There, under the oppressive, gray hush of Wall Street’s dawn, three crypto soldiers emerge—Circle (CRCL), Coinbase (COIN), and GameStop (GME). Each, in the semidarkness of commerce, carries its own lamp through the labyrinth of digital longing. Circle rallies like an impassioned lover: flushed, trembling—carried aloft by investor jubilation, yet chained at the ankle to Coinbase’s restless fate. 🤦♂️

Coinbase, meanwhile, expands its dominion across continents, new alliances gleaming like medals pinned over regulatory wounds. But political storms gather at their flanks, while GameStop, ever prankish and mercurial, pirouettes on the very edge of speculation—trading more in dreams than delivered realities, investors squinting towards a Web3 tomorrow that may yet vanish with the morning mists.

Circle Internet Group (CRCL)

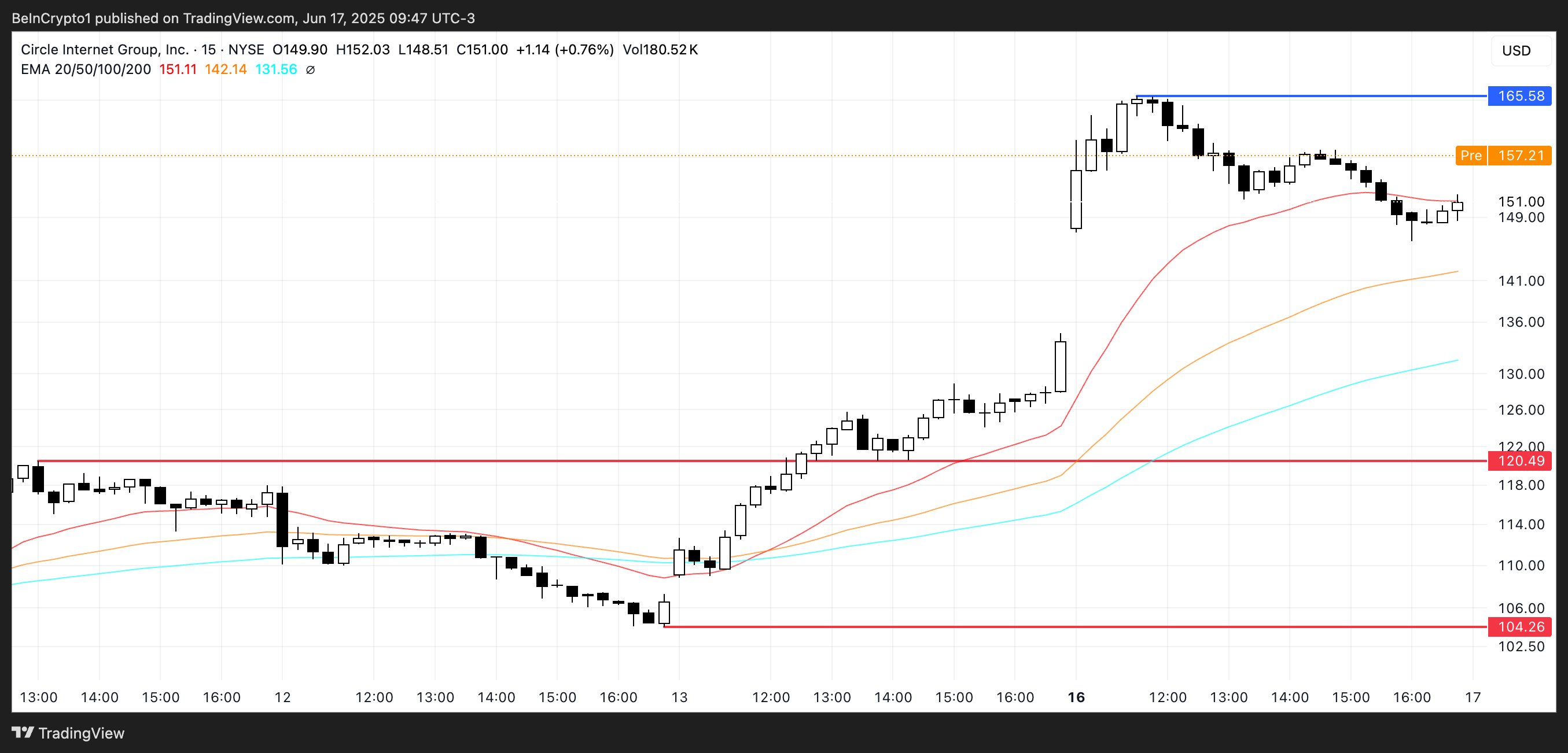

Circle bursts onto the NYSE stage like a poet receiving overdue acclaim, shares soaring upwards—Monday’s close a robust 13%, another 4% pre-market. Triumph, yes, but always with the shadow: Ark Invest waves goodbye with $51.8 million in Circle scripts, collecting the fruits after an ascent from $31 to over $150. Ah, such numbers—the kind that seduce wallets and quicken heartbeats. 📈

The lovefest persists, Q1 fundamentals making investors weep: 59% revenue growth, 75% net income—enough to make even the hardest-hearted bear reconsider. Jim Cramer, ever the carnival barker, pronounces Circle a “pure play on digital assets,” while others listen, credulous.

But amid starlit hopes, the grump of the ball, Arthur Hayes, bemoans Circle’s shackled coexistence with Coinbase—a laboring Bizarro-world marriage that, he claims, starves Circle of breath and coin, Tether’s grand network laughing somewhere in the background. The critics howl: can such a union survive, or will profit margins wither in the shade?

Should the wind carry this momentum, CRCL might soon wrestle with the $165 resistance, like a Dostoevskian lawyer arguing with fate.

Coinbase Global (COIN)

