Oh, what a jolly month June has been for DeFi lending! While the big wigs are busy hoarding Bitcoin like it’s the last cookie in the jar, a sneaky little stream of capital is tiptoeing into lending protocols, quietly making a splash!

This delightful trend is like a treasure chest for investors, but it also means these protocols are juggling more funds than a circus clown with too many balls in the air! 🎪

Active Loans Soar to New Heights!

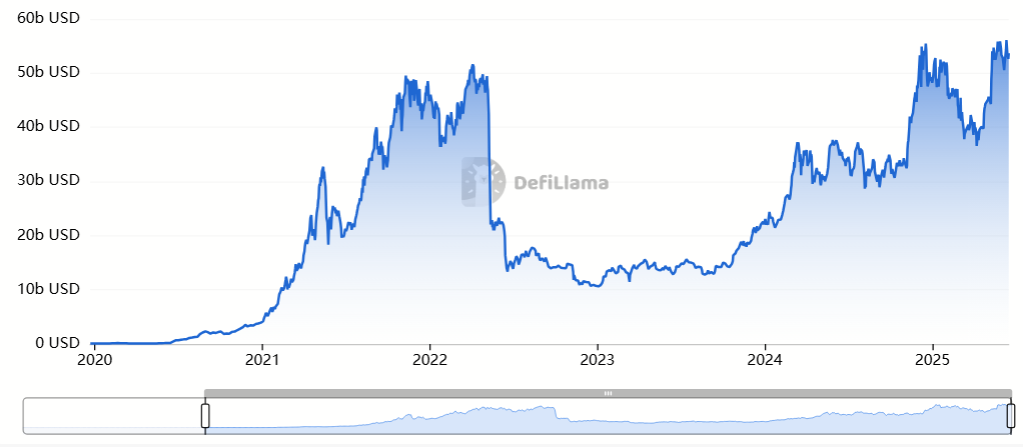

According to the wise owls at DefiLlama, as of June, the total value locked (TVL) in lending protocols has soared past a whopping $55 billion! That’s right, folks, the highest level in the history of DeFi! 🏆

This astonishing figure includes all the shiny assets locked away in DeFi lending platforms, covering both the treasures deposited by lenders and the collateral provided by borrowers. It’s like a grand game of hide and seek with money!

Now, while TVL took a little tumble during the first three months of the year—thanks to pesky external worries like tariff wars—it bounced back quicker than a rubber ball! The rising numbers show that investors are feeling as confident as a cat in a room full of rocking chairs when it comes to earning yields through lending.

And guess what? Data from Token Terminal reveals that active loans have reached a staggering $26.3 billion as of June 2025! That’s the highest value ever recorded in the sector’s history! It’s like a record-breaking rollercoaster ride! 🎢

Now, let’s break it down! Aave is the big cheese in the lending market with a colossal $16.5 billion in active loans, making up over 60% of the total pie! Morpho comes in second with a modest $2.2 billion, while Spark is trailing behind with $1.6 billion. Talk about a lending showdown!

But hold your horses! Aave’s dominance is a double-edged sword. If anything goes wrong—like a technical hiccup or a legal kerfuffle—it could send shockwaves through the whole system! 😱

Demand for Lending is Booming, But Watch Out for Risks!

The recent explosion of high-yield stablecoins has lured more capital into lending protocols like bees to honey! Stablecoins such as USDT, USDC, and DAI are designed to keep their value as steady as a rock, making users feel as snug as a bug in a rug when lending or borrowing.

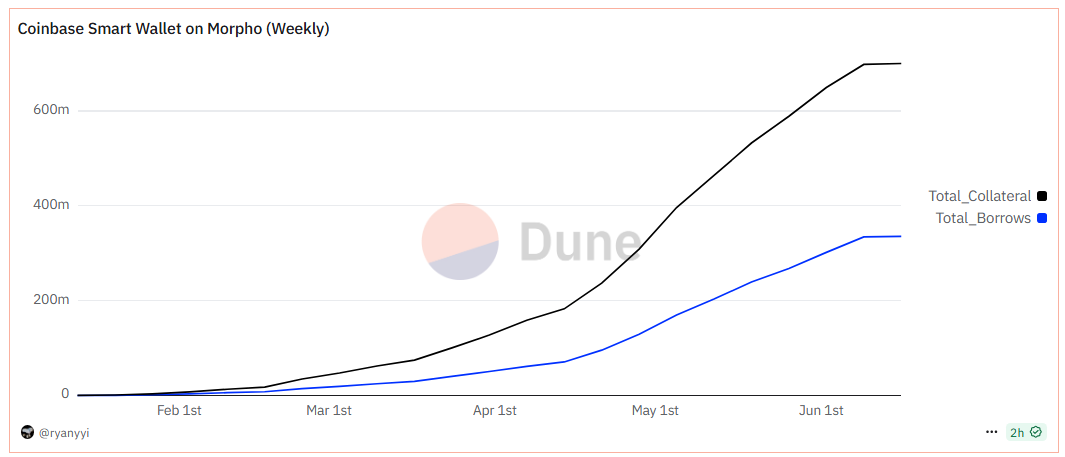

Recently, Max Branzburg, the Head Honcho of Consumer Products at Coinbase, spilled the beans that Coinbase users have borrowed a jaw-dropping $400 million in USDC at around 5% interest! And all this happened in just a few months after launching the product! Talk about a money-making machine! 💰

But beware, dear friends! One major concern is the risk of liquidation tied to loan-to-value (LTV) ratios. The LTV ratio is like a tightrope walker, measuring the value of a loan against the collateral. If the value of the collateral—usually cryptocurrencies—drops faster than a hot potato, the LTV ratio can shoot up like a rocket!

For instance, Coinbase’s current LTV is 0.48. But if it exceeds the 86% threshold, the collateral will be sold off quicker than you can say “liquidation,” leaving borrowers in a pickle! 🥒

Moreover, in a bullish market, investors are itching to ride the wave! They borrow funds from DeFi protocols to snatch up more crypto assets like Bitcoin and Ethereum, often using leverage to amplify their trades. It’s like trying to catch a greased pig at a county fair!

“Leverage is a double-edged sword, tread carefully crypto fam,” Investor Lil G wisely advised. 🗡️

As confidence rises, so does the use of leverage. But beware! A market drop of 10–20% could trigger a chain reaction that sends everyone running for cover! History has shown that sharp dips can happen, especially when unexpected news comes knocking at the door!

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- EUR USD PREDICTION

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Prime Gaming Free Games for August 2025 Revealed

2025-06-16 16:56