So, Uniswap’s price has absolutely faceplanted into bear market territory — down over 20% since what experts (and your crypto-obsessed cousin) called “the peak” in May. If you’re a fan of dramatic nosedives, you’re in for a real treat. 🎢

Picture this: It’s Saturday, July 5. Uniswap’s hanging around $6.95, looking like it just woke up from a rough night, compared to its $20 high last November. The market cap’s taken a swan dive too, now at a humble $4.8 billion. Last year it was flexing at over $10 billion, but apparently the crypto gods don’t believe in happy endings. 📉

Of course, it isn’t alone. Altcoins are all staging their own little fire sale. Crypto’s total market cap (minus Bitcoin, Ethereum, and those stablecoins who think they’re too good for the drama) has taken a 30% hit this year. Proof that misery really does love company.

Now, for the plot twist. Why is Uniswap specifically getting dumped—that is, apart from the universal law that what goes up must come down (except, apparently, for my rent)? Uniswap’s lost its cool-kid status in the DEX playground: Last 30 days? Uniswap shuffled $80 billion in DEX volume. PancakeSwap? $160 billion. Literally double. I suspect there’s some pancake-based bribery happening over there. 🥞

If that’s not enough, the new kid, Hyperliquid, just waltzed in and handled $220 billion during the same span. Hello, Hyperliquid, do you even go here? Also vying for the throne: Raydium and Aerodrome Finance. Basically, it’s a DeFi episode of “Survivor.”

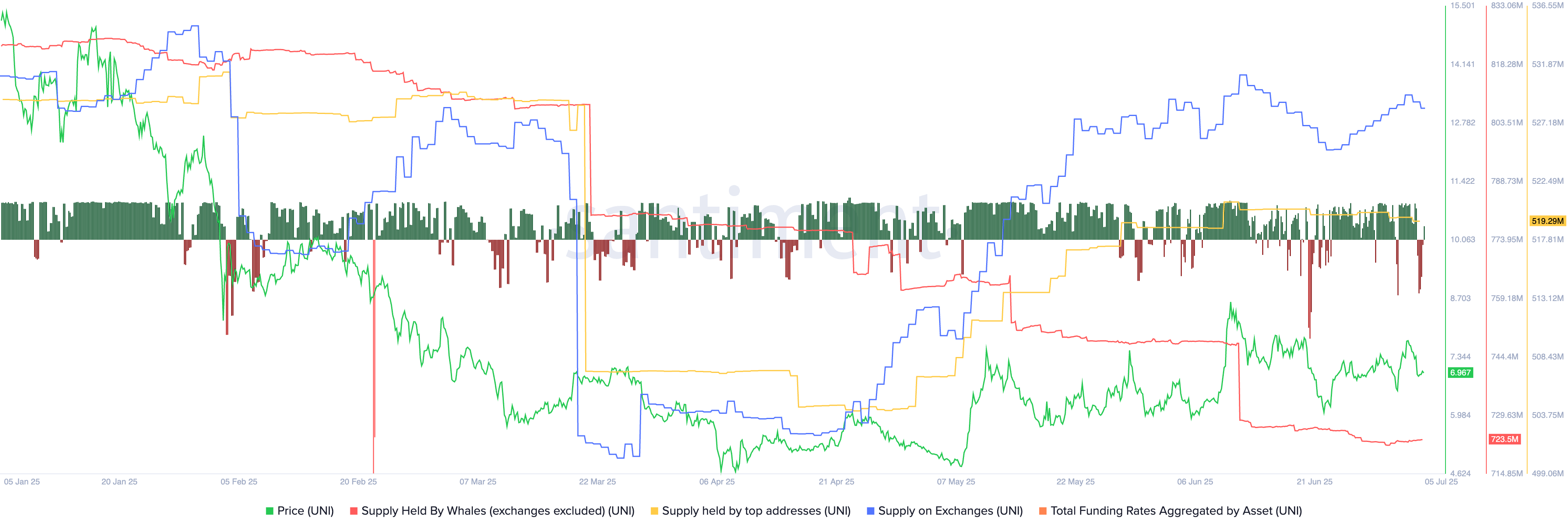

Meanwhile, the blockchain receipts say investors are treating UNI like a hot potato. The UNI supply sitting on exchanges has ballooned to 84.6 million from just 69 million at its low this year. Crypto translation: everyone’s loading it up just to get rid of it. Welcome to the digital equivalent of a garage sale.

Oh, and let’s not forget the whales. Once benevolent overlords of the UNI token, they’ve trimmed their stash from 824 million coins down to 723 million since January. If the whales are heading for the exit, maybe check the lifeboats (just saying).

Plus, funding rates have slipped into negative territory. In trader-speak: investors bet UNI’s future is about as bright as my ex’s commitment issues. 💔

Uniswap Price Technical Analysis (For People Who Love Graphs and Sadness)

The daily chart’s a rollercoaster of regret. After peaking near $20 last November, UNI is now somewhere around $6.98. It bounced a bit after dipping to $4.7, but “bounced” is a generous word—think more “slightly less sinking.”

UNI’s chart has drawn itself a textbook bearish flag: one big drop, then an optimistic little rise, like someone tripping and pretending they meant to do it. If this pattern breaks down (as patterns are wont to do), brace yourself for a visit to $4.70 yet again. Bulls hoping for a miracle? Unless we see $8.6, you’re left reading horoscopes not charts. 🐂🔮

Read More

- Solo Leveling: Ranking the 6 Most Powerful Characters in the Jeju Island Arc

- How to Unlock the Mines in Cookie Run: Kingdom

- Gold Rate Forecast

- Gears of War: E-Day Returning Weapon Wish List

- Bitcoin’s Big Oopsie: Is It Time to Panic Sell? 🚨💸

- The Saddest Deaths In Demon Slayer

- How to Find & Evolve Cleffa in Pokemon Legends Z-A

- Most Underrated Loot Spots On Dam Battlegrounds In ARC Raiders

- Top 8 UFC 5 Perks Every Fighter Should Use

- Bitcoin Frenzy: The Presales That Will Make You Richer Than Your Ex’s New Partner! 💸

2025-07-05 19:15