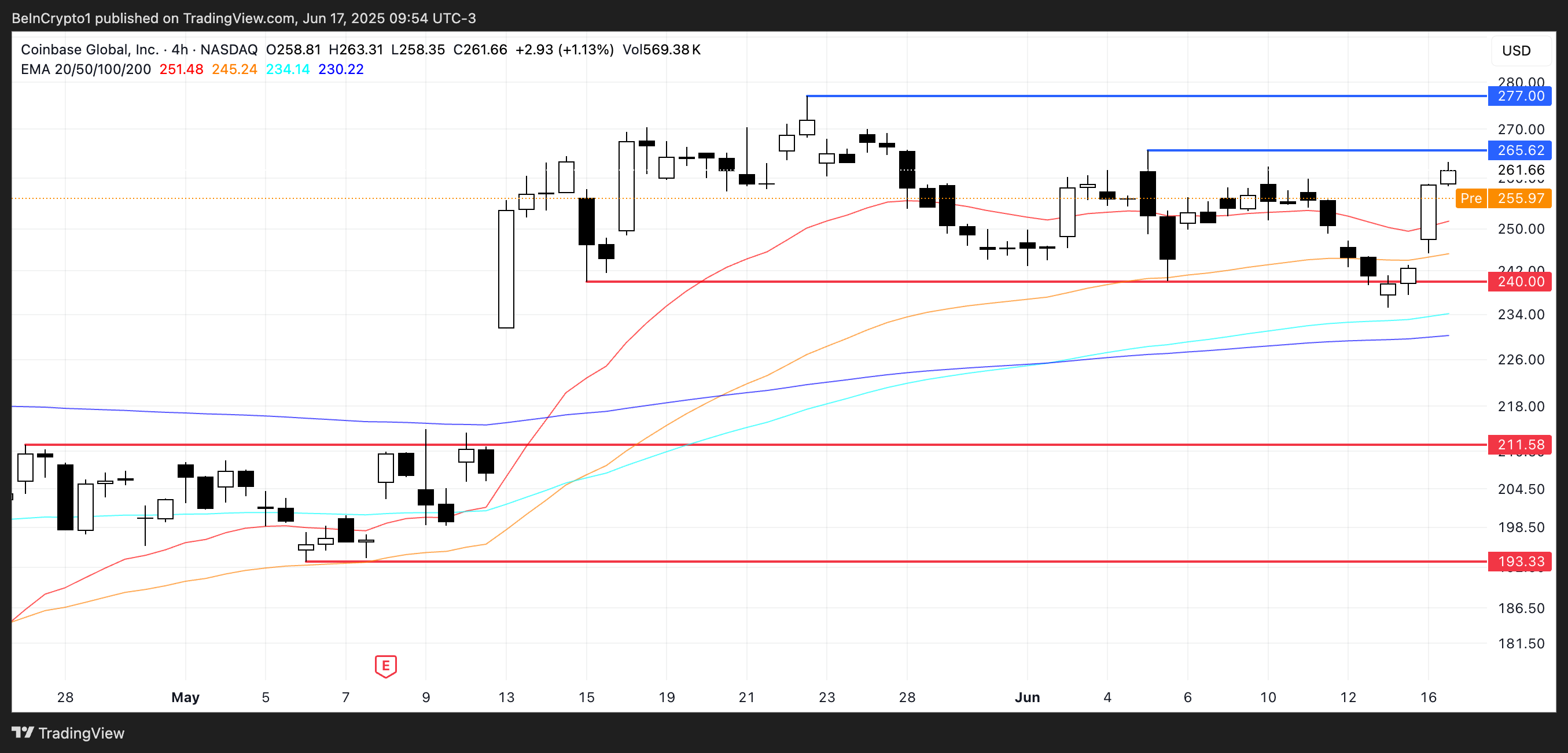

Coinbase, not content with homebound squalor, waltzes into global parlors—partnering with Shopify and Stripe in the kind of alliance that makes accountants swoon. USDC slips through the marketplace, butter-smooth, the infrastructure barely disturbed, merchants bobbing along in fiat or stablecoin ecstasy—or at least tolerable confusion. 🤹♂️

There are treaties in Luxembourg, whispered promises of an EU license under MiCA; regulatory doors are ajar, cryptographic fumes leaking through the cracks. All the while, somewhere in America, Coinbase funds a U.S. Army parade—even as the ghosts of crypto purists gnash their teeth at last rites for decentralization, wondering if Satoshi ever envisioned such a parade float.

Brian Armstrong, steadfast and possibly caffeinated, gestures at world domination. He woos UK lawmakers, pleading for regulations like a lovesick bard. The market, meanwhile, rewards this ambivalence: up 8% one moment, slipping 2% the next—eternally wavering between glory and gloom. Watch the $265 resistance they say, somberly: break it and there’s $277 sunshine; lose $240 and you trip, perhaps gracelessly, down to $211. Such is the ballet of risk.

GameStop Corp. (GME)

GameStop, darling of memetic legend, lurches through existential fog. Profits flicker up, but sales spiral down—a tragicomedy worthy of Chekhov, if Chekhov had ever owned a used console. Investors plead for clarity, but are met with silence; since 2023, not even a curtain call. 🎭

