- Bitcoin has taken a tumble below $106k, and oh, what a bearish spectacle it is!

- On-chain metrics reveal a curious calm, as investors clutch their coins like lifebuoys in a storm.

Ah, Bitcoin [BTC], that fickle friend, has slipped beneath the fair value gap at $106.5k. A bearish omen, indeed! The whispers of a descent towards $102.5k and perhaps even a plunge to $100k echo ominously. Yet, fear not, for a fall below $100k seems a distant nightmare.

Meanwhile, geopolitical tensions are rising like bread in an oven, with nations trading missiles in the Middle East as casually as one might exchange pleasantries. Inflation in the U.S. has slowed, but alas, it remains a far cry from the Federal Reserve’s lofty targets. Tariffs and economic uncertainty loom like dark clouds, prompting investors to scurry towards gold, that age-old refuge.

Yet, amidst the FUD (Fear, Uncertainty, Doubt) swirling in traditional markets, Bitcoin stands defiantly above the $100k mark. It appears that investors are beginning to view this digital asset as a veritable fortress of value.

Bitcoin investors are in a wait-and-watch mode

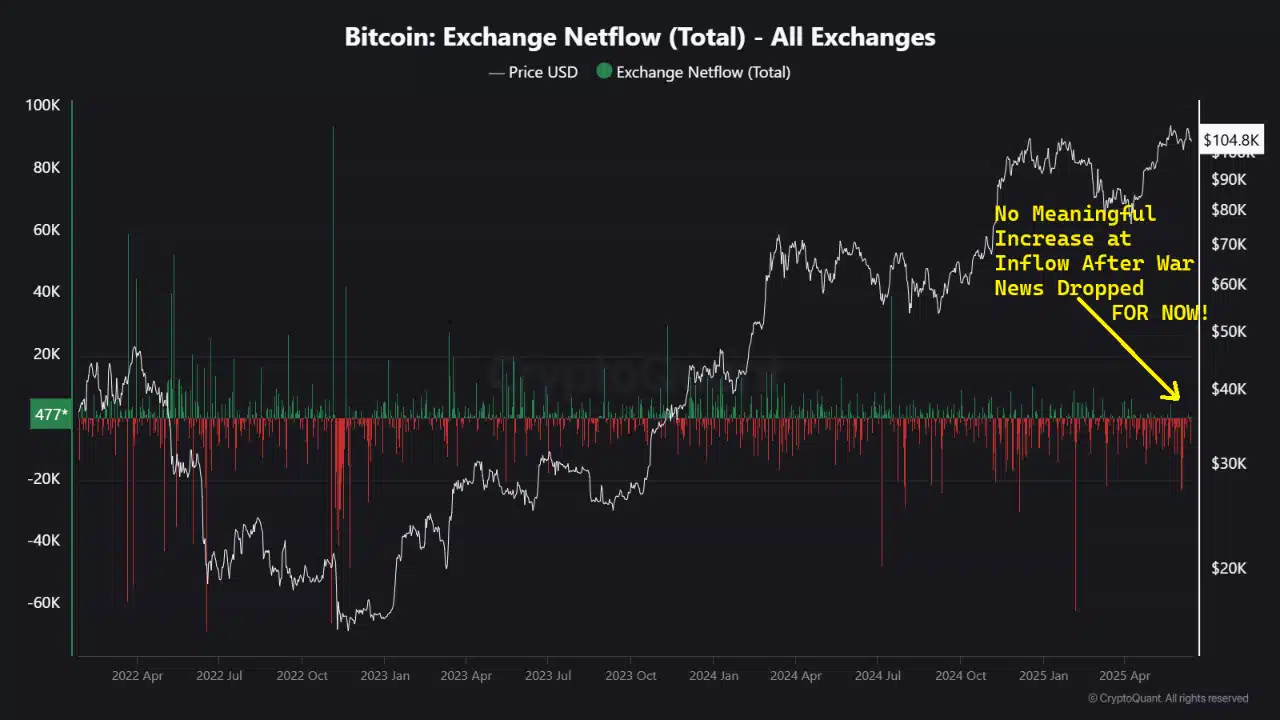

In a post on CryptoQuant Insights, the astute user CryptoMe noted that netflows have been as stagnant as a pond in mid-summer. No significant positive changes, no high inflows—just holders clinging to their profits like a cat to a sunny windowsill.

