- On-chain volume and a flurry of transactions paint a vibrant landscape, but alas, SOL’s price prefers to impersonate a fainting goat.

- The trading masses—those reckless spot and high-wire futures performers—continue gleefully shoveling up SOL, as if collecting daisies before a thunderstorm.

Behold! In the last day, Solana [SOL], with the unsteady gait of a Moscow goose, slipped a modest 3.5%—nestling at $150.67 like a ruble under the floorboard after a week’s worth of bravura leaps (+6.15%). A most theatrical reversal!

The financial curtain parts: on one side, a chorus of bears trills songs of doom; on the other, bulls stomp and buck—buying with fervor altogether unsuitable for bear funerals. Drama! Intrigue! AMBCrypto undertakes the thankless role of chronicler in this uproarious circus.

On-Chain Fireworks: A Cause for Applause or Alarm?

On-chain revelry continues without heed—new actors, more applause, everyone shouting lines over each other.

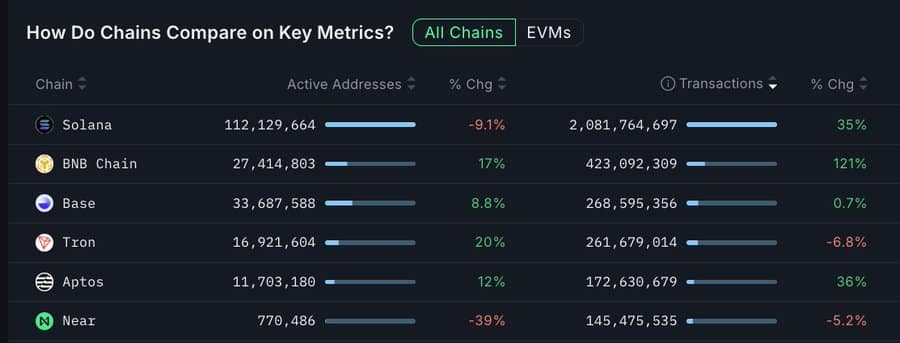

Consider this: Nansen, our ever-watchful backstage hand, reports Solana’s Total Transactions have soared 35% in 30 days—2 billion hurrahs (and probably a handful of jeers).

But fortune favors not the naive! Higher transaction counts arrive arm-in-arm with greater On-chain Volume. DeFiLlama, monocle firmly in place, declares the pot’s bubbling at $61.513 billion this month—with $2.078 billion swirled in just 24 hours. Bravo!

Solana, for its troubles, now pirouettes in second place for trading volume. Binance Smart Chain still hogs the spotlight, while Ethereum sulks somewhere in the third row. A comedy of errors, truly!

Traditionally, the literati would predict prices rising skywards amid such feverish bustle. But no, not here—expectation is tossed out the window like yesterday’s newspaper.

The Great Exodus—Stage Left, Please!

Despite the hullabaloo, Solana’s weekly audience (those elusive “active users”) has exited quietly, no curtain call—down to 22 million, a number worthy of early May’s melancholy encore.

Cue mysterious violins: prices fall, volumes swell, but the crowd evaporates. Is this selling? Or merely a mass Russian tea break?

Sometimes, a dip in numbers signals nothing but waning faith in a miraculous comeback. The downtrend, it seems, was merely awaiting its cue to stagger onto the stage before today’s dramatic price collapse.

Enter the Opportunists, with Wallets Wide Open

But here comes Act Two! While on-chain tea leaves predict doom, the off-chain potion brews something altogether merrier. In corners of the spot and futures markets, optimists gather, unfazed by falling chandeliers.

At press time, it’s either a case of collective delusion or inspired foresight: buyers are swooping up SOL, betting on its inevitable (they hope) rebirth.

CoinGlass, that perspicacious soothsayer, notes that over two days, buyers have boomeranged back into action—after flirting disastrously with the Sell button. $27.5 million in SOL has vanished from exchanges, reappearing in private enclaves like so much contraband literature. A plot twist worthy of Bulgakov’s cat.

If this farce continues, exchange reserves will run dry, and the stampede for SOL may lift prices—assuming the next act isn’t titled “Everyone Changes Their Mind Again.”

Derivatives, not to be outdone, chase after the action. Open Interest Weighted Funding Rates—yes, that mesmerizing mouthful—signal a tide for buyers at +0.0025%. More long contracts than Bella in Moscow’s summer—what could possibly go wrong? 😸

The lesson? The Solana spectacle rolls on: half the troupe sells, half buys, and all the world watches in a state of bemused confusion. Pass the popcorn, and the rubles—if you have any left. 🍿

Read More

- Gold Rate Forecast

- How to Unlock the Mines in Cookie Run: Kingdom

- How To Upgrade Control Nexus & Unlock Growth Chamber In Arknights Endfield

- How to Find & Evolve Cleffa in Pokemon Legends Z-A

- Gears of War: E-Day Returning Weapon Wish List

- Top 8 UFC 5 Perks Every Fighter Should Use

- Byler Confirmed? Mike and Will’s Relationship in Stranger Things Season 5

- USD RUB PREDICTION

- Most Underrated Loot Spots On Dam Battlegrounds In ARC Raiders

- The Saddest Deaths In Demon Slayer

2025-07-05 01:16