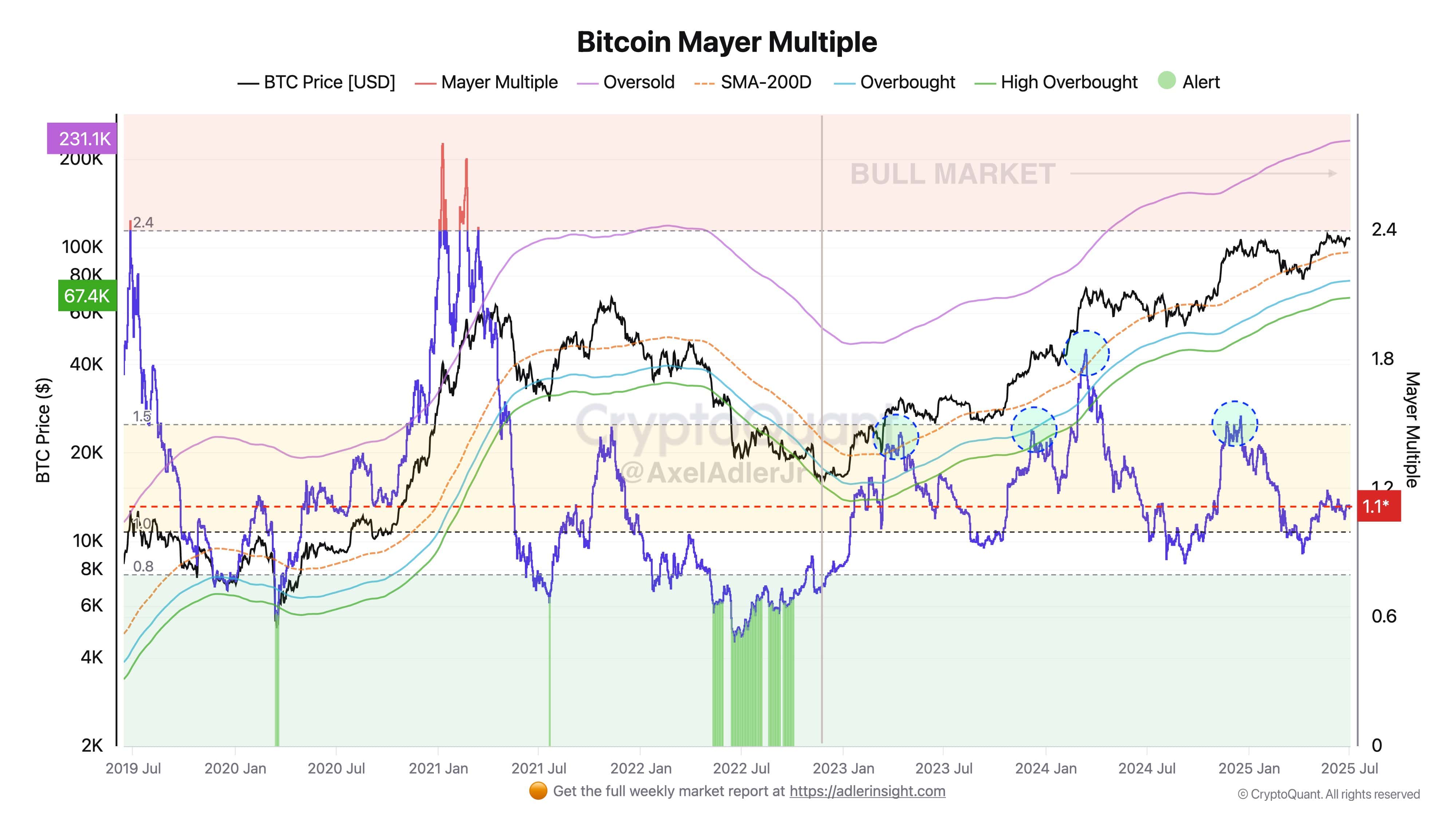

Alright, time to get up close and weird with the Mayer Multiple — aka that metric no one brags about at crypto parties. This thing just compares Bitcoin’s price to its 200-day moving average to see if we’re heading for Lamboland or for a sad desk lunch. Surprise! It’s chilling at 1.1x, which is suspiciously neutral. (It only starts wearing a party hat at 1.5x and above.) In short: Not even close to “overbought.” Insert disappointed trader face here.

