As a seasoned analyst with extensive experience in both traditional finance and the burgeoning world of cryptocurrencies, I find myself intrigued by this recent development. The large-scale Bitcoin transaction from Coinbase to an undisclosed wallet, worth almost half a billion dollars, is certainly a noteworthy event that warrants closer scrutiny.

In an intriguing turn of events, Whale Al alert, a well-known platform monitoring significant cryptocurrency transactions, has announced the transfer of 7,999 Bitcoin (BTC) from Coinbase, a prominent US crypto exchange, to an unidentified wallet. With each BTC currently valued around $62,200, this single transaction is estimated to be worth approximately $500 million.

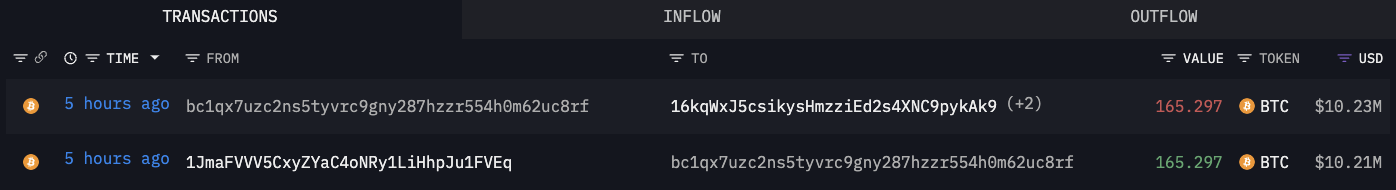

An in-depth analysis of the blockchain records shows an intriguing trend regarding the shifting of these Bitcoins. After an inaugural transaction to an address labeled “1JmaF,” the Bitcoin underwent several splits, eventually ending up in the possession of 62 distinct addresses.

Every following transaction amounted to around 165.3 Bitcoin, which is roughly equal to ten million two hundred thousand dollars, sparking curiosity regarding the reasons for the division of such large sums and the hidden figures behind the transactions.

CPI Day

This significant withdrawal occurring at this moment is particularly intriguing, as it aligns with increased excitement among analysts regarding upcoming U.S. consumer inflation figures. The release of the Consumer Price Index (CPI) is expected to carry substantial weight in financial markets, potentially influencing sectors such as cryptocurrency.

Although it’s generally anticipated that the Consumer Price Index for April won’t show a substantial increase in inflation, there’s still apprehension about how financial markets will respond to this data.

The April Consumer Price Index (CPI) results carry great influence over investors’ attitudes in the financial markets. An unexpectedly high CPI figure may lead to heightened market instability, whereas a less alarming report could momentarily alleviate apprehensions regarding inflation.

As a crypto investor, I’m intrigued by the mystery surrounding the recent large-scale Bitcoin withdrawal. Could it be the work of a seasoned investor, or a “whale,” as we call them in the cryptocurrency community, positioning themselves for potential market growth based on positive economic data? Only time will tell.

Read More

- BTC PREDICTION. BTC cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD COP PREDICTION

- Ethereum (ETH) Crashes Dramatically, What’s Next? Solana (SOL) Can Still Reach $200, XRP Struggling Before $0.63 Test

- TAO PREDICTION. TAO cryptocurrency

- DOGE PREDICTION. DOGE cryptocurrency

- Upbit & Other South Korean Exchanges Suffer With New Crypto Law In Effect

- Profit from the Dip: Hong Kong To Debut Asia’s First Inverse Bitcoin ETF — Here’s When

- TRIAS PREDICTION. TRIAS cryptocurrency

2024-05-15 12:11