As a researcher with experience in blockchain technology and cryptocurrency markets, I have closely monitored the recent developments in Bitcoin, particularly the impact of the latest Halving event on miner revenues. The data suggests that the hype around the new Bitcoin Runes has severely dropped, which is not a good sign for miner revenues.

As a researcher studying cryptocurrency trends, I’ve noticed that the excitement surrounding the new Bitcoin Runes seems to have waned significantly. This trend is concerning because it could negatively impact miner revenues.

Bitcoin Halving Effect Settles In On Miner Revenue As Runes Interest Drops

As a Bitcoin analyst, I recently witnessed the highly anticipated Bitcoin Halving take place. This is an inherent part of the Bitcoin system, where the reward for mining new blocks is reduced by half. The frequency of these events is every 210,000 blocks, approximately every four years. The most recent Halving marked the fourth instance of this reduction in rewards.

As a miner, I earn block rewards, which are significantly influenced by the Halvings. These rewards serve as my compensation for successfully mining and adding new blocks to the blockchain. Historically, this has been my primary source of income.

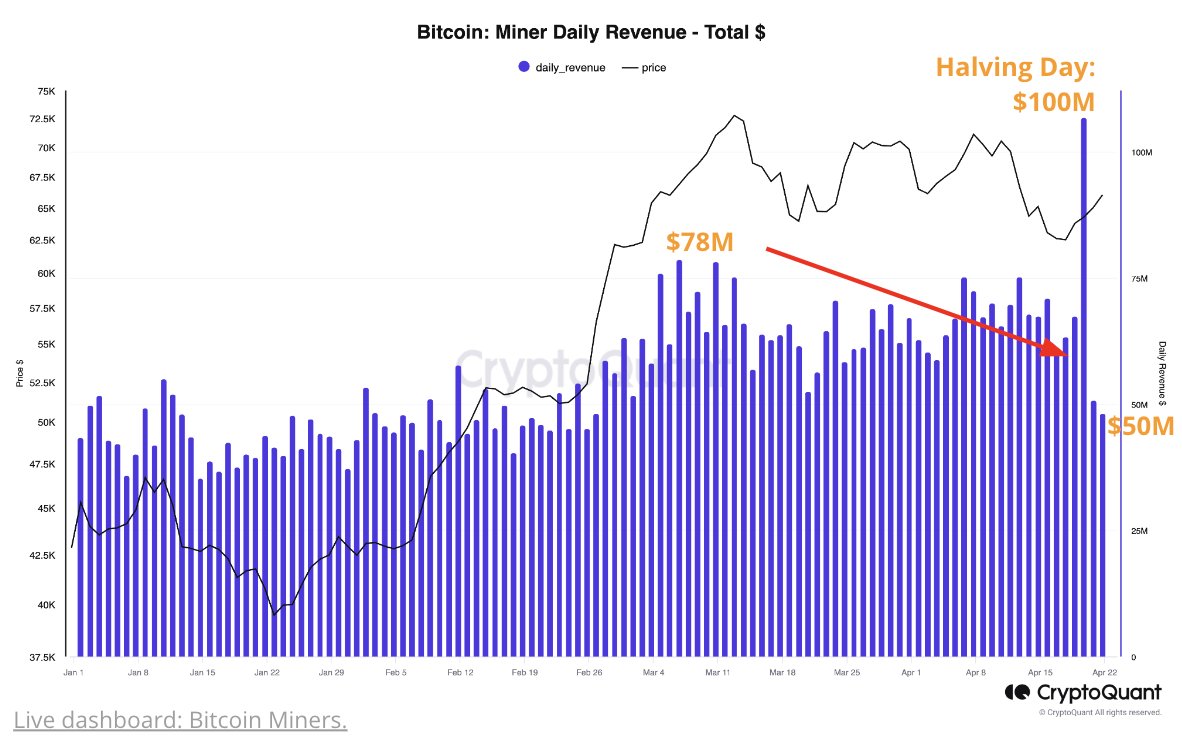

The Halvings can pose a challenge to this community’s finances due to a substantial decrease in their revenue that follows. Yet, just after the most recent Halving, mining revenues experienced a remarkable surge, reaching an unprecedented high of $100 million.

