- Ah, Cardano (ADA), the brave soldier holding its ground above $0.60! The $0.63 Fibonacci support zone is like a cozy blanket, but alas, the resistance near the $0.68–$0.72 EMA cluster looms like an ominous cloud. ☁️

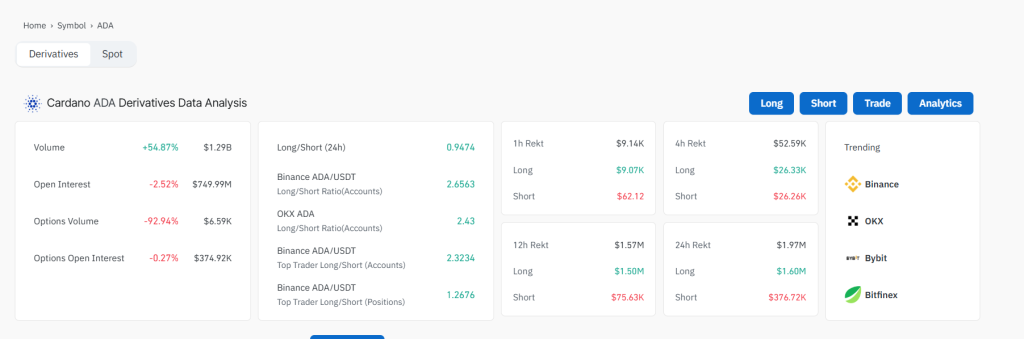

- On-chain volume has been as lively as a sloth since early June, yet the long/short ratios above 2.5 on Binance and OKX suggest traders are gearing up for a bullish reversal. Or are they just daydreaming? 😴

- To confirm a trend shift, a breakout above $0.72 is essential. But if $0.60 gives way, ADA might just find itself revisiting the $0.48–$0.50 support range. Talk about a rollercoaster! 🎢

Cardano On-Chain and Governance Update

In a remarkable feat, Cardano has surpassed 1.3 million staking addresses this week! It’s like a party, and everyone’s invited! 🎉 Staking activity is expected to ramp up with the upcoming launch of $NIGHT token rewards, which will be issued alongside regular ADA staking returns. Who doesn’t love a good reward?

Meanwhile, Charles Hoskinson’s $100M ADA treasury reallocation proposal is stirring the pot. The plan aims to mint native stablecoins (USDM, USDA, iUSD), generate treasury yield, and bolster DeFi liquidity.

This could potentially transform Cardano’s treasury into a decentralized sovereign wealth fund. Ambitious? Yes. Controversial? Absolutely! The community is divided like a family at Thanksgiving. 🍗

ADA/USD Technical View: Price Compression Beneath Resistance

- As of June 17, ADA is trading at $0.634 after a valiant rebound from a local low of $0.62. Price action is stuck in a range, with key support at the 0.618 Fibonacci retracement level ($0.60–$0.63), which has been a reliable fortress during previous corrections. 🏰

- Despite holding this support, ADA is trading below a tightly stacked EMA cluster, including the 20-, 50-, 100-, and 200-day moving averages, currently between $0.68 and $0.72. This multi-timeframe confluence forms a resistance ceiling that bulls must clear to validate a breakout structure. It’s like trying to break through a brick wall! 🧱

- The RSI (14) is hanging around 39.5, indicating mildly oversold conditions. The MACD is still below the signal line, with a flattening histogram showing reduced downside pressure—but no bullish crossover yet. Patience is a virtue, right? ⏳

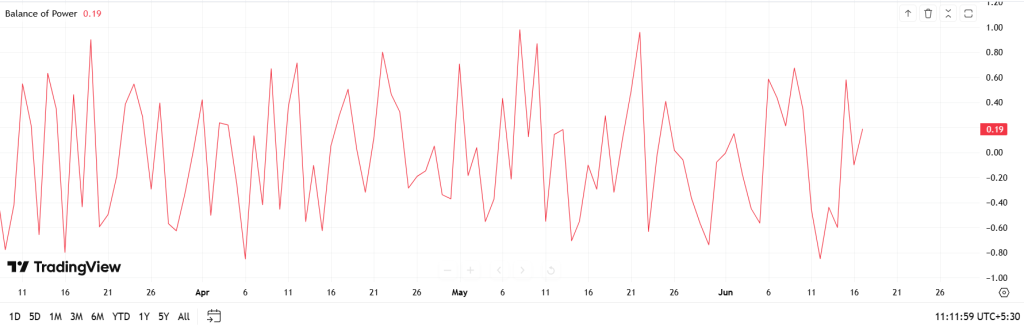

- The Balance of Power indicator is measuring the strength of buyers versus sellers in the market, helping to identify momentum shifts. It’s neutral-to-positive, reflecting accumulation attempts but subdued momentum. A classic case of “I’m not sure what to do!” 😅

