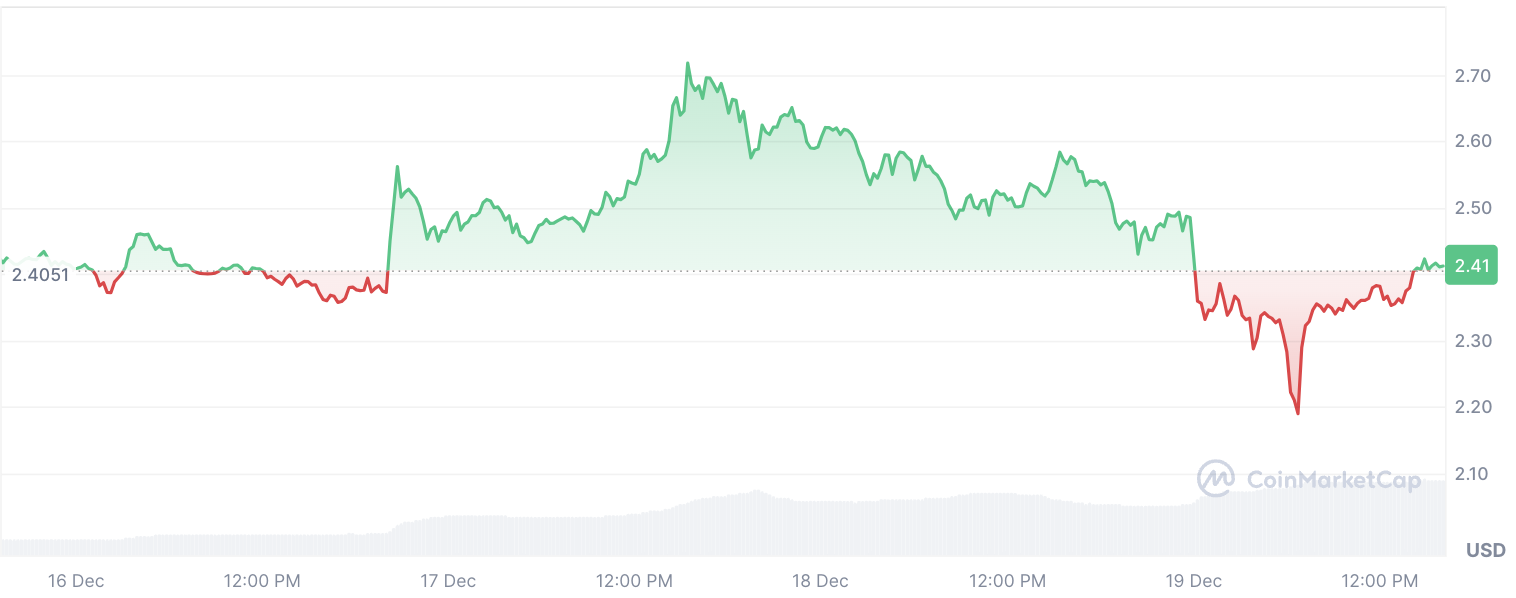

During the reviewed timeframe, the price of XRP plummeted over 16% and hit a temporary low of $2.17. Yet, in today’s trading, it partially recovered from its drop, climbing back up by approximately 11%.

Currently, the XRP price trend and its circumstances seem strikingly similar to a widely recognized internet joke, leaving one to ponder if the peak has passed. However, this uncertainty doesn’t change the fact that the market will likely catch off-guard those who neglect proper risk management.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- PlayStation and Capcom Checked Another Big Item Off Players’ Wish Lists

- EUR CAD PREDICTION

- CTXC PREDICTION. CTXC cryptocurrency

- XDC PREDICTION. XDC cryptocurrency

- MNT PREDICTION. MNT cryptocurrency

- EUR INR PREDICTION

- Black Ops 6 Zombies Actors Quit Over Lack Of AI Protection, It’s Claimed

- GLMR PREDICTION. GLMR cryptocurrency

2024-12-19 17:01