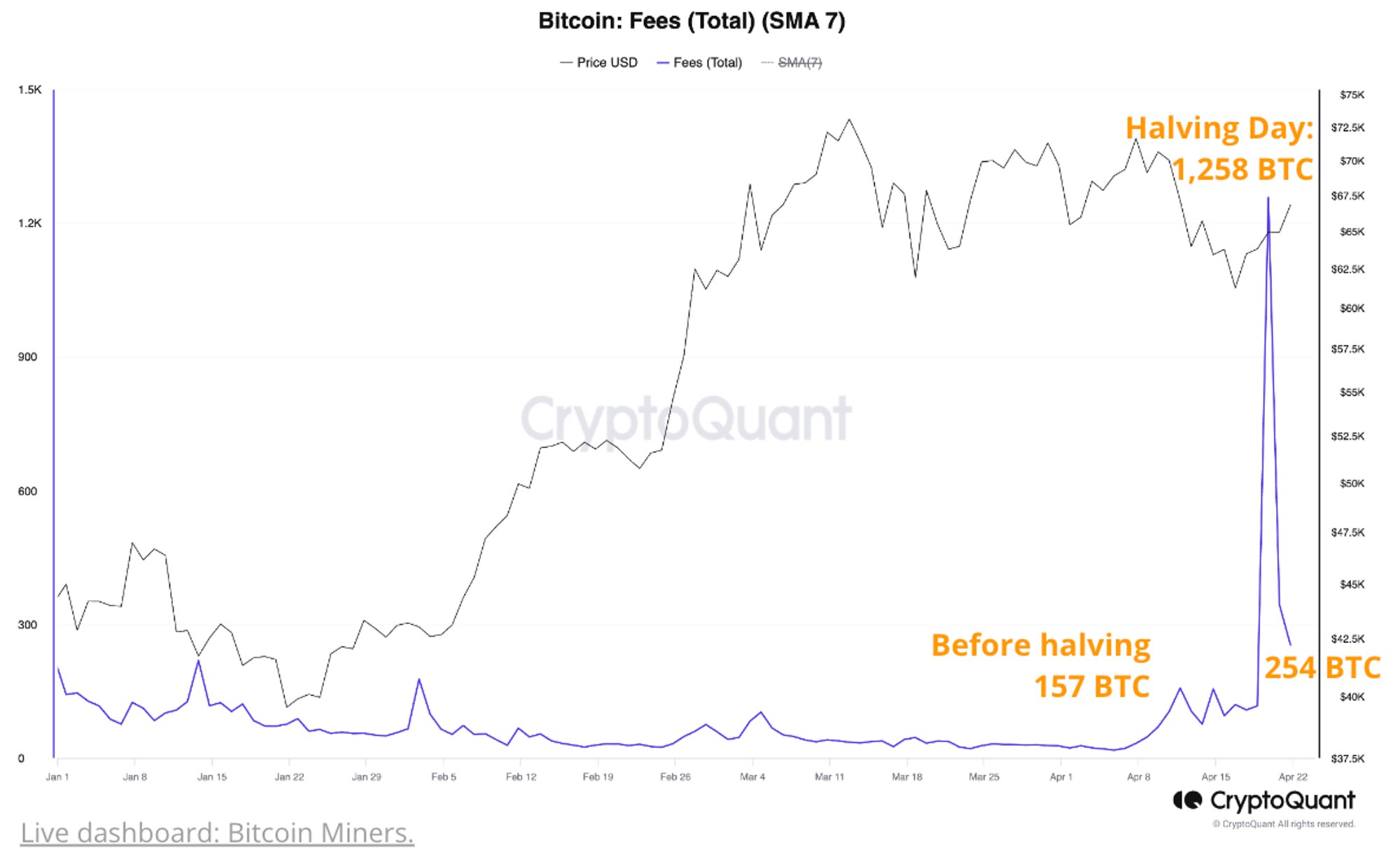

With the occurrence of this event, the block rewards were reduced by half, yet surprisingly, the transaction fees experienced a significant surge. Consequently, the overall income increased instead of decreasing as is typically the case.

As a network analyst, I’ve observed a significant increase in transaction fees, which can be attributed to a major development that occurred on Halving Day – the implementation of the Runes protocol. In simpler terms, this protocol serves as a tool enabling the creation of fungible tokens directly on the Bitcoin blockchain.

As a researcher studying the world of digital currencies, I can explain that fungible tokens and individual Satoshis (the smallest unit of Bitcoin) share a key characteristic: they are interchangeable. Fungibility means that each token or satoshi is indistinguishable from any other. In contrast, non-fungible tokens (NFTs) do not possess this quality – they are unique and cannot be exchanged for something else of equal value.

The use of Runes quickly gained favor among the public, resulting in a significant surge in network traffic. Consequently, the fees for transactions on the network tend to correspond with network activity levels, causing an increase in transaction costs when this new protocol was introduced.

During periods of heavy network usage, transfers may encounter delays as the system’s capacity is maxed out, resulting in longer wait times for users. To expedite these transactions, it becomes necessary for users to pay higher fees.

According to data from on-chain analysis firm CryptoQuant, there was a significant surge in total transaction fees following the launch of Runes, indicating strong demand and heightened interest.

The chart indicates a decline in the indicator’s heat following its remarkable high point. Previously, there was significant enthusiasm for Runes when they were first introduced, but that initial excitement has begun to fade.

As a result, Bitcoin mining revenues, which had been extremely high post-Halving, have also fallen.

The income generated by Bitcoin miners has dropped to approximately $50 million, which is half of the peak earnings of $100 million experienced previously. Consequently, the temporary financial cushion provided by the Runes for miners is no longer in effect, leaving them vulnerable and under increasing stress as chain validators.

BTC Price

At the time of writing, Bitcoin is trading at around $63,900, down over 1% in the past seven days.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- USD COP PREDICTION

- EUR ILS PREDICTION

- CKB PREDICTION. CKB cryptocurrency

- ANKR PREDICTION. ANKR cryptocurrency

- PRIME PREDICTION. PRIME cryptocurrency

- SCOMP PREDICTION. SCOMP cryptocurrency

2024-04-27 03:11