Axel Adler Jr. (because of course, he’s a “Jr.”), analyst at CryptoQuant, says we’re basically in the bargain bin. “Today’s Mayer Multiple indicates that Bitcoin is trading at a discount to its historical bull rallies,” Adler posted on X. So apparently, Bitcoin’s not overpriced, it’s just shy—like your cousin at every family reunion. “It’s more undervalued than overvalued, a good fuel reserve for a new upward impulse.” Which I think means, “strap in, maybe?”

Mayer Multiple shows Bitcoin not overheated, source: X

Translation for the non-crypto-wizards: If you’re waiting for Bitcoin to explode higher before jumping in, you might want to check your FOMO supply. Historically, major tops happen when the Multiple basically shouts at you in all caps. Right now, it’s more, “psst… dude, you up?” Maybe, just maybe, it’s time to buy… or at least check if your Coinbase password still works.

But don’t lose your cool — the Mayer Multiple isn’t your psychic hotline. It’s more of a financial mood ring. Check it alongside other indicators, sure, but if this rally’s planning a Hollywood ending, the script isn’t done yet. Stay tuned for the sequel. 🍿

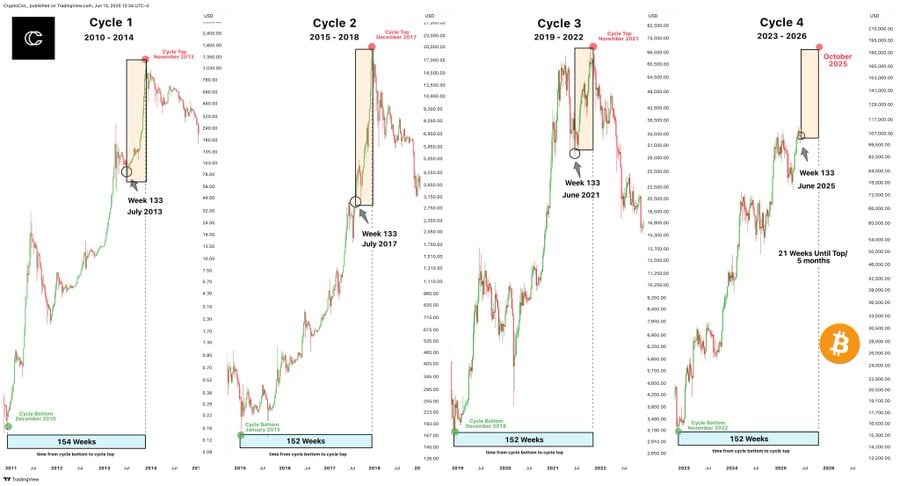

October 2025: The Next Blow-Off Top?

Bitcoin’s current cycle basically wants to be just like its older brothers. If past “halving to peak” timelines hold (around 152 weeks), the confetti canon might go off in just 2-3 months.

On X, analyst CryptoCon announced, “the Bitcoin cycle top will be in October this year. We’ve got about 21 weeks or 5 months… yada yada… Other cycles had already completed their First Cycle Top by this time and were getting ready to lose all their hair. Some people act like this cycle can drag to 2026, but most charts are looking pretty 2025-ish—whether you’re ready or not.” Spoiler: Data suggests the party’s over by New Year’s Eve.

But here’s the twist: maybe we don’t go bonkers this cycle. Could we finally be growing up? Maybe Bitcoin will ditch the parabolic drama queen act for a slow, steady march led by men in boring suits and ETFs. Imagine: less “rollercoaster with no seatbelt,” more “S&P 500 but after three Red Bulls.” Revolutionary, right?

Still, everyone secretly wants that October moonshot. 🚀

For now, the Mayer Multiple is whispering, “Expensive? Pfft. Bitcoin might still have the clearance sticker on it.” This could be the best risk-reward deal you get until AI tokens start trading for actual kidneys.

Read More

- The Winter Floating Festival Event Puzzles In DDV

- Best JRPGs With Great Replay Value

- Jujutsu Kaisen: Why Megumi Might Be The Strongest Modern Sorcerer After Gojo

- Sword Slasher Loot Codes for Roblox

- Jujutsu Kaisen: Yuta and Maki’s Ending, Explained

- One Piece: Oda Confirms The Next Strongest Pirate In History After Joy Boy And Davy Jones

- Roblox Idle Defense Codes

- All Crusade Map Icons in Cult of the Lamb

- USD COP PREDICTION

- Dungeons and Dragons Level 12 Class Tier List

2025-07-09 03:01