On-Chain Activity and Derivatives Sentiment

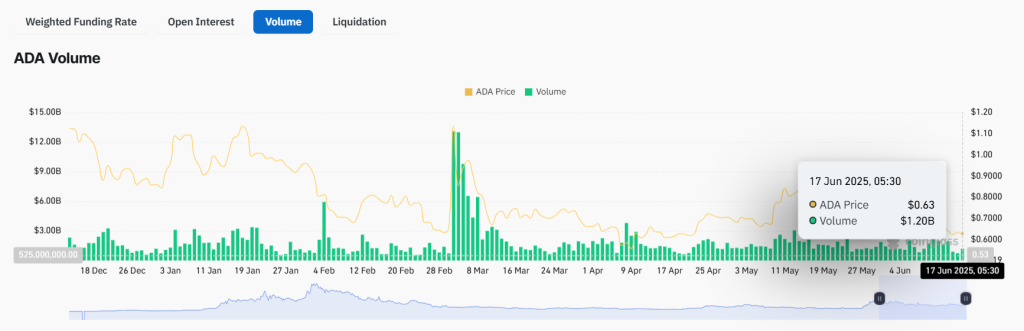

On-chain volume has dropped over 45% since June 1, with ADA slipping from $0.69 to $0.63. This contraction reflects a possible consolidation phase, especially as traders wait for a macro or governance catalyst. The suspense is palpable! 🎭

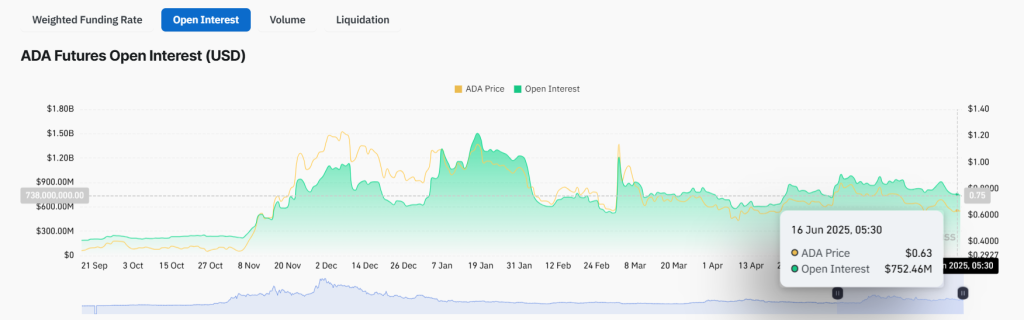

Derivatives data shows ADA futures open interest holding around $752M, while the long/short ratio remains elevated at 2.65 on Binance and 2.43 on OKX. This suggests that speculative traders expect a bullish outcome. Or are they just wishful thinkers? 🤷♂️

However, shrinking futures volume and stagnant spot flows signal that conviction remains weak. It’s like a party with no music! 🎶

Coinbase saw minor inflows (~$367K), while OKX and Kraken registered outflows exceeding $700K each. It seems like some are packing their bags! 🧳

Conclusion: Accumulation or Breakdown Ahead?

Cardano’s fundamentals—staked address growth, treasury innovation, and DeFi integrations—continue to strengthen. But the technicals are under pressure. A sustained breakout above the $0.68–$0.72 EMA cluster is needed to confirm trend reversal and attract fresh liquidity. The stakes are high!

Until then, ADA remains trapped between speculative long bias and structural fragility. Traders are watching $0.60 closely. If it holds, accumulation continues. If it breaks, downside targets shift to $0.50 and lower. The drama unfolds! 🎭

Read More

- Solo Leveling: Ranking the 6 Most Powerful Characters in the Jeju Island Arc

- How to Unlock the Mines in Cookie Run: Kingdom

- Bitcoin Frenzy: The Presales That Will Make You Richer Than Your Ex’s New Partner! 💸

- YAPYAP Spell List

- How to Build Muscle in Half Sword

- Top 8 UFC 5 Perks Every Fighter Should Use

- Bitcoin’s Big Oopsie: Is It Time to Panic Sell? 🚨💸

- Gears of War: E-Day Returning Weapon Wish List

- How to Find & Evolve Cleffa in Pokemon Legends Z-A

- The Saddest Deaths In Demon Slayer

2025-06-17 15:26