Ah, the eternal dance of chance and fate, where fortunes are won and lost with each tick of the clock. Today, a staggering $4.11 billion in Bitcoin and Ethereum options contracts shall meet their maker, leaving traders to ponder the great unknown.

Like a condemned man awaiting his fate, the crypto market stands poised on the precipice, bracing for the impact of this massive expiration. Will the winds of fortune blow in favor of the bulls, or shall the bears emerge victorious? Only time will tell.

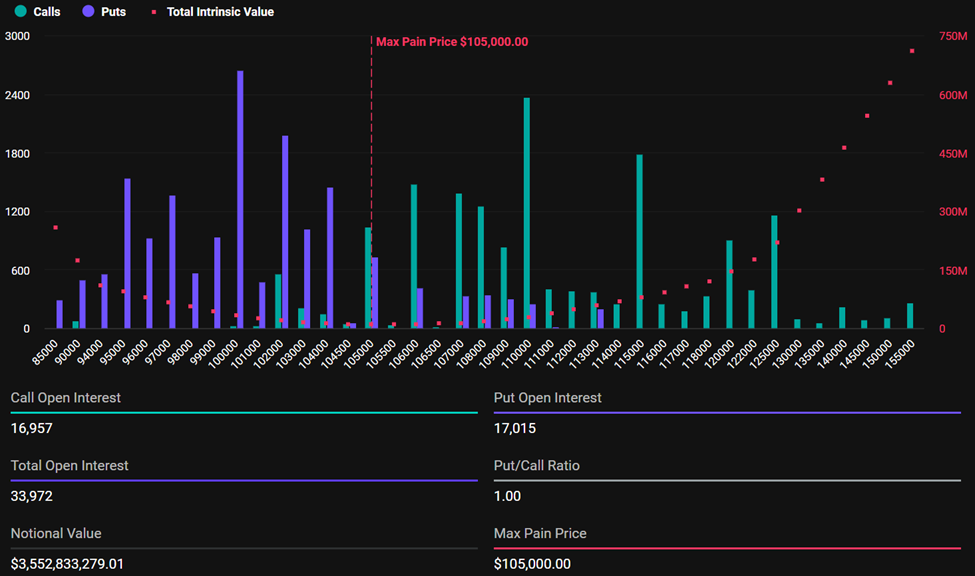

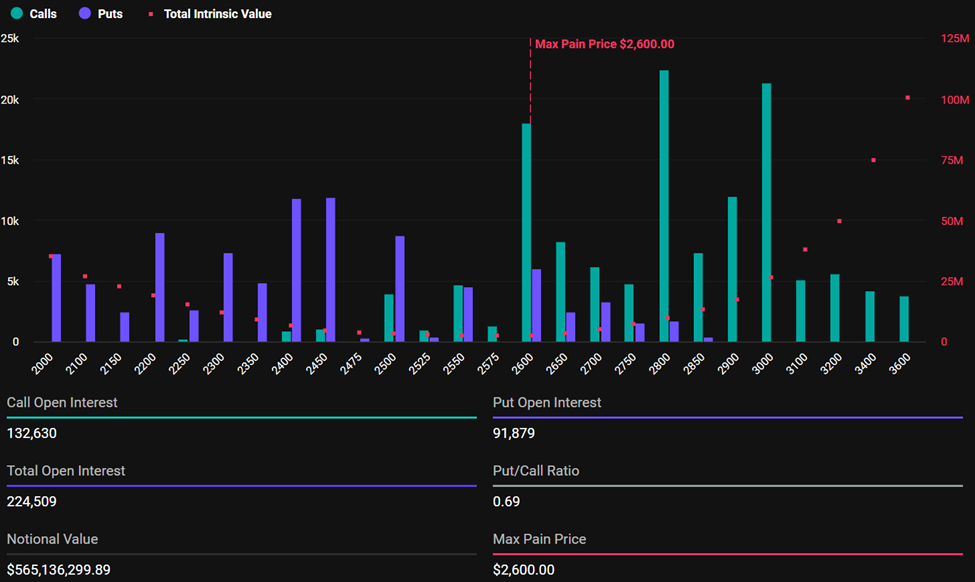

According to the sage scribes at Deribit, Bitcoin options valued at $3.5 billion and Ethereum at $565.13 million shall be the main event. A total of 33,972 Bitcoin contracts and 224,509 Ethereum contracts shall expire, leaving traders to pick up the pieces.

But what secrets lie hidden in the ancient tomes of options data? Ah, dear reader, it appears that traders are as divided as a Ukrainian village at a town hall meeting. The put-to-call ratio for Bitcoin stands at 1.00, a perfect balance of yin and yang, while Ethereum’s ratio of 0.69 hints at a bullish bias.

And what of the maximum pain price, that mystical level at which options expire worthless, leaving traders to weep and wail? For Bitcoin, it stands at $105,000, a lofty peak that few dare to climb. Ethereum’s maximum pain price, on the other hand, lies at a more modest $2,600.

But fear not, dear reader, for the Max Pain Theory shall guide us through these treacherous waters. Like a trusty map, it reveals the hidden patterns of the market, showing us that asset prices tend to gravitate towards their respective max pain or strike prices.

And so, as the clock ticks down to expiration, traders and investors alike shall hold their collective breath, waiting to see which way the winds of fortune shall blow. Will Ethereum’s bullish bias prove correct, or shall Bitcoin’s balanced positioning prevail? Only time will tell.

“BTC shows more balanced positioning near max pain, while ETH flows tilt bullish with calls dominating up the curve. How will the market respond this time?” ask the wise sages at Deribit.

But amidst the chaos and uncertainty, one thing remains clear: the market shall stabilize, like a ship righting itself after a storm. And when the dust settles, traders and investors shall emerge, blinking, into the bright light of a new day.

And yet, dear reader, there are those who would seek to upset the applecart. Analysts at Greeks.live note that market sentiment among crypto derivatives traders has turned bearish in the short term, like a Ukrainian winter.

The Federal Reserve Chair Jerome Powell’s latest FOMC statement has cast a pall of gloom over the market, like a dark cloud on the horizon. And so, traders are positioning themselves for downside risk, like a farmer preparing for a long winter.

“Traders are running negative delta for July positions while planning to add positive deltas for Q4,” write the sages at Greeks.live.

And so, dear reader, we find ourselves at the mercy of the markets, like a leaf blown about by the winds of chance. But fear not, for in the end, it is not the markets that shall decide our fate, but our own cunning and guile. 💸

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- 8 One Piece Characters Who Deserved Better Endings

- Mewgenics Tink Guide (All Upgrades and Rewards)

- Top 8 UFC 5 Perks Every Fighter Should Use

- Who Is the Information Broker in The Sims 4?

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Sega Declares $200 Million Write-Off

- Full Mewgenics Soundtrack (Complete Songs List)

2025-06-20 09:21