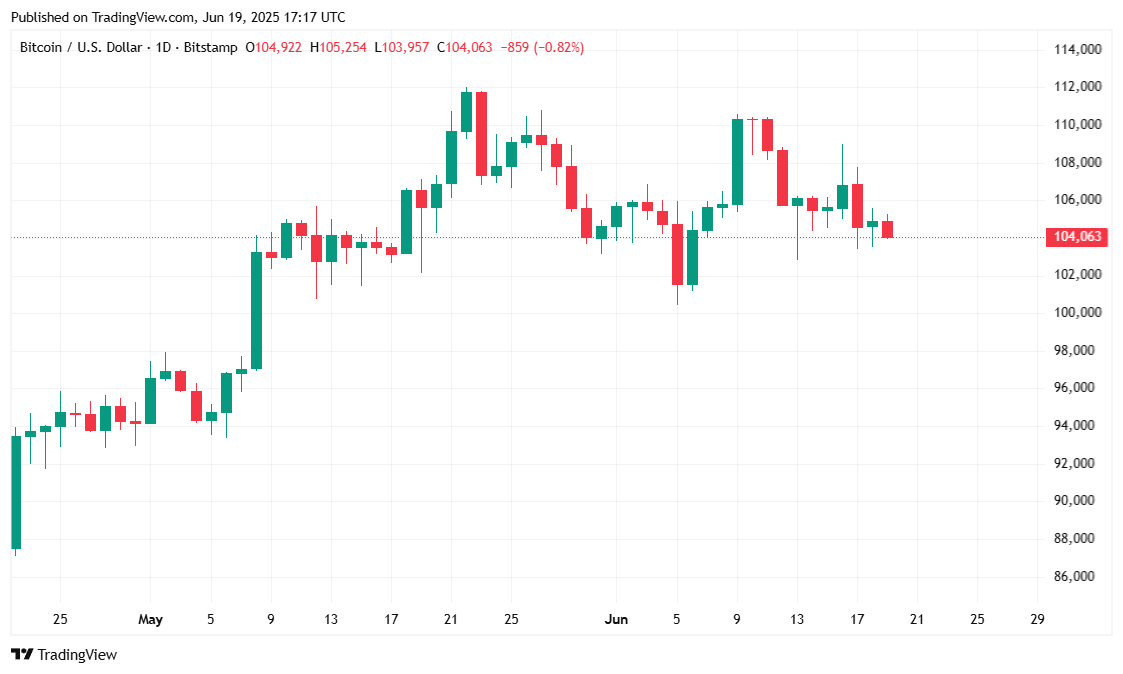

Oh, the delightful drama of cryptocurrency—Bitcoin has been as motionless as a forgotten goldfish since the Israel-Iran conflict started, languishing around $104K, like it’s lost its taste for adventure.

What a Thrilling Ride: Bitcoin, Stocks, and Crypto Remain Stubbornly Indifferent

Israel, in a display of military fervor, has vowed to intensify its strikes against Iran, as the conflict trudges into its seventh day. Naturally, this geopolitical tempest did wonders for Bitcoin’s mood, making it plummet faster than a lead balloon. It has since decided to do absolutely nothing, tethering itself to the $104K mark like it’s afraid to leave its comfy spot.

