It is a truth universally acknowledged, that a single cryptocurrency in possession of a good fortune, must be in want of a rebound. And so, dear reader, we find ourselves in the midst of a most thrilling tale, wherein Bitcoin, that most mercurial of digital coins, has recorded a staggering $1 billion inflow, a sum most considerable and most unexpected.

For two consecutive weeks, the tides of fortune had flowed away from this esteemed cryptocurrency, leaving many to wonder if its star had finally begun to wane. But alas, dear reader, the market, much like a lady’s heart, is a fickle thing, and sentiments can shift with the wind. And so, as the week drew to a close, a most welcome resurgence was observed, with strong capital flows returning to BTC ETFs, like a suitor returning to his beloved.

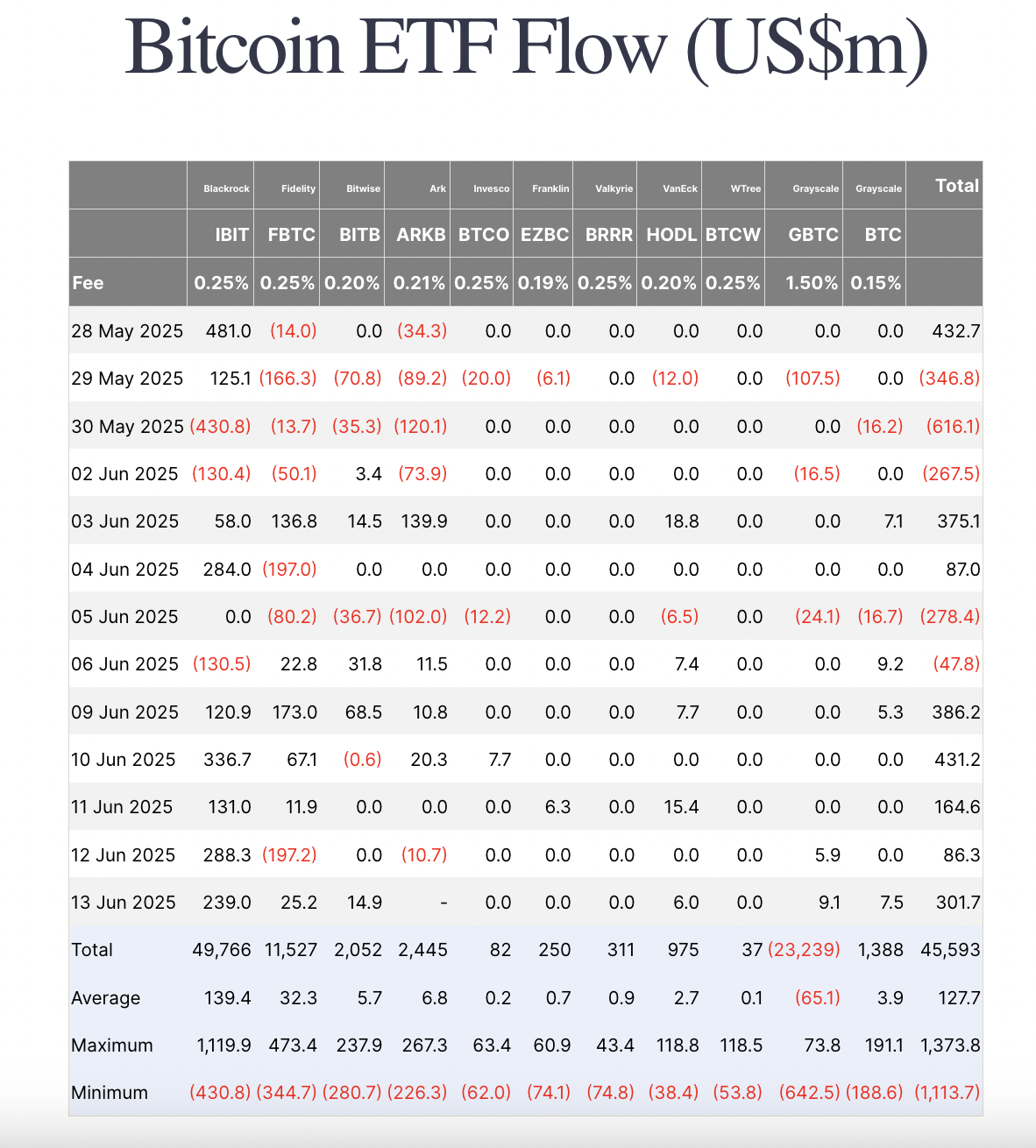

Between the 9th and 13th of June, a period of mere days, Bitcoin-backed funds recorded a most astonishing $1.37 billion in net inflows, a sum that defies explanation, much like the workings of the human heart. And this, dear reader, despite the coin’s lackluster price action for most of the week, a state of affairs that had initially prompted institutional investors to reduce their exposure, like a gentleman withdrawing his affections.

