So, Sei’s price is basically doing a free fall right now. I mean, it’s like it got on the crypto rollercoaster and forgot to buckle up. On June 17, the crash hit hard, driving the price of Sei (SEI) down to $0.1660. Yep, the lowest it’s been since April 17. It’s like watching your stocks drop while you’re holding a bag of popcorn, unsure whether to laugh or cry. Oh, and by the way, from its high in May, it’s down over 40%. From the glorious peak back in November 2023? A whopping 77% drop. Yeah, it’s pretty much the definition of “yikes.”

But, hey, don’t jump to conclusions. Despite the price looking like it’s taking a dive off a cliff, Sei’s underlying fundamentals are actually pretty solid. It’s like that one guy at a party who’s totally bombed but still somehow manages to carry on a conversation without embarrassing himself. According to DeFi Llama (yep, that’s a thing), Sei’s total value locked (TVL) has hit an all-time high of over 3.08 billion SEI. That’s a big jump from 715 million back in January. Guess that’s something, right?

On top of that, Sei’s decentralized apps are getting a lot of love. Yei Finance, which is like Aave’s cooler cousin, now has over $295 million in assets, while Takara Lend is sitting pretty with $51 million. You know, nothing too impressive… just millions.

And let’s talk about stablecoins for a sec. Sei’s stablecoin supply is also on the rise, which is surprising since we all thought the market was just going to burn down. It now has over $200 million in stablecoins. That’s up from $1.2 million in March. Now we’re talking real numbers. USDC is dominating here, holding a solid 83% of the stablecoin market in the Sei ecosystem. It’s basically the star of the show.

The Sei decentralized exchange? Steady as she goes. In May, the protocols on Sei handled over $640 million in volume, which is more than April’s $612 million and way more than March’s $407 million. So, you know, people are still trading, even if it feels like the world is on fire.

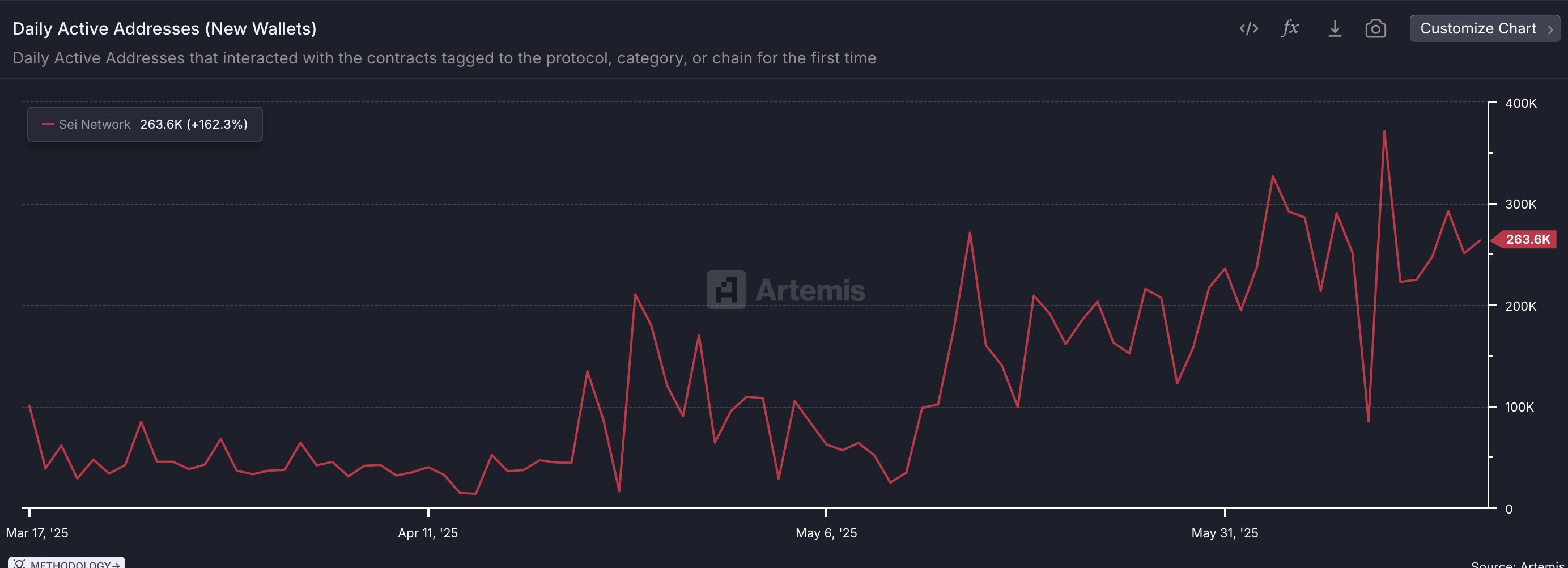

And get this, more people are actually signing up for Sei. Daily active addresses have soared to 263.6k from a measly 61,000 back in March. It’s like a party that started with a few folks, and now, everyone’s showing up. It’s crowded, but hey, someone has to pay for the drinks.

Sei Price Technical Analysis

Looking at the daily chart, it’s like watching a slow-motion train wreck. SEI has been plummeting since May 11, when it peaked at $0.2747. And of course, it’s been dragged down even further by the overall crypto market meltdown. Classic.

Right now, it’s under all major moving averages. The MACD and the Relative Strength Index are both giving us the sad, downward trend signal. It’s not looking good, folks. If you’re holding on, it’s like holding onto your seatbelt during a bumpy ride.

But, wait, there’s hope—kind of. SEI’s approaching a double-bottom formation around the $0.1295 level, which could be a potential support. If that holds up and things go according to the plan, a bounce back to $0.2800 might just happen. Fingers crossed, but don’t bet the house on it.

Read More

- How to Unlock the Mines in Cookie Run: Kingdom

- YAPYAP Spell List

- How to Build Muscle in Half Sword

- Bitcoin Frenzy: The Presales That Will Make You Richer Than Your Ex’s New Partner! 💸

- Bitcoin’s Big Oopsie: Is It Time to Panic Sell? 🚨💸

- How to Find & Evolve Cleffa in Pokemon Legends Z-A

- How to Get Wild Anima in RuneScape: Dragonwilds

- Gears of War: E-Day Returning Weapon Wish List

- The Saddest Deaths In Demon Slayer

- Most Underrated Loot Spots On Dam Battlegrounds In ARC Raiders

2025-06-17 17:58