This lack of selling, for now, may be a sign that investors are not yet in a panic. Or perhaps they’re just waiting for the right moment to pounce! 🐱

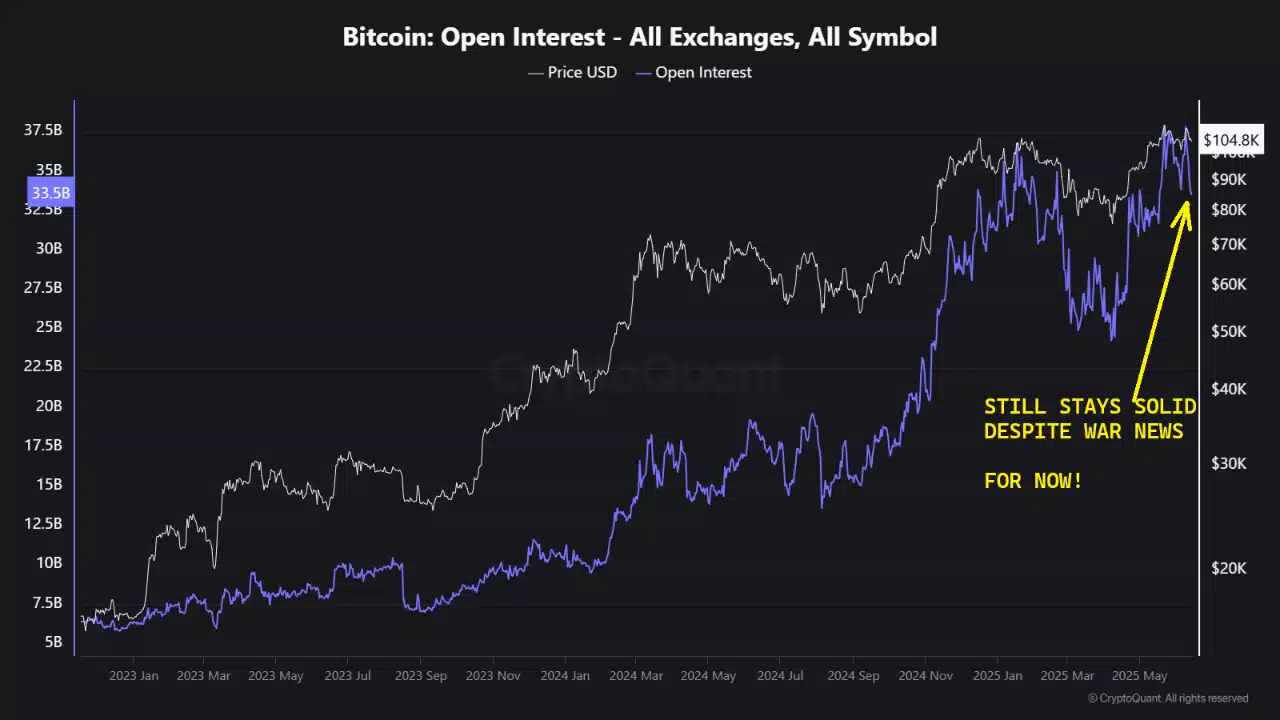

The Open Interest on centralized exchanges has not plummeted dramatically. The correction from $110k to $105k saw some long liquidations, akin to a game of musical chairs where a few unfortunate souls were left standing. Yet, this was not a mass exodus. High OI levels suggest that speculative interest remains robust, even amidst the swirling fears.

In a post on X, crypto analyst Axel Adler Jr observed that the sentiment reading was at a tepid 46%, just shy of the neutral 50%. To reignite the uptrend seen in June, the index must soar beyond 60%-65%. A tall order, requiring sustained demand and a flood of capital.

The 1-day chart reveals a bearish bias looming over Bitcoin like a dark cloud. A long southward wick last Friday, with a low at $102.6k, may soon be revisited. The CMF indicates that selling pressure reigns supreme, while the Awesome Oscillator suggests that downward momentum is the order of the day.

In conclusion, market participants should brace for short-term volatility. Yet, in the face of FUD, the resilience of holders is a beacon of hope. Perhaps it is wise for retail investors to adopt this wait-and-watch stance as well, with a dash of humor and a sprinkle of sarcasm! 😏

Read More

- Solo Leveling: Ranking the 6 Most Powerful Characters in the Jeju Island Arc

- How to Unlock the Mines in Cookie Run: Kingdom

- YAPYAP Spell List

- Top 8 UFC 5 Perks Every Fighter Should Use

- Bitcoin Frenzy: The Presales That Will Make You Richer Than Your Ex’s New Partner! 💸

- How to Build Muscle in Half Sword

- Gears of War: E-Day Returning Weapon Wish List

- Bitcoin’s Big Oopsie: Is It Time to Panic Sell? 🚨💸

- How to Find & Evolve Cleffa in Pokemon Legends Z-A

- Most Underrated Loot Spots On Dam Battlegrounds In ARC Raiders

2025-06-16 08:12