As a researcher with a background in the crypto and NFT market, I’ve witnessed firsthand the meteoric rise and subsequent fall of NFT trading volumes. The once-buzzing marketplace now resembles a ghost town, leaving many wondering if this is the end for NFTs or just a temporary setback.

The frenzied NFT marketplace, which saw digital art and collectibles fetching millions, now bears a striking resemblance to an abandoned online market. According to recent findings, trading volume has plummeted by 97% compared to 2021 levels, while an astounding 95% of NFT projects currently hold no value in the market.

As a crypto investor closely following the NFT market, I find myself pondering over this significant downturn. Is this a harbinger of impending doom for the NFT industry, or merely a momentary setback?

From Jpeg Millionaires To Tumbleweed Sales

Two years ago, NFTs (Non-Fungible Tokens) gained significant popularity and were the talk of the town. The sale of Beeple’s digital collage for an astonishing $69 million set a cultural precedent, and tales of newfound wealth from “on-chain jpegs” ignited a speculative craze. Nevertheless, this excitement appears to have cooled down.

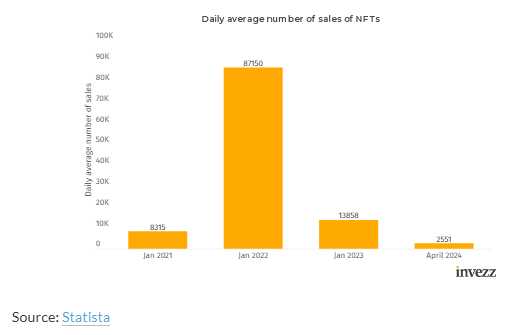

Currently, the typical NFT sale fails to exceed $200, representing a significant decrease from the high-value seven-figure sales of the past. The number of daily transactions has plummeted from an active 87,000 in 2021 to just 2,000 in 2024.

Crypto Winter And Beyond: A Cocktail Of Challenges

As an analyst, I would attribute the recent downturn to a combination of factors. The broader crypto market slump, or what is commonly referred to as the “crypto winter,” has significantly contributed to this trend. Furthermore, economic instability and geopolitical tensions have further dampened investor confidence, exacerbating the situation.

As an analyst, I’ve come across concerns that the struggles in the NFT market may extend further. Critics argue that there is an oversupply of low-quality projects and limited practical use for numerous NFTs beyond showcasing ownership. The headline-grabbing sales worth millions of dollars in 2021 might have been driven more by hype than actual value.

A Glimmer Of Hope? Retail Investors Hold The Key

Although the current scene appears dismal according to the report, it proposes a possible recovery based on past tendencies in the crypto market. The writers refer to how downturns in the market have frequently been preceded by revivals.

As an analyst, I would put it this way: Retail investors, known for their appetite for higher risks in pursuit of substantial returns, may re-enter the market, invigorating it. This revival relies on a broader market recovery and a restored confidence among investors.

Regulation: A Looming Cloud

The road ahead for NFTs is filled with challenges. Looming regulatory oversight from the US authorities poses a significant threat. Some believe that stringent regulations could bring clarity and credibility to the sector, while others are apprehensive that it might hinder creativity. Striking a harmonious equilibrium between safeguarding investors and nurturing expansion will be essential for the NFT market’s prosperity.

The Verdict: A Time Of Reckoning

The current state of the NFT market can be seen as a time of reckoning, marking a shift from the extravagant expectations of 2021 towards a more pragmatic perspective. It remains to be seen whether NFTs will evolve into a robust asset class with tangible uses or if they will simply fade into the annals of digital history.

Read More

- ENA PREDICTION. ENA cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD COP PREDICTION

- USD ZAR PREDICTION

- PNG PREDICTION. PNG cryptocurrency

2024-05-16 12:11