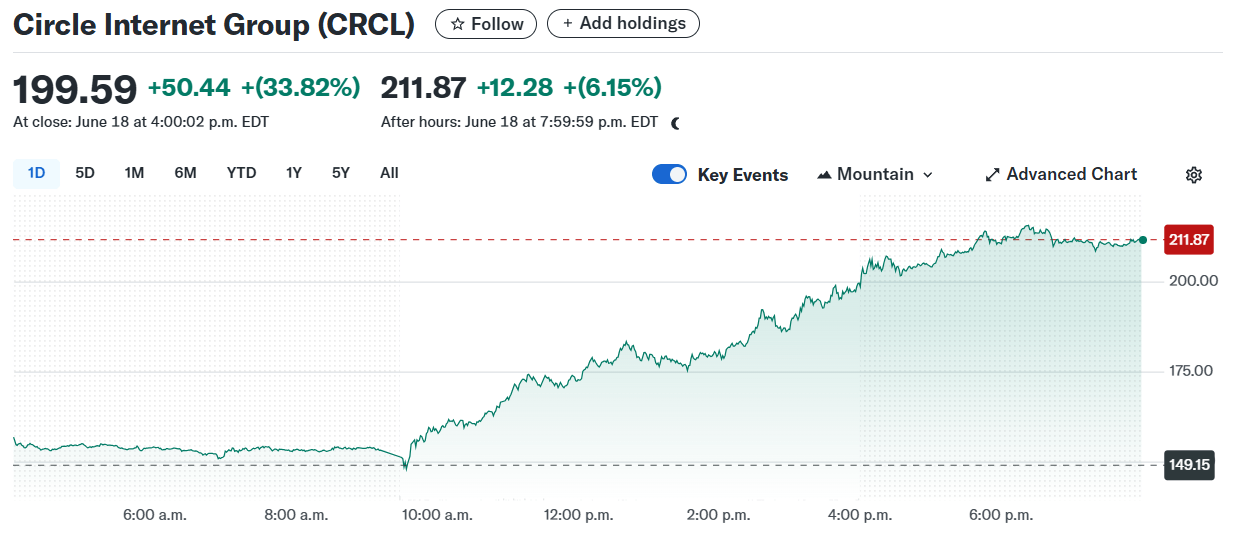

The broader crypto market, in a true show of indifference, barely flinched on Thursday—down a minuscule 0.09%. Meanwhile, stocks were as mixed as a salad on a diet, with the S&P 500 and Dow down by 0.03% and 0.10%, respectively. Only the Nasdaq dared to make a tiny effort, inching up 0.13%, as if that would impress anyone. But wait—Circle (CRCL) and Coinbase (COIN) on the Nasdaq had the audacity to jump 33.82% and 16.32%, respectively, after the U.S. Senate passed the GENIUS Act. Yes, *the* GENIUS Act. Talk about a title that promises far too much.

While Circle and Coinbase basked in their newfound glory, Bitcoin sat there, glumly watching Iranian missiles hit Israel’s Soroka Medical Center in Beersheba. Meanwhile, Israel’s Defense Minister, the ever-dramatic Israel Katz, issued a warning so theatrical that it could’ve been scripted for a soap opera.

“The cowardly Iranian dictator sits deep inside his fortified bunker and launches deliberate attacks at hospitals and residential buildings in Israel,” Katz declared, with the flair of a man who knew he was about to headline the evening news. “The Prime Minister and I have instructed the IDF to intensify strikes against strategic targets in Iran.” Yes, because why not add a bit of theatrical flair to military strategy?

Market Metrics Overview

Bitcoin managed to slip a mere 0.18% over the last 24 hours, trading at $104,116.58, because even it knows how to stay in bed when things get too complicated. The price action stayed comfortably neutral, confined within a 24-hour range between $103,602.26 and $105,250.89. A 3.50% decline over the past week? Oh, just a minor inconvenience, nothing to panic about. The lack of direction suggests that investors are, indeed, taking cautious naps as the Middle Eastern drama unfolds.

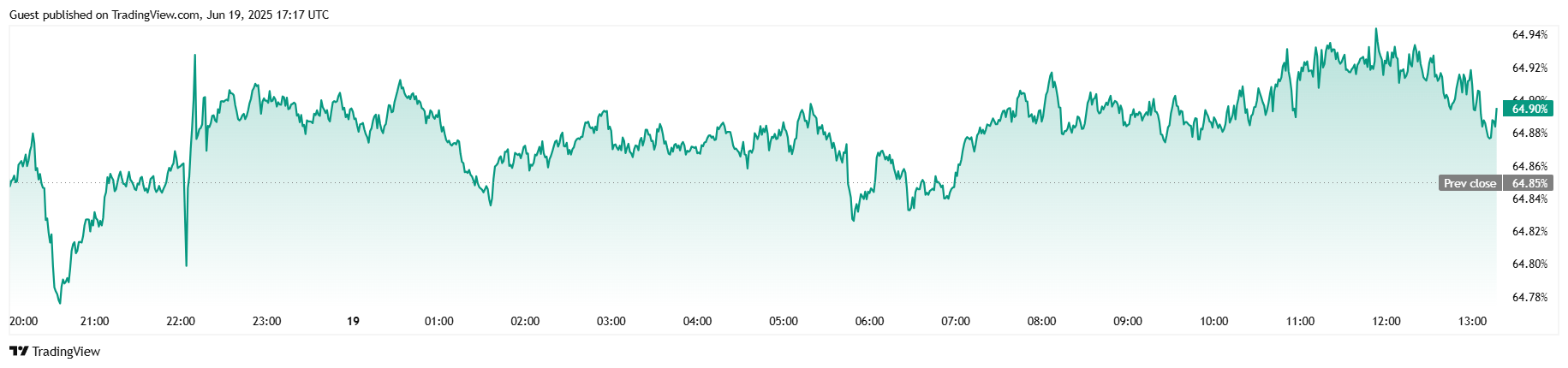

Volume? Oh, that too fell by 14.60%, to a meager $40.43 billion, because who needs enthusiasm when you have chaos in the air? Bitcoin’s market cap dipped slightly by 0.17% to $2.06 trillion—just a little dip in a never-ending rollercoaster. But hey, at least Bitcoin’s dominance rose a bit, by 0.06%, to 64.90%. Small victories, right?

Futures markets, not wanting to miss out on the fun, saw a slight pullback in speculative positioning, with open interest dipping by 0.13% to $69.15 billion. Oh, and did I mention the $23.97 million in total liquidations over the past 24 hours? Yes, long positions took a nice, big hit, with $15.47 million wiped out, while the shorts just lost $8.50 million. Who’s counting at this point?

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- 8 One Piece Characters Who Deserved Better Endings

- Mewgenics Tink Guide (All Upgrades and Rewards)

- Top 8 UFC 5 Perks Every Fighter Should Use

- Who Is the Information Broker in The Sims 4?

- Sega Declares $200 Million Write-Off

- Full Mewgenics Soundtrack (Complete Songs List)

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

2025-06-19 21:37