But, as the coin’s price rebounded strongly by June 13, closing above the $106,000 price mark, investor interest and momentum were revived, much like a lady’s ardor is rekindled by a gentle lover’s caress. And thus, dear reader, we are reminded that ETF flows remain as sensitive to BTC’s price trajectory as a lady’s heart is to the whispers of her beloved.

Today, BTC is up 1%, a modest rise, to be sure, but one that has brought a measure of stability to the market, like a gentle breeze on a summer’s day. As of this writing, the leading coin trades at $106,590, a sum most respectable, and notes a 16% rise in trading volume over the past day, a development most intriguing.

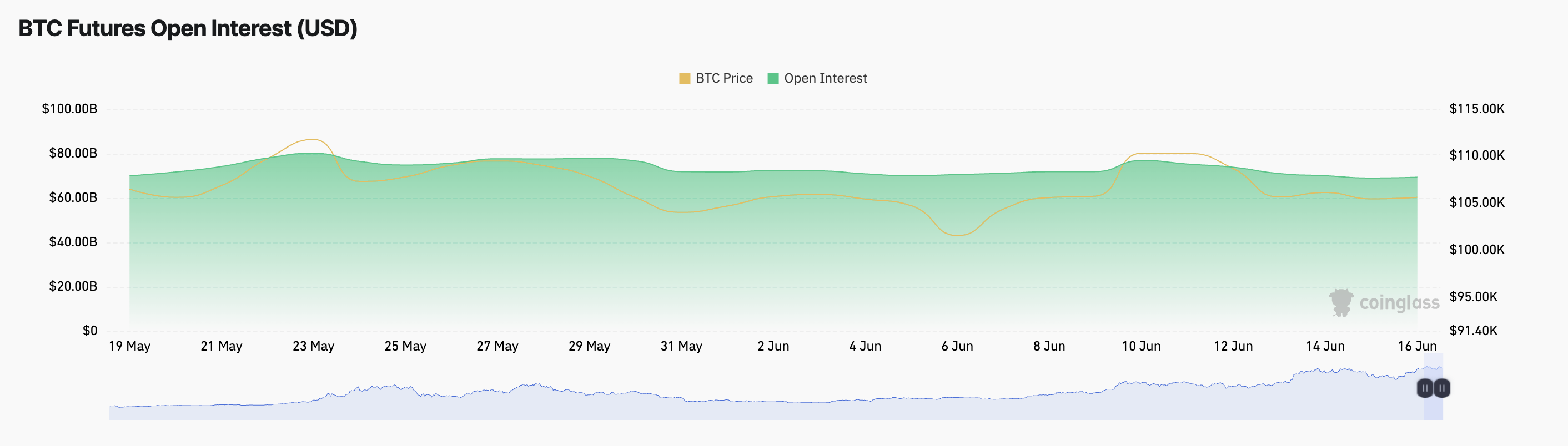

And yet, dear reader, despite this seeming stability, the derivatives market signals unease, like a nervous suitor fidgeting with his gloves. The coin’s steadily declining futures open interest suggests traders remain cautious, seeking safer ground, like a prudent gentleman seeking shelter from a storm. Per Coinglass, this stands at $69.39 billion, a sum most considerable, but one that has plunged almost 10% since June 10, a development most unsettling.

Open interest, dear reader, refers to the total number of active derivative contracts, such as futures or options, that have not been settled or closed, a state of affairs most akin to a gentleman’s outstanding debts. When an asset’s open interest consistently drops, especially during periods of muted price performance, it signals that traders are unwinding their positions, like a prudent gentleman cutting his losses.

