According to data recorded on the blockchain, Bitcoin‘s transaction fees have surpassed Ethereum‘s in terms of another measurement. Specifically, more fees are being paid on the Bitcoin network compared to the Ethereum network at present.

Bitcoin Total Transaction Fees Is Now Higher Than Ethereum’s

According to an analysis by James Van Straten in a recent post on X, the cost of making a Bitcoin transaction has surpassed that of Ethereum once more. In this context, “transaction fees” signify the charges that all users on these networks must pay as compensation for miners or validators who process their transfers.

On the blockchain, fees are typically connected to the current level of activity. When there’s heavy usage, the queue of unconfirmed transactions (mempool) may get clogged. Since validators can only handle a certain number of transactions at once, transfers might be delayed until capacity becomes available.

During busy network periods, investors eager for faster transaction processing may pay above-average fees to secure priority. This results in an increase in the average fee rate for the entire network when numerous senders engage in such competition.

During busy times on the blockchain, the total transaction fees automatically increase. Conversely, when there’s minimal activity, validators typically earn small transfer fees since users prefer smaller transactions due to a lack of incentive for larger ones.

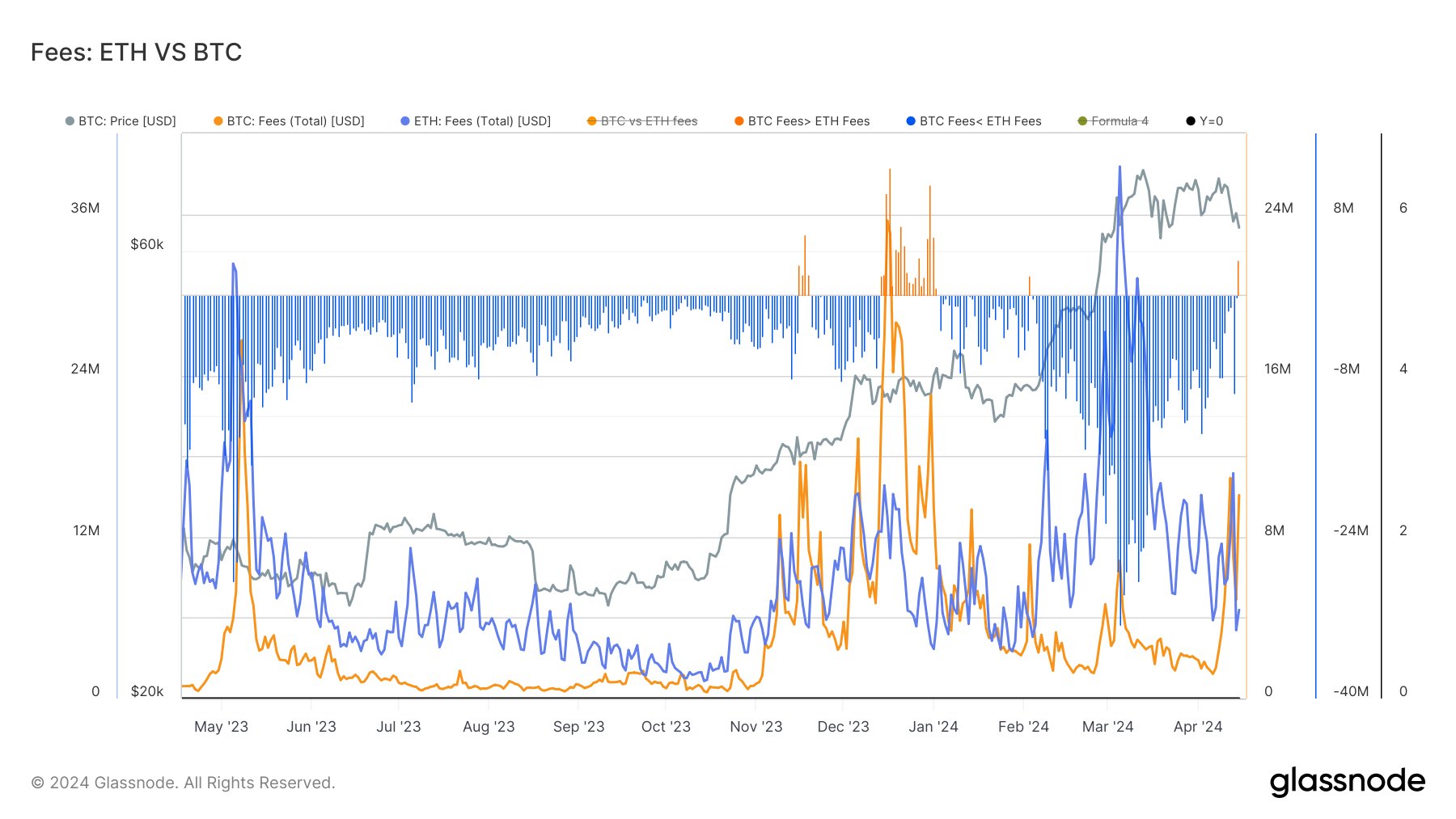

Here’s a chart displaying the difference in total transaction fees (expressed in US Dollars) between Bitcoin and Ethereum over the past twelve months.

Throughout most of the previous year, Ethereum has generally been known for charging more in transaction fees compared to Bitcoin, as illustrated by the given chart.

In the past few months, it’s been surprising to see Bitcoin’s transaction fees exceed Ethereum’s on several occasions. However, Ethereum’s fees have generally been lower than Bitcoin’s for the past five years.

Based on the graph, the largest difference between the two blockchains in favor of Bitcoin occurred around the end of 2023 through early 2024.

The cost of Bitcoin transactions rising was partially caused by Inscriptions, a feature enabling data to be written directly onto a satoshi (the tiniest bit of Bitcoin).

Inscriptions hold various roles across the blockchain, such as non-fungible tokens (NFTs). The network manages transactions involving Inscriptions in a similar fashion to regular ones, consequently impacting the transaction fee economy.

Previously, The Inscriptions experienced significant growth and as a result, Bitcoin’s transaction fees outpaced those of Ethereum. Lately, The Inscriptions have regained popularity, contributing to the recent reversal in their relative fees.

The longevity of this trend is uncertain since the previous growth period didn’t last forever, and fees eventually returned to their usual amounts.

BTC Price

In recent days, Bitcoin has made several attempts to bounce back, but these efforts have not been successful yet, and the digital currency is currently hovering around $62,400 once again.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- USD CLP PREDICTION

- USD PHP PREDICTION

- USD ZAR PREDICTION

- USD COP PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- RIDE PREDICTION. RIDE cryptocurrency

2024-04-17 21:41