Ryan Cohen, captain of the ghost ship, dives headlong into crypto—$6 billion in cash, 4,710 Bitcoin stashed away, while analysts puzzle over the lack of a map. No bold Web3 tale. No glorious NFT charge. “Why so mysterious?” the critics sigh, swirling their vodka.

And yet, hope persists. Some see a transformation lurking: GME, if only the managers dared, could break from the cocoon and fly, joining the SBETs and KWMs of the world. For now, the stock hops up 5% on rumor and… faith, or maybe just boredom. But as pre-market ticks lower, the mirage flickers. Flirt too long with indecision, and support at $21.56—with a tragic lurch to $20.78—may be all that awaits. No grand destiny, only the pitiless undertow of retail spikes and short squeezes.

No matter: in this world of digital shadows, only one thing’s certain—everyone’s pretending to know the plot, and most forgot their lines.

Read More

- How to Unlock the Mines in Cookie Run: Kingdom

- YAPYAP Spell List

- How to Build Muscle in Half Sword

- Bitcoin Frenzy: The Presales That Will Make You Richer Than Your Ex’s New Partner! 💸

- Bitcoin’s Big Oopsie: Is It Time to Panic Sell? 🚨💸

- How to Find & Evolve Cleffa in Pokemon Legends Z-A

- How to Get Wild Anima in RuneScape: Dragonwilds

- Gears of War: E-Day Returning Weapon Wish List

- The Saddest Deaths In Demon Slayer

- Most Underrated Loot Spots On Dam Battlegrounds In ARC Raiders

2025-06-17 17:37