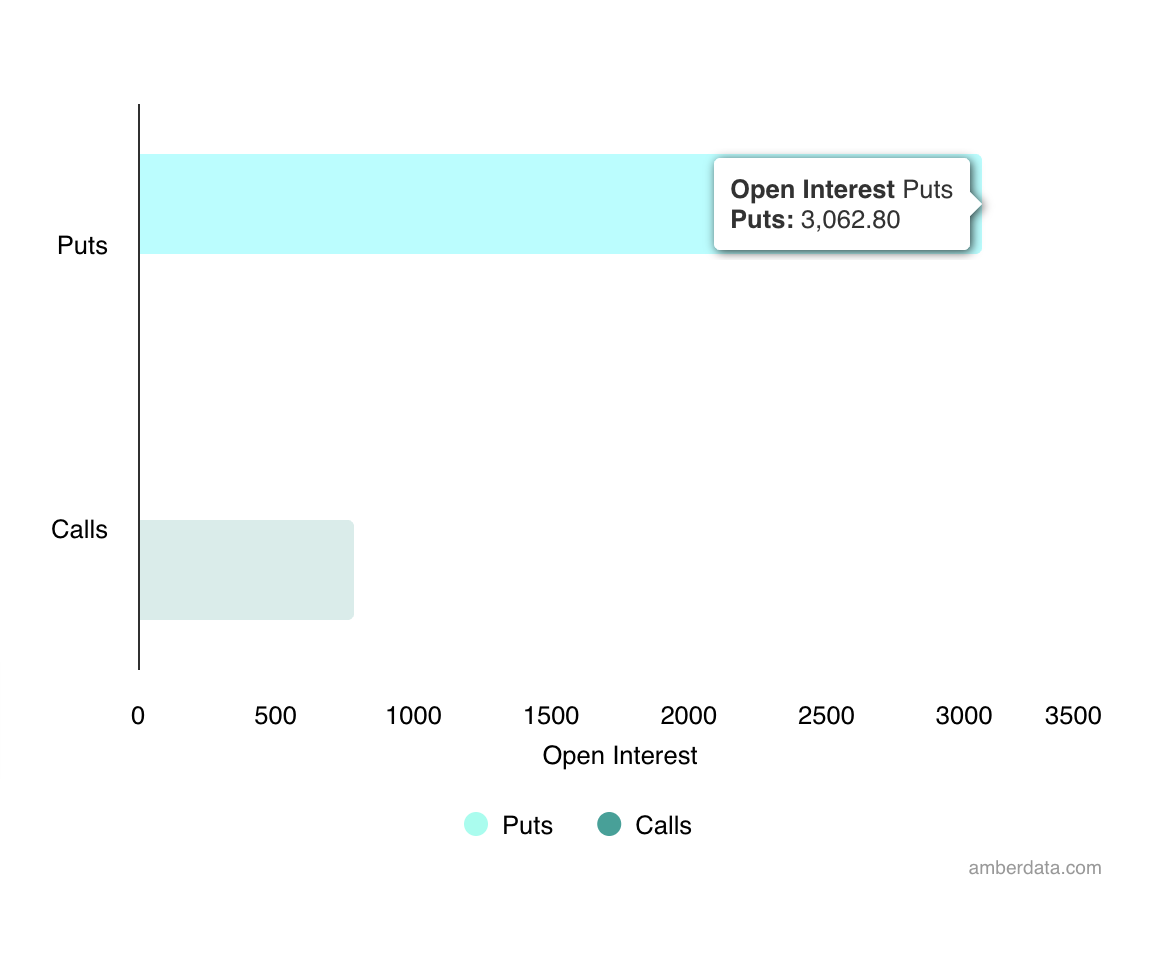

This trend, dear reader, reflects the declining market participation and growing uncertainty about BTC’s near-term outlook, a state of affairs most vexing. Moreover, on-chain data shows a tilt toward protective positioning on the options front, a development most telling. Demand for put options—contracts that profit when prices fall—has outpaced calls, a state of affairs most akin to a gentleman’s desire to hedge his bets.

This, dear reader, signals a rise in bearish sentiment and caution among traders looking to hedge against potential downside risk, a state of affairs most prudent. And thus, we are reminded that, in the world of cryptocurrency, fortune can shift with the wind, and even the most seemingly stable of coins can be subject to the whims of the market, a truth most universally acknowledged. 🤑

Read More

- Solo Leveling: Ranking the 6 Most Powerful Characters in the Jeju Island Arc

- How to Unlock the Mines in Cookie Run: Kingdom

- Bitcoin Frenzy: The Presales That Will Make You Richer Than Your Ex’s New Partner! 💸

- YAPYAP Spell List

- How to Build Muscle in Half Sword

- Top 8 UFC 5 Perks Every Fighter Should Use

- Bitcoin’s Big Oopsie: Is It Time to Panic Sell? 🚨💸

- Gears of War: E-Day Returning Weapon Wish List

- How to Find & Evolve Cleffa in Pokemon Legends Z-A

- The Saddest Deaths In Demon Slayer

2